Petra Diamonds expects 3% more output, ups capex 19%

Petra CEO Johan Dippenaar

Photo by Duane Daws

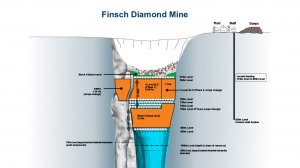

Finsch Diamond Mine

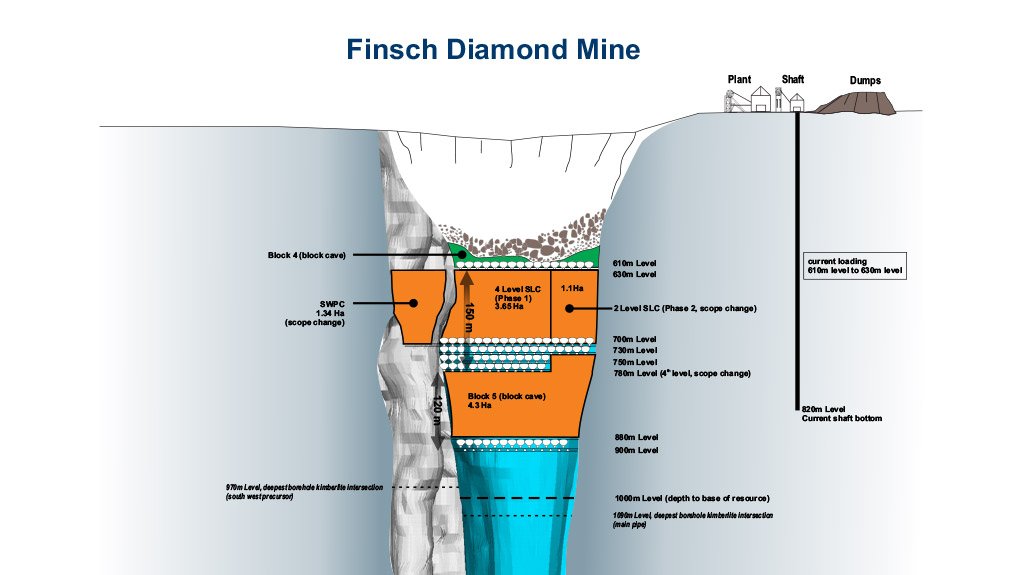

Cullinan Diamond Mine

JOHANNESBURG (miningweekly.com) – London-listed Petra Diamonds on Monday announced a scope change at its Finsch diamond mine in the Northern Cape, which brings forward by three years higher levels of undiluted production from a sub-level cave project.

Petra CEO Johan Dippenaar and FD David Abery, gave guidance of a 3% production lift from the 3.1-million carats produced in 2014 and spoke of average diamond prices to 2019 lifting on the back of increased run-of-mine (RoM) production over tailings, which would deliver higher value carats into the product mix.

The company is guiding production of 3.2-million carats in the 12 months to June 30.

In its last year of relying mainly on production from the mature working areas, Petra said it would spend 19% more capital in a well-controlled cost environment.

Capital expenditure (capex) for the South African operations would increase by R300-million, or 19%, to R1.9-billion on value accretive scope changes not only at Finsch but also at Koffiefontein.

From its 2016 financial year onwards, growth in production would be accelerated as waste-diluted block caves that bring about lower diamond grades were phased out.

Dippenaar told analysts that in every case, Petra’s expansion programmes would open up new areas of undiluted ore that would boost grades.

Longer term, he said Petra was firmly on track to reach its target of five-million carats a year in 2019, at diamond prices forecast to be progressively higher than those achieved in 2014.

The scope change at Finsch, which Petra has operated for just over two years, would allow for an earlier ramp up of a sub-level cave (SLC) to a steady state production level of 3.5-million tons a year by financial year 2018, as opposed to the previous target of 2021 (see schematic).

The acceleration had been made possible by enlarging the footprint of the SLC as well as by giving 700 m-level access to mining at the South West Precursor (SWPC), situated next to the main orebody of the Finsch kimberlite pipe.

Although the scope change had added R160-million to capex, it boosted net present value by $100-million and gave Finsch the opportunity to mine for another eight years before having to begin the main Block 5 block cave.

The grade at Finsch is forecast to rise from 38 carats per hundred tons (cpht) in this financial year to around 58 cpht from 2017 once the mine sources its production from undiluted SLC ore.

CULLINAN C-CUT

Some 85% of the tons that Petra mined at the Cullinan mine last financial year were sourced from highly diluted areas, an issue that was compounded by increased waste from the development activities having to be processed through the plant as there are no separate waste handling facilities at the mine.

Dippenaar said Cullinan was managing those challenges by accessing additional tonnages and migrating mining to less diluted areas.

There would be an increase in production of undiluted kimberlite tons, as well as a reduction in development waste in this financial year.

Up to 22% of underground tonnage would be sourced from undiluted areas, including the C-Cut Phase 1 kimberlite development (see schematic).

Abery said that for the next four financial years, capex remained fully funded from company cash flows and current debt facilities.

Company funding headroom and dividend commencement remained on track.

At Koffiefontein, management had focused on debottlenecking with improvements made to be reflected from this financial year onwards.

The Williamson mine plan was consistent with earlier guidance at 3.7-million tons and was on course to attain 4.3-million tons in 2016 and steady-state production of five-million tons from 2017 onwards.

“A lot of moving parts, but looks likely to lead to a downgrade in nearer-term numbers, although the long term value story remains intact,” Investec Securities commented in a note.

As Petra’s kimberlite orebodies remain open-ended at depth, residual resources remain beyond current mine plans.

This is most pronounced at Cullinan and Finsch, where extensive residual resources have been well defined and include total resource figures, indicating substantial mine lives after 2030 - the end of current mine plans at both operations.

Dippenaar said plans beyond 2030 would leverage off infrastructure established as part of the current capital programmes.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation