Prieska copper/zinc project, South Africa

Name of the Project

Prieska copper/zinc project.

Location

Northern Cape, South Africa.

Project Owner/s

Orion Minerals.

Project Description

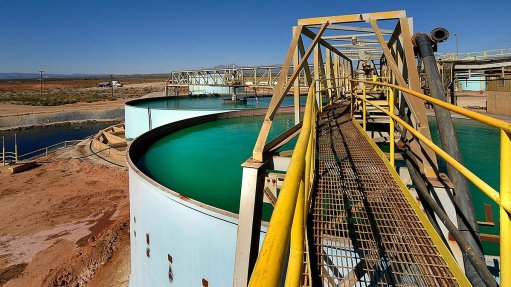

A bankable feasibility study (BFS) on the foundation phase of the Prieska project has confirmed the quality and scale of the project. The BFS evaluates the establishment of new mining operations at the Prieska copper mine, which has been closed since 1991.

The project has a maiden ore reserve of 13.62-million tonnes at 1.1% copper and 3.2% zinc for 143 000 t of contained copper and 433 000 t of contained zinc.

The BFS has investigated the commercial viability of a mining plan for the foundation phase aimed at establishing mine infrastructure and operational capacity, which are intended to establish the platform for further mining of deposit extensions, and the exploration and mine development of neighbouring prospects.

According to the BFS, the foundation phase runs for ten years of run-of-mine production at a design ore processing rate of 2.4-million tonnes a year. This phase targets the exploitation of those portions of the Prieska deposit that have been upgraded to indicated and inferred mineral resources from the first surface-based drilling campaign conducted from 2017 to 2018. The production target comprises 65% probable ore reserves and 35% inferred mineral resources, with ore reserves predominating during the early stages of the mining plan.

Underground and surface mining methods are planned to be used for the duration of the foundation phase, in conjunction with conventional froth-flotation concentration to produce differentiated copper and zinc concentrates for export.

Beyond the Foundation Phase, it is expected that mine-life extension will be underpinned by delineated mineral resources not yet incorporated into the mining plan and known deposit extensions and existing pillars, which are expected to require low or no additional capital investment to extend the mine life. An estimated 9.7-million tonnes of indicated and inferred mineral resources, at grades of 1.1% copper and 3.6% zinc, remain outside the immediate mining plan, providing near-term potential to optimise mine plans to incorporate more of these resources into the foundation phase. Significant potential for nearby satellite deposits has also been identified.

The project has a mine life of 9.7 years.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has a pretax net present value, at an 8% discount rate, of A$574-million and an internal rate of return of 38%, with a payback of 2.9 years from first production.

Capital Expenditure

The project has a peak funding requirement of A$378-million.

Planned Start/End Date

A two-year construction period is scheduled to be followed by the production of the first copper.

Latest Developments

Completed mining right documents are awaiting approval, while discussions with a number of South African and foreign banks are at an advanced stage.

“. . . we’re starting to exchange draft term sheets on some of the money, which is very encouraging,” Orion Mining CEO and MD Errol Smart has told Mining Weekly.

Currently, between 60% and 70% of the R4-billion capital required will come from debt and the balance from equity or equity equivalents.

The company’s new black economic-empowerment partners are providing strong support, and the opportunity to procure new mills and winders at a significant discount to market is being considered.

Key Contracts and Suppliers

DRA Projects South Africa; A&B Global Mining; ABS Africa; BPDT & Co; Bluhm Burton Engineering & Ventilation Consultants; Beulah Africa; Cart Investments; Earth Science Solutions; Endeavour Financial Limited; Falcon & Hume Attorneys; Fraser McGill Mining & Minerals Advisory; Knight Piésold; METC Engineering Consultants; Mets Consulting South Africa; Patterson & Cooke; PCDS Consultants; Power Plant Electrical Technologies; Professional Cost Consultants; Questco; Shift Innovations; Steffen, Robertson & Kirsten South Africa; The MSA Group; Turnkey Civil (International) Group; VBKom Engineering Consultants; and Z Star Mineral Resource Consultants (BFS).

On Budget and on Time?

Not stated.

Contact Details for Project Information

Orion Minerals, tel +27 11 880 3159 or email info@orionminerals.com.au.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation