Mardie salt and potash project, Australia – update

Name of the Project

Mardie salt and potash project.

Location

On the Pilbara coast of Western Australia.

Project Owner/s

Australia-based resources company BCI Minerals.

Project Description

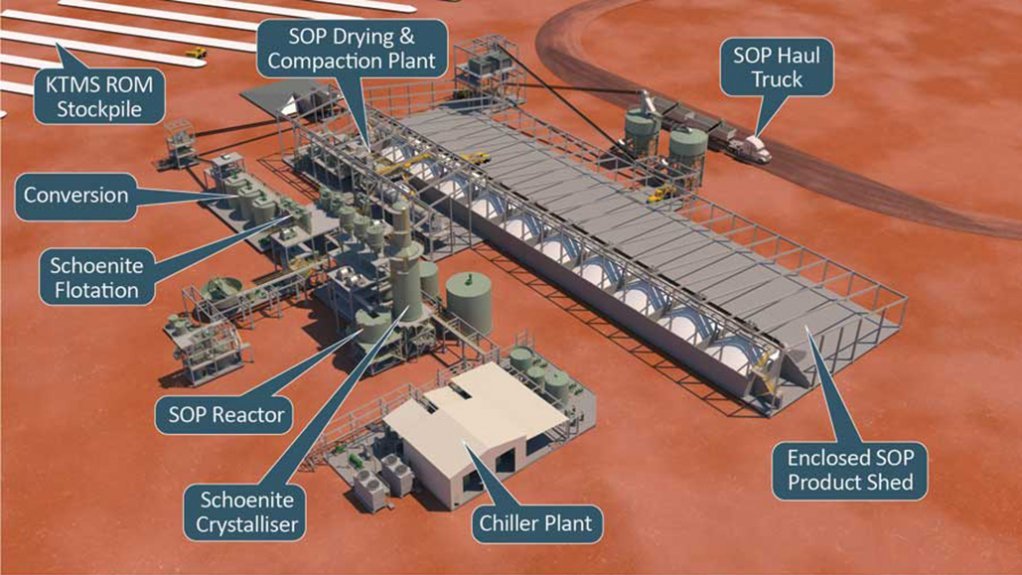

An optimisation study has delivered a bigger project and an improved layout, compared with the July 2020 definitive feasibility study (DFS). An expansion of the evaporation area has resulted in an increase of about 20% in salt production, from 4.4-million tonnes a year in the DFS to 5.35-million tonnes a year in the optimisation study, as well as an increase in sulphate of potash (SoP) production from 120 000 t/y to 140 000 t/y.

Using an inexhaustible seawater resource and a production process driven mainly by natural solar and wind energy, there is potential to optimise and expand the project beyond the currently planned production levels.

The project’s operating life is estimated at a minimum of 60 years.

Potential Job Creation

During construction, 490 jobs are expected to be created, while 2 200 jobs are expected to be created during operations.

Net Present Value/Internal Rate of Return

The project’s estimated ungeared net present value has increased from A$1.19-billion, at a 7% discount rate, in the DFS, to $1.67-billion in the optimisation study.

Capital Expenditure

Main construction capital costs have increased from A$779-million in the DFS to A$913 in the optimisation study. The project has an internal rate of return of 16.1%.

Planned Start/End Date

BCI aims to start construction in early 2022, which will allow for first salt sales to be achieved by the fourth quarter of 2024 and first SoP sales by the first quarter of 2026.

Latest Developments

On November 25, Western Australian Minister for Environment Amber-Jade Sanderson granted BCI Minerals approval to construct its Mardie salt and potash project.

The approval follows an earlier announcement by the Minister that the recommendations made by the state’s Environmental Protection Authority (EPA) in July this year should be amended to better reflect the intended outcome of the EPA’s assessment and to improve transparency and confidence in the research offset conditions.

BCI has said that the conditions contained in the Ministerial Statement are consistent with those set out in the recent appeals determination and allow for BCI to develop an environmentally sustainable project that preserves the flora, fauna and water systems of the area. The conditions will not have a material impact on the Mardie project design, costings or operations, and will be incorporated in BCI’s environmental management plans to ensure impacts are minimised and managed.

With environmental approval now in place, BCI expects construction to start in early 2022, subject to securing secondary statutory approvals and shareholder approval for a A$360-million capital raise to fund the project construction.

The company has launched a A$360-million capital raise, which comprises a A$240-million share placement, a A$20-million share purchase plan (SPP) and a potential A$100-million convertible note issue.

The company has received commitments for the placement of about 588.1-million shares, at 43c each, to raise the A$240-million, subject to shareholder approval at the company’s general meeting scheduled for December 20. Subject to this approval, as well as final statutory approvals, the funding solution will allow for construction at Mardie to start in early 2022.

Owing to the strong demand, subscriptions from cornerstone investors AustralianSuper for A$75-million and Wroxby for A$110-million have been scaled back to A$72.5-million and A$103-million respectively.

Accordingly, Canaccord has underwritten the A$64.5-million balance of the placement, including subscriptions from Ryder for A$28.5-million and Sandon for A$3.5-million.

The SPP will open on November 26, and will close on December 17.

Key Contracts, Suppliers and Consultants

The DFS was managed by BCI, with support from GR Engineering Services (DFS lead engineer), additional support from Worley, CMW Geosciences, Preston Consulting, RPS, Roskill, Argus Consulting, Braemar ACM Shipbroking and KPMG, besides others; and Engenium (project management contractor).

Contact Details for Project Information

BCI Minerals, tel +61 8 6311 3400 or email info@bciminerals.com.au.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation