Prieska copper/zinc project, South Africa

Name of the Project

Prieska copper/zinc project.

Location

The project is located in the Northern Cape, in South Africa.

Project Owner/s

Orion Minerals.

Project Description

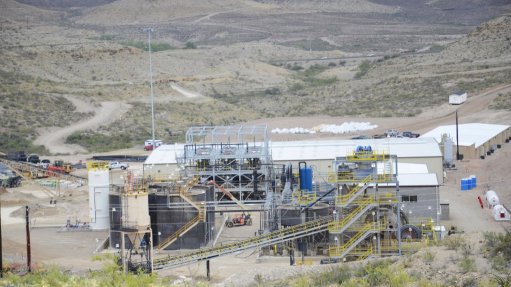

An updated bankable feasibility study (BFS) has confirmed the potential of the Prieska project to underpin a significant near-term, low-cost, copper/zinc development project, with exceptional opportunities for future growth.

The project has total mineral resources of 30.49-million grading 1.2% copper and 3.7% zinc.

The updated BFS on the foundation phase of the project proposes the development of a new 2.4-million-tonne-a-year copper/zinc mining operation at the brownfield project.

Underground and surface mining methods are planned to be used in conjunction with conventional froth-flotation concentration to produce differentiated copper and zinc concentrates for export.

Peak production is estimated at 23 000 t/y of copper and 88 000 t/y of zinc.

The life-of-mine has been extended by two years from 9.7 years to 11.5 years.

Material changes in the updated BFS, compared with the 2019 BFS plan, include:

• reducing the mine dewatering timeline and supplementing the treatment of that water,

• incorporating additional mineral resources into the mining plan that will increase the mine life by two years,

• a more conservative timeline to ramp up to steady-state production,

• prioritising early mining of the high-grade zones in the mining sequencing,

• the adoption of semiautogenous grinding mills in the processing flowsheet,

• an owner-miner operating philosophy for underground mining,

• using an experienced contractor to operate the processing plan, and

• a change in the key operational infrastructure being supplied by third-party financing and in the supply of select key operational infrastructure.

The mining methods for the project remain unchanged, compared with those stated in the 2019 BFS. Tunnel development remaining from the previous mining operations allows for early access to underground production mining areas. A combination of longhole open stoping with fill and drift-and-fill mining methods are planned to be used, supported with paste backfill.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has a net present value, at an 8% discount rate, of A$779-million, compared with A$574-million in the 2019 BFS, and an internal rate of return of 39%, compared with 38% in the 2019 BFS. Payback from first production is estimated at 2.4 years, a decrease of five months.

Capital Expenditure

Total startup capital, including contingency, has decreased from A$400-million in the 2019 BFS to A$373-million in the updated BFS.

Peak funding requirements have increased from A$378-million in the 2019 BFS to A$413-million.

Planned Start/End Date

Orion Minerals is targeting a production startup in 2024 as market conditions permit.

Latest Developments

Private equity group Tembo Capital has extended the term of the repayment date of the $3.6-million loan facility set aside to advance metals explorer Orion Minerals’ Prieska copper/zinc project until June 30, 2021.

The loan facility was originally due for repayment by October 31.

The unsecured convertible loan facility had initially been agreed with Tembo Capital on January 25, 2019.

Under the terms of the loan facility, Tembo Capital may elect for repayment of the balance of the loan facility (including capitalised interest and fees) to be satisfied by the issue of fully paid ordinary shares by Orion to Tembo Capital at a deemed issue price of $0.026 apiece.

Tembo Capital can also elect to receive shares in repayment of the outstanding amount in substitution of payment in cash.

As at September 30, the balance of the loan facility was $4.7-million, including capitalised interest and fees.

Meanwhile, Orion Minerals CEO Errol Smart has said that the clean, green copper that the company will mine with the help of the Northern Cape’s hot sun and prime wind will be almost free of cost, paid for by the zinc credits.

Smart has described the Prieska project – the centrepiece of Orion’s asset portfolio – as a “build-ready project”.

“Our mine will start up being 52% renewable energy, but we can see very clearly a pathway to being completely off-grid and being 100% renewable energy, with a combination of hydrogen or one of the battery storage systems.

“It’s not box ticking. It's actually financially attractive to do this. Renewable energy is now becoming lower cost than certainly what Eskom can give us in the long term. Now, the regulations are in place that we can self-generate, I think it’s going to unlock a lot of value for the Northern Cape.

“Again, this is going to be a mine of the future,” Smart has said.

Key Contracts, Suppliers and Consultants

Companies involved in the BFS included: A&B Global Mining; ABS Africa; BPDT & Co; Bluhm Burton Engineering & Ventilation Consultants; Beulah Africa; Cart Investments; DRA Projects South Africa; Earth Science Solutions; Endeavour Financial Limited; Falcon and Hume Attorneys Inc; Fraser McGill Mining & Minerals Advisory; Knight Piésold; METC Engineering; Gariep Mining and Exploration Services; Mets Consulting South Africa; Patterson and Cooke; PCDS Consultants; Power Plant Electrical Technologies; Professional Cost Consultants; Promethium Carbon; Shift Innovations; SRK Consulting; Strategy4Good; The MSA Group; Turnkey Civil (International) Group; VBKom Engineering Consultants; Whittle Consulting; and Z Star Mineral Resource Consultants.

Contact Details for Project Information

Orion Minerals, tel +27 11 880 3159 or email info@orionminerals.com.au.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation