Near-term catalysts place Integra Gold on the fast track to production

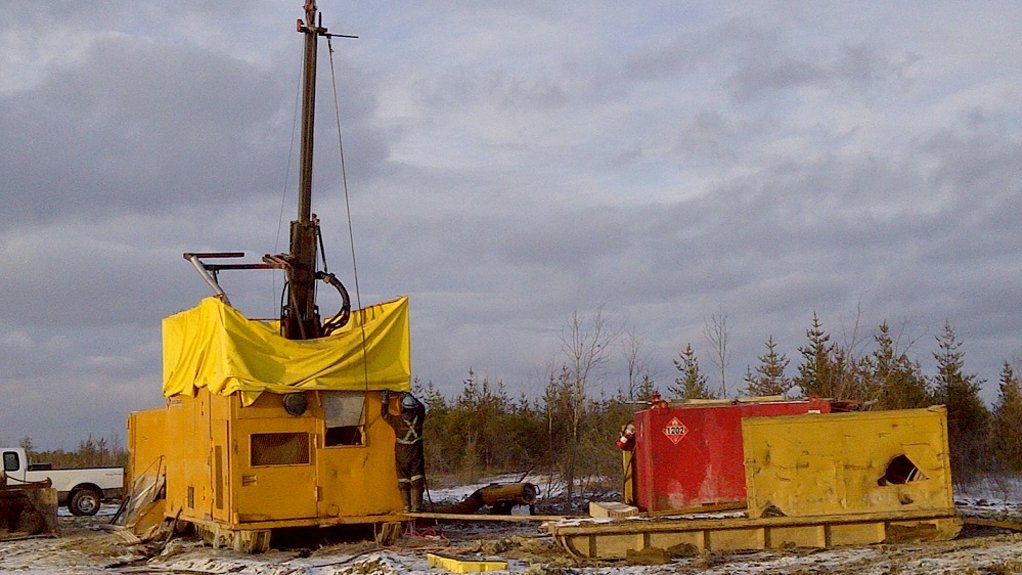

Drilling at the Parallel Zone at Lamaque South, Quebec

Photo by Integra Gold Corp

TORONTO (miningweekly.com) – Two significant near-term catalysts were shaping up to keep Integra Gold Corp investors intrigued and would contribute to help differentiate the Canadian project developer from its peers, who are competing for capital in a tough junior market environment.

Speaking to Mining Weekly Online from Vancouver, president and CEO Stephen de Jong on Tuesday said the company’s September acquisition of the Sigma-Lamaque mill and historic mines had proven to be somewhat-unexpectedly fortuitous for its flagship Lamaque South project, in Val-d'Or, Quebec.

“There are very few companies out there in the junior space right now that have major catalysts on their horizon. We should be able to publish our updated preliminary economic assessment (PEA) in January, that would incorporate the economics of the newly acquired mill into our existing scenario, and on the back of that, the company expects to release early in the second quarter an updated resource estimate as well, that would incorporate about 40 000 m of drilling since the last estimate was published in April,” De Jong said.

With two recent milestones under the TSX-V-listed company’s belt being the announcement last month that the Canadian Environmental Assessment Agency (CEAA) had informed it that Integra would not be required to file a federal environmental assessment for the combined properties, and having received provincial authorisation to continue with underground exploration of the Parallel Zone at Lamaque South, the company was on a fast track to become one of Canada’s next high-grade gold producers.

SERENDIPITOUS SYNERGY

“There’s no better time to build a mine and attract skills than in a bear market,” De Jong commented, saying that the opportunistic acquisition of bankrupt Century Mining Corporation’s assets had several benefits for its own Lamaque South project.

In March, Integra put out its maiden PEA that estimated a two-year timeline to production, relying on third-party toll-milling agreements to process the project’s ore. However, with the September acquisition of the Sigma-Lamaque complex, conveniently located next to Lamaque South, the initial scenario was significantly optimised, giving the company access to better recoveries, lower operating costs, better capital synergies and a quicker path to permitting.

De Jong stressed that from a time value perspective to cash flow, the CEAA’s ruling last month was expected to save an estimated 6 to 12 months as Integra progressed towards a production decision, in addition to the positive timeline implications stemming from the infrastructure obtained in the acquisition.

The acquisition, which involved C$7.55-million in cash and scrip comprising C$1.8-million in cash and 25-million common shares valued at C$5.75-million, secured milling capacity for Integra, lowered processing and transportation costs relative to a toll-milling scenario and avoided entering complicated toll-milling agreements.

The purchase price represented a significant discount to the replacement value of the 1 200 t/d to 2 200 t/d mill and tailings infrastructure, estimated in 2014 by independent engineering firm WSP Canada at about $100-million, excluding gold resources on the property.

De Jong said the mill provided the company with a platform for regional consolidation and production growth, while simultaneously providing a pre-existing tailings management facility with increased capacity potential and all environmental permits in place, reducing the overall environmental impact and permitting risk.

The acquisition also added contiguous mining claims and 586 000 oz of measured and indicated gold resources and 1.85-million ounces in the inferred category, all of which might become economically viable should gold prices rise in the future.

De Jong pointed out that among the most important benefits was that in restoring the Sigma-Lamaque mine site to full operation, Integra would address the unfunded environmental liability.

“The biggest focus for 2015 is to integrate the Sigma-Lamaque mill and property into the company, while simultaneously assuring investors that the company is not pursuing the same ‘spent’ resources previous owners had failed to recover. We have our own independent virgin lands to the south of the complex, and our primary objective in the transaction was to secure a mill to process material from Lamaque South,” De Jong said.

He added that the deal provided synergies with Integra’s own Lamaque South project, owing to the underground infrastructure potentially being easily integrated. Integra was currently modifying its development plan to reflect a change in which ore from the Parallel zone would no longer be mined from surface, but instead be accessed from underground infrastructure acquired with the mill property, thereby reducing the environmental impact.

Further, most of the required permits for the acquired property were already in place, four of which had already been transferred into Integra's name.

SNOWBALLING FEASIBILITY

Integra in March published a PEA for Lamaque South, which contemplated a 112 000 oz/y operation at an all-in cost of C$805/oz, with a C$70-million price tag.

The PEA had demonstrated robust economics, with a pre-tax net present value of C$146-million at an assumed gold price of C$1 250/oz gold, and a pre-tax internal rate of return of 51%.

Over the project’s five-year life, it was expected to produce 505 600 oz of gold at an average head grade of 8.19 g/t.

De Jong said that the mill's historic recovery rate averaged between 91% and 97%. The mineralised material processed historically is very similar to what is found on Lamaque South, suggesting similar recoveries would be feasible.

Further, by not toll milling, the company expected to save between $15/t to $20/t in transport and toll-milling fees.

The mining complex had the benefit of strong existing infrastructure in the mining-oriented district, and skilled personnel were available in the mining town of Val-d'Or, located about a kilometre down the road from the project.

“From a project perspective, we do not have metallurgical or staffing problems. We need to find money, and that will be a big theme for 2015,” De Jong said, adding that the company was in the final stages of completing an updated PEA, which would analyse the economic effect of the mill acquisition on the existing Lamaque PEA.

The company last week upsized a C$6-million bought-deal financing to C$7-million, which De Jong said was an indication of the strong investor interest in the company. Underwriters Paradigm Capital and Cormark Securities had agreed to buy 21.74-million flow-through common shares of the company at a price of C$0.23 apiece and 7.4-million of the company’s Quebec super flow-through common shares at a price of C$0.27 apiece.

The financing was expected to close at month-end.

Intergra’s TSX-V-listed stock had gained 11.76% since the start of the year, and on Tuesday closed at C$0.185 apiece. The company’s market capitalisation stood at C$38.97-million.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation