Nueva Esperanza gold/silver project, Chile – update

Name and Location

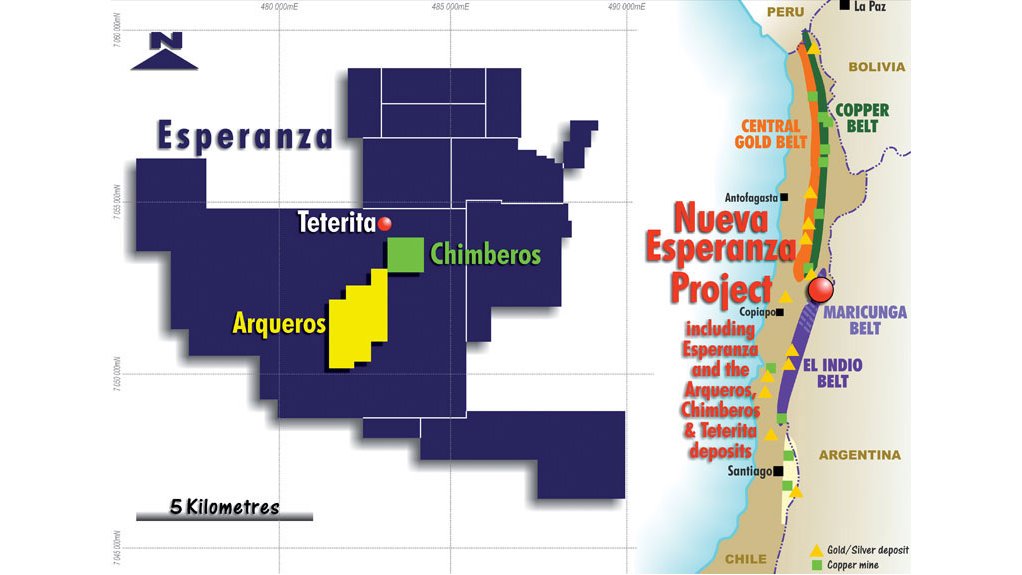

Nueva Esperanza gold/silver project.

Location

Atacama, Chile.

Project Owner/s

Kingsgate Consolidated.

Project Description

A prefeasibility study (PFS) on Nueva Esperanza has delivered positive economics, with the project technically and financially viable at a silver price of $19/oz and a gold price of $1 200/oz.

The project has measured, indicated and inferred mineral resources estimated at 39.4-million tonnes grading 0.39 g/t of gold, 66 g/t of silver for 490 000 oz gold and 83.4-million ounces of silver or 1.88-million ounces of gold on a metal equivalence basis.

The project comprises the Arqueros, Chimberos and Teteria orebodies. Mining will be sequenced to maximise cash flow by extracting the highest-value ore blocks as early as possible.

Each pit has been staged with a number of pushbacks to assist in maximising cash flow. Lower-grade material will be stockpiled and treated towards the end of the project. The selection of ore blocks for mining is based on the highest revenue generated by the gold and silver metal.

No gold equivalents are used in the selection of mining blocks.

Mining rates are reasonably consistent at 26-million tonnes a year and are achieved using a fleet of two excavators, up to two front-end loaders and a fleet of 100 t trucks.

About one-million tonnes of ore and waste will be mined prior to the mill being commissioned.

The process plant, which will be located 3 200 m above sea level, consists of a primary crusher, a semiautogenous and ball mill, leaching and metal extraction by Merrill Crow.

Tailings are dewatered in a filter press and stacked as dry in a valley fill.

The design process rate is two-million tonnes a year.

Throughput rates have been designed using the 75% percentile for hardness and abrasiveness.

Grind size will be P80 120 μm and the leach time will be 48 hours. The plant will treat 23-million tonnes over the 11.6-year mine life.

Life-of-mine metal production will be about 275 000 oz of gold and 47-million ounces of silver.

Production over the first five years will be an average of 135 000 oz/y gold equivalent calculated at a 60:1 silver to gold ratio.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has a pretax net present value, at a 5% discount rate, of $168-million and an internal rate of return of 25%, based on a $1 200/oz gold price and a $19/oz silver price.

Capital Expenditure

Capital expenditure for the project is estimated at $206-million.

Planned Start/End Date

Mining is expected to be completed in six years.

Latest Developments

Kingsgate has reported that it will allow TDG Gold Corporation to extend the completion of its financing to fund the acquisition of the Nueva Esperanza project. TDG has requested an extension to the end of January 2022 to complete its financing for the acquisition.

In consideration of this, TDG has agreed to increase the nonrefundable deposit by C$1-million, to C$1.5-million, and agreed to make an initial payment of C$500 000 by November 5, with the balance due by the end of November.

TDG will also reimburse Kingsgate for holding costs incurred at Nueva Esperanza, as a result of the extension at the time of the first C$25-million payment under the agreement. Costs are estimated at $500 000.

Kingsgate struck a deal with TDG to divest of its Nueva Esperanza project in October this year. The definitive agreement followed the signing of a letter of intent in June.

Under the agreement, Kingsgate will be paid C$25-million on the completion of the transaction, and the company will be issued 14% of TDG’s outstanding common shares, calculated on a post-closing basis.

A further C$6.25-million is payable to Kingsgate within three months of completion of a definitive feasibility study, and a payment of C$5-million, or 10-million TDG shares, would be due to Kingsgate on a construction decision.

In addition, the company will be paid either C$5-million, or 10-million in TDG shares, at the one-year production anniversary, and a further payment of C$8.75-million at the two-year production anniversary.

Kingsgate will also have a representative on the TDG board, providing Kingsgate owns 10% or more of the issued and outstanding shares. Further, for 24 months following closing of the agreement, Kingsgate will have the right to participate in the issuance of securities offerings to maintain its percentage interest and/or increase its percentage ownership interest up to 19.9% of the outstanding shares of TDG.

The transaction is subject to TDG’s raising finance of at least C$35-million.

Key Contracts, Suppliers and Consultants

None stated.

Contact Details for Project Information

Kingsgate Consolidated, tel +61 2 8256 4800, fax +61 2 8256 4810 or email info@kingsgate.com.au.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation