Platinum market could see surplus in 2017

PGM MARKET REPORT The platinum market could see a surplus in 2017 for the first time in six years

STABILISATION EXPECTED In 2016 and 2017, underlying mine production is expected to stabilise at between 4.2-million ounces and 4.3-million ounces

The platinum market could see a surplus in 2017 for the first time in six years, owing to a predicted fall in automotive and jewellery demand, platinum-group metals (PGMs) authority Johnson Matthey states.

In its latest ‘PGM Market Report’, which is updated on a six-monthly basis in May and November, Johnson Matthey says, primary supplies will be flat at best in 2017, with potential for a rebound in autocatalyst recycling following two consecutive years of price‐related sluggishness.

In most industrial sectors, the demand outlook for 2017 remains firm, but buying in the autocatalyst industry is expected to dip slightly, as lower platinum‐loaded catalyst systems are introduced in increasing numbers in European vehicles.

As demand in the Chinese jewellery sector seemed set on a downward trend, market balance this year would likely depend on the extent of growth in autocatalyst recycling and the level of physical investment. “Unless the latter remains at similar levels to those seen in 2016, we could see the platinum market return to a surplus for the first time since 2011,” notes Johnson Matthey, which adds that the extent of the fall in demand will depend in large part on investment activity and, in particular, whether there is a slowdown in Japanese bar sales.

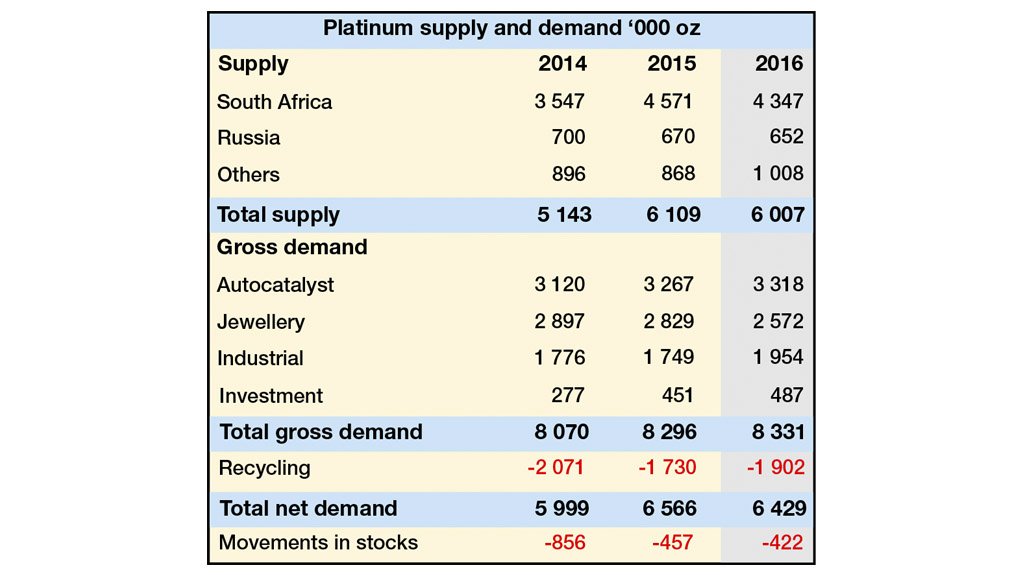

Prospects for short- to medium-term growth in PGM mining in South Africa are muted. The country’s platinum output peaked at over five-million ounces in the mid-2000s, but has been on a generally declining trend since 2007. “In 2016 and 2017, we expect underlying mine production to stabilise at between 4.2-million ounces and 4.3-million ounces.” Johnson Matthey added that it should be noted that some limited stock sales are expected to keep supplies slightly ahead of production in both years.

This decline in output is mainly due to ore reserve depletion, rationalisation and shaft closures at the large underground mines on the western Bushveld owned and operated by platinum producers Anglo American Platinum, Impala Platinum and Lonmin. These operations, traditionally the mainstay of the South African platinum industry, produced nearly 3.4-million ounces of platinum in 2007, but output has since fallen by around one-third, to little more than 2.2-million ounces. Looking forward, two large replacement shafts at Impala’s lease area are currently in the ramp-up phase, but these gains will be offset by rationalisation elsewhere on the western Bushveld, explains Johnson Matthey.

Overall, the research company sees little prospect of any near-term improvement in primary platinum output, with global shipments in 2017 likely to be similar to levels seen in 2016. This means that the direction of total primary and secondary supplies in 2017 will be determined by trends in recycling markets, and particularly in the autocatalyst recovery sector.

Palladium Forecast

Johnson Matthey indicates that autocatalyst demand for palladium is set to continue its upward trend this year, buoyed by further gains in global production of light- duty gasoline vehicles and a tightening of emissions legislation in North America and China.

The research company notes that, while vanadium- based selective catalytic reduction (SCR) is gaining share in European heavy- duty vehicles, it is not used in light-duty applications, nor is it approved for use in North America (except in some nonroad applications).

However, the ‘PGM Market Report’ notes that the US market is undergoing other developments in catalyst technology. In particular, the light-duty diesel sector is expected to move towards higher palladium loadings on catalyst bricks upstream of the SCR unit to help the aftertreatment system pass the low-temperature portion of the testing cycle. This additional palladium is displacing platinum to a certain extent.

The world’s two largest heavy-duty markets, India and China, use relatively little PGM in diesel emissions treatment – about 200 000 oz combined, or 6% of total world platinum demand in diesel catalysts. However, Johnson Matthey points out that both countries are entering a period of rapid legislative change that will lead to much greater platinum use.

Further, the research company adds that, while there is potential for secondary supply from autocatalyst recycling to rebound, there is little chance of any significant growth in primary palladium production from mines this year.

“With demand in industrial sectors looking set for a strong year, driven by significant capacity expansions in the Chinese chemicals industry, the palladium market looks likely to record another year of significant deficit in 2017, even if physical investment remains firmly negative.”

The Year That Was

In 2016, the decline in platinum supply from South Africa was expected to be partially offset by some growth in mine production elsewhere and higher levels of recycling, largely in the jewellery sector. This left combined primary and secondary supplies only marginally higher in 2016 than in the previous year, with a market deficit of 422 000 oz.

Further, full implementation of Euro 6b legislation (the sixth incarnation of the European Union directive to reduce harmful pollutants from vehicle exhausts) led to a further increase in autocatalyst demand in Europe, more than offsetting modest declines in most other regions, and lifting global platinum use in automotive catalysts in 2016 by 1.6%.

Additionally, buying in other industrial sectors was solid last year, driven by continued capacity expansions in China. Physical investment demand also remained buoyant, reflecting heavy net buying of bars in Japan, where a weak platinum price in yen and a sustained discount to gold favoured platinum sales. However, a third successive annual decline in jewellery demand in China was expected to drive global demand in this sector lower by 9% in 2016, says the Johnson Matthey report.

In terms of palladium, mine production was flat in 2016, with total supplies supported by only a modest increase in metal from recycling activities. Demand in the autocatalyst sector once again set a new record at 7.84-million ounces, up by more than 2% in 2015. Other industrial demand softened slightly and physical investment demand remained in negative territory, although liquidation of exchange-traded funds fell, compared with 2015. The market recorded a palladium deficit of 651 000 oz.

The ‘PGM Market Report’ aims to provide detailed data, analysis and commentary on the PGM market. It includes estimates of supply by country and demand by application for platinum, palladium and rhodium, and demand figures for ruthenium and iridium, detailed by application. The figures include a five-year history and forecast for the current year.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation