NiWest nickel/cobalt project, Australia – update

Photo by Alliance Nickel

Name of the Project

NiWest nickel/cobalt project.

Location

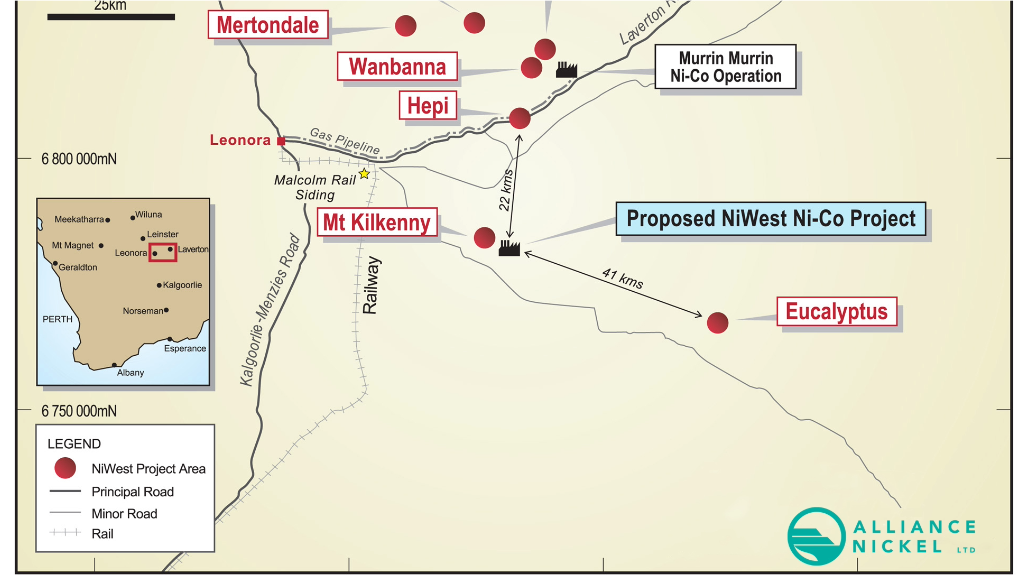

Adjacent to Glencore’s Murrin Murrin operation, in the north-eastern goldfields of Western Australia.

Project Owner/s

Alliance Nickel, formerly GME Resources.

Project Description

An updated feasibility study has confirmed the robustness of a long-life operation producing high-purity nickel and cobalt sulphate products, to be delivered to lithium-ion battery raw material markets.

The mine and process schedule remain unchanged for the 2018 prefeasibility study (PFS) that proposes conventional openpit mining at a low strip ratio of 2:1.

Envisaged is a 27-year mining operation with a nameplate ore throughput of 2.4-million tonnes a year, resulting in total production of 456 000 t nickel (in nickel sulphate) and 31 400 t cobalt (in cobalt sulphate). Projected steady-state nickel and cobalt recoveries are estimated at 79% and 85% respectively.

Average production over the first 15 years is expected to be 19 200 t/y nickel and 1 400 t/y cobalt.

The processing route selected is heap leaching followed by neutralisation, impurity removal, direct solvent extraction and crystallisation to produce nickel and cobalt sulphate products.

Forecast operating and capital costs have been re-estimated through further prospective supplier interaction and general inflationary scaling.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The updated PFS presents three financial projections.

In Case 1, the project has a net present value, at an 8% discount rate, of A$1.88-billion and an internal rate of return of 21.6%, with a payback of 4.4 years.

In Case 2, the project has a net present value, at an 8% discount rate, of A$2.6-billion and an internal rate of return of 25.9%, with a payback of 3.7 years.

In Case 3, the project has a net present value, at an 8% discount rate, of A$3.31-billion and an internal rate of return of 29.7%, with a payback of 3.3 years.

Capital Expenditure

Preproduction capital expenditure has increased from A$966-million in the 2018 PFS to A$1.26-billion in the updated PFS.

Start/End Date

Construction is expected to take 24 months from the final investment decision, with the forecast heap pad and plant ramp-up phase taking about 20 months.

Latest Developments

Alliance Nickel has received a letter of support from Export Finance Australia (EFA) to provide potential financing for the project.

Subject to EFA board approval, the letter of support could be converted into a binding agreement following due diligence, sufficient lender support and other customary financing terms.

The next step in securing project finance would be the completion of the definitive feasibility study for NiWest, as well as further due diligence work.

Alliance earlier this year signed a binding offtake agreement with automotive maker Stellantis over the NiWest project, covering up to 170 000 t of nickel sulphate and 12 000 t of cobalt sulphate over an initial five-year offtake term, amounting to 40% of the future yearly forecast from NiWest.

Key Contracts, Suppliers and Consultants

None stated.

Contact Details for Project Information

GME Resources, tel +61 8 9336 3388, fax +61 8 9315 5475 or email enquiries@gmeresources.com.au.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation