New private equity with a difference has $750m firepower for mining

JOHANNESBURG (miningweekly.com) – A new class of private equity, with a deeper understanding of mining’s needs, was officially launched last week with $750-million to deploy in the mining space.

London-based Appian Capital Advisory, founded by former JP Morgan mining team member Michael Scherb, spoke to Mining Weekly Online on the sidelines of the Investing in African Mining Indaba in Cape Town.

Appian’s ten-year fund intends investing at a rate of $150-million a year for the next three years.

“We launched last week officially. It’s new and we’re pretty excited,” Scherb commented.

The fund’s maiden investment is in a near-term gold producer in Colombia and announcements on two more transactions are expected in the next few months.

Scherb’s Appian team has the combined past experience of having developed more than 60 mines and managed transactions totalling some $200-billion.

Targeted now, at a time when traditional forms of mining funding have dried up and newer ways of financing are being introduced, are small-to-medium opportunities in Africa, Latin America and North America.

“You’ll see a different class of private equity emerging from more specialist investment houses, with people who understand mining and who allocate capital appropriately.

“Our strategy is very different. It’s not simply new capital springing up. It’s new capital plus a very deep operating team,” Scherb told Mining Weekly Online.

One of mining’s problems is that the hedge fund investments of the past have expected short-term redemptions.

In sharp contrast, Appian has taken long-term capital from pension plans and long-term investors allowing it to provide long-term capital to what is a long-term business.

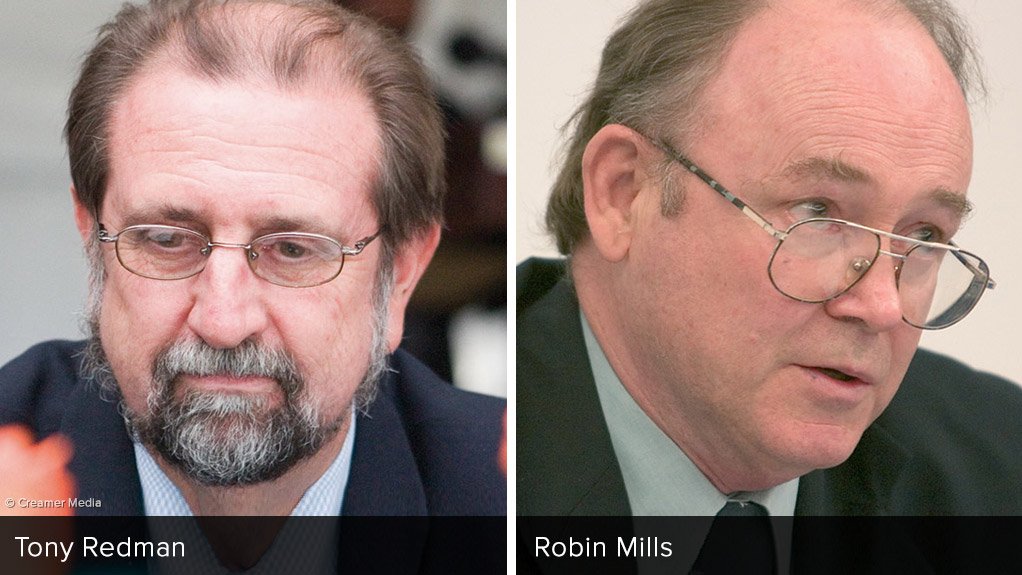

However, because the junior mining sector is not only under capitalised but also under skilled, Appian has drawn in former Anglo American stalwart Tony Redman, one-time Anglo Platinum, De Beers and AngloGold executive Robin Mills and ex-Rio Tinto Exploration GM Jos Haumann to underpin its investment banking team that includes former JP Morgan MD Verne Grinstead and Bain Capital Private Equity Europe co-founder Vincent Jacheet.

“It’s not just capital. Every investment comes with a Redman, a Mills and a Haumann,” Scherb added.

Appian has full discretion on where it will invest and has decided to give iron-ore, uranium, diamonds, bauxite and nickel wide berths.

It is prepared to ride both the up cycles and the down cycles for the few correct, select long-term assets, which it will seek to move up the value curve.

It sees opportunities for dividend streaming and its exits will range from straight sales to mergers and acquisitions and initial public offerings.

It will pick up listed and unlisted assets in a 60%/40% split, taking up to 20% shareholdings in listed entities and higher percentages of private companies with assets that are able to generate near-term positive cash flow.

The Appian Natural Resources Fund is a signatory to the United Nations-backed principles for responsible investment and is committed to meeting the highest international environmental, social and governance standards.

Scherb, an Austrian national who has lived and worked in six countries, started his career structuring foreign investment into Beijing, China.

At JP Morgan, he discerned an inappropriate allocation and tempo of funding to the small- and medium-sized mining segment and he has founded Appian to correct that imbalance.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation