Private miner completes acquisition of AngloGold’s Navachab

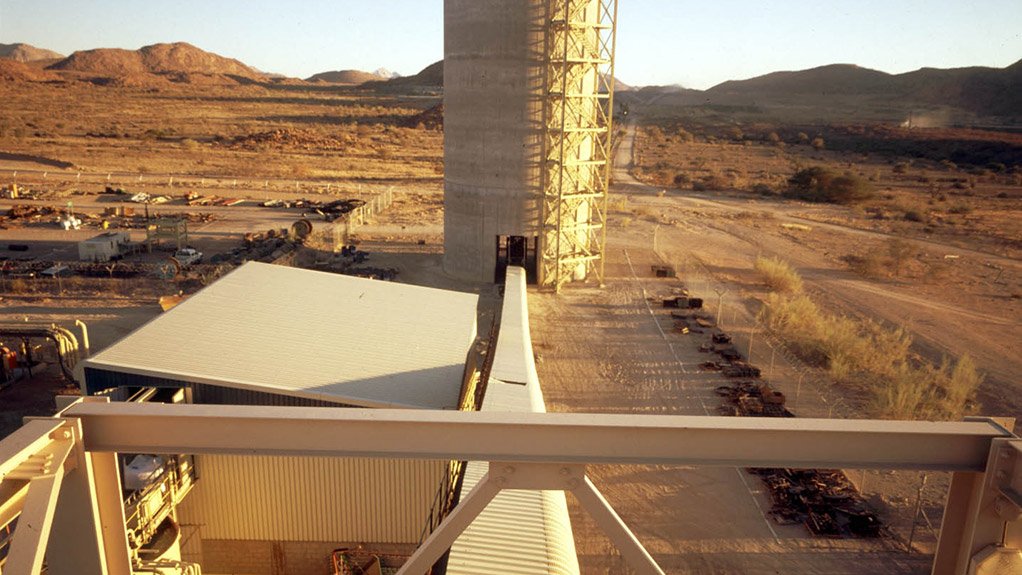

JOHANNESBURG (miningweekly.com) – The acquisition by QKR Corporation of Navachab gold mine, in Namibia, is complete, the private mining company confirmed on Tuesday.

QKR president Lloyd Pengilly, a former Johannesburg gold analyst who left JP Morgan to set up QKR, announced the deal in February as the company’s maiden transaction.

AngloGold Ashanti has disposed of Navachab, which last year produced below 2% of its total production, to allow it to concentrate on operations larger than the Namibian mine, which is situated near Karibib, 6 km south of the Okahandja-Swakopmund road.

QKR, the major shareholders of which are Qatar Holdings and Kulczyk Investments, wants to acquire and build a diversified portfolio of development and growth assets in the Europe, Middle East and Africa region and the Americas.

Namibia’s State-owned mining company Epangelo has partnered QKR in the $110-million deal for Navachab, which has 3.9-million resource ounces and 1.92-million reserve ounces.

Last year the opencast mine produced 63 000 oz of gold at a cash cost of $691/oz and an all-in sustaining cash cost of $781/oz.

AngloGold Ashanti executive VP strategy and business development Charles Carter said the transaction had been concluded at the end of June after all conditions precedent had been met and monies paid.

Pengilly commented that the focus would be on maximising Navachab’s inherent value and realising the full potential of the asset, while Epangelo Mining MD Eliphas Hawala said that the transaction had brought Epangelo closer to fulfilling its objective of ensuring State participation in mining, beneficiation and creation of mineral-related employment opportunities for the people of Namibia.

“We thus look forward to making our contributions in order to ensure maximum value is derived for our shareholders and stakeholders,” added Hawala, a Cameroonian.

Epangelo, with the government of Namibia as its sole shareholder, is intent on realising higher economic benefits for Namibia, particularly in the realm of foreign export earnings.

AngloGold said when the deal was announced in February that the partly cash payment for the asset would be adjusted to take in net debt and the working capital position on the transaction’s closing date.

In addition, AngloGold said it would receive deferred consideration in the form of a net smelter return, which would be paid quarterly for seven years following the second anniversary of the closing date.

The net smelter return, described as a form of royalty payment, would be determined at 2% of ounces sold by Navachab during a relevant quarter, subject to an average gold price of $1 350/oz being achieved, and capped at 18 750 oz sold a quarter.

At the time, Carter described QKR as “the right group to take Navachab forward”, and explained the sale as being “for fair value in the midst of a difficult market”.

QKR said in February that it would be working closely with Navachab management, the Namibian government and Epangelo to steer the mine through what it described as "its next phase of growth".

The sale of Navachab, which has been owned and operated by AngloGold Ashanti since its formation in 1998, stems from a strategy launched last year in which AngloGold said it would strip out corporate, capital, exploration and operational costs totalling $482-million and equal to $100/oz.

As part of the cost-saving drive, AngloGold Ashanti CEO Srinivasan Venkatakrishnan said the JSE- and NYSE-listed company would dispense with noncore operations, provided good value was received.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation