Maricunga lithium brine project, Chile – update

Name of the Project

Maricunga lithium brine project.

Location

Northern Chile.

Project Owner/s

Minera Salar Blanco (MSB), a subsidiary of Lithium Power International.

Project Description

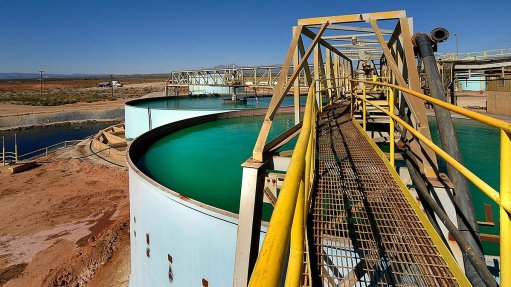

Maricunga is regarded as one of the highest-quality preproduction lithium brine development projects globally.

The project has mineral resources of 2.07-million tonnes of lithium carbon equivalent.

The study’s mineral reserve estimate of 742 000 t of lithium carbon equivalent supports the 20 000 t/y projected for the project over its 20-year mine life.

The study is based on an average of 173 ℓ/s of brine throughout the project’s mine life, with a peak extraction rate of 300 ℓ/s during the first two years of the project to allow for the ponds to fill. Brine will be extracted from a minimum of 12 individual wells, pumping through two central collection ponds to the evaporation ponds.

Concentrated lithium brine from the evaporation ponds will be pumped to the reservoir ponds, which will feed a salt removal plant. The concentrated lithium brine obtained from the plant will be fed to the lithium carbonate plant, where purification, solvent extraction and filtration remove remaining impurities, including calcium, magnesium and boron. Thereafter, the concentrated lithium brine will be fed to a carbonation stage, where the lithium carbonate precipitates through the addition of soda ash.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has a leveraged net present value, at an 8% discount rate, of $1.3-billion and an internal rate of return of 29.8%, with a payback of 3.5 years.

Capital Expenditure

Total capital expenditure is estimated at $563-million.

Planned Start/End Date

Construction of the mine and lithium plant is expected to begin in 2020, with first production of lithium expected in 2023.

Latest Developments

Lithium Power plans to raise A$12.4-million through a share placement to sophisticated and institutional investors.

The company will place 47.69-million shares, at 26c each, with the offer price representing a 10.3% discount to the company’s last closing price, and a 12.9% discount to its five-day volume weighted average share price.

Funds raised in the placement will be used for the development of the Maricunga lithium brine project, and for renewed exploration programmes at Lithium Power’s Western Australian operations, including its Greenbushes project and other targets.

“We are working with a number of large, international institutions to partner us in the final development of Maricunga. The quality of these potential partners is very encouraging,” CEO Cristobal Garcia-Huidobro has said.

Key Contracts, Suppliers and Consultants

WorleyParson (definitive feasibility study) and GEAMesso (production process design and future supply contract for the equipment and production plant).

Contact Details for Project Information

Lithium Power International, tel +61 2 9276 1245 or email info@lithiumpowerinternational.com.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation