Mahenge graphite project, Tanzania – update

Photo by Black Rock Mining

Name of the Project

Mahenge graphite project.

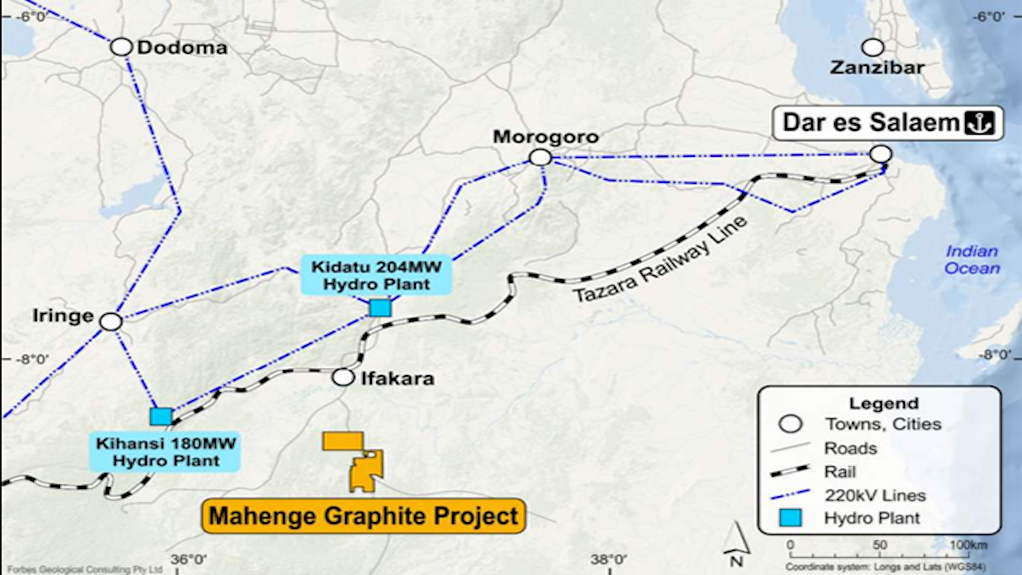

Location

Ulanga district of the Morogoro region, Tanzania.

Project Owner/s

Australian mining company Black Rock Mining.

Project Description

Mahenge will be an openpit mining operation, based on mining the Ulanzi and Cascade deposits.

An independent review of the front-end engineering design (FEED) and an enhanced definitive feasibility study (eDFS) has confirmed the Tier 1-scale Mahenge project as robust, with attractive returns.

The project will use contract mining as proposed in the eDFS instead of owner operator mining.

Mahenge ore will be processed over the life-of-mine (LoM) using a four-stage approach where four process plants will be built sequentially in a modular format.

Processing throughput will initially be one-million tonnes a year when the Module 1 process plant is commissioned, increasing to two-million tonnes a year when Module 2 is commissioned, to three-million tonnes a year when Module 3 is commissioned and to four-million tonnes a year with the completion of Module 4.

The four stages will be developed over the initial years of the mine, with the current mine schedule indicating an LoM of 26 years, after which the current defined deposits will be depleted.

The Module 1 and 2 process plants will process ore from the Ulanzi deposit, while the Module 3 and 4 process plants will process ore from the Cascade and Epanko deposits.

The Module 1 process plant will be fed run-of-mine ore at an average grade of 8.24% total graphitic carbon and will recover an estimated 93% of this graphite to produce about 89 000 t/y of graphite products over the first 20 full years of production.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has an after-tax net present value, at a 10% nominal rate, of $1.38-billion and an internal rate of return 36%, with a payback of 3.8 years.

Capital Expenditure

Based on the FEED work, the updated capital cost estimate for the development of Module 1 is $182-million, including a contingency allowance of $22-million. Module 2 is estimated at $107-million. The updated capital expenditure for modules 3 and 4 is estimated at $117-million and $104-million respectively.

Planned Start/End Date

Black Rock Mining is targeting first production from its Mahenge graphite project in 2024.

Latest Developments

Black Rock Mining has received approval from the Development Bank of Southern Africa (DBSA) for project debt of up to $59.6-million, which is expected to form part of the project debt facilities for the Mahenge graphite project.

Several potential lenders, including development finance institutions and Tanzanian commercial banks, have progressed through the substantive part of the due diligence process, including site visits, and are progressing indicative term sheets based on their due diligence and the eDFS update outcomes.

Black Rock expects lender board approvals from several potential lenders to be notified to the company during the fourth quarter. Once those board approvals are received, Black Rock will then seek to negotiate and execute full form facility agreements with successful lenders, and confirm the structuring of the project financing package.

Such approvals and facilities are expected to contain terms and conditions usual for facilities of this type, but there is no guarantee of the conditions potential lenders may seek to impose, or that facility agreements will ultimately be entered into.

Ultimately, funding for the project to reach production will require a combined debt and equity project finance package, with Black Rock saying it is targeting up to 50% debt through traditional project finance.

Korean steelmaking company Posco has entered into a memorandum of understanding (MoU) with Black Rock for a potential cornerstone equity position of up to $40-million and the debt component is expected to require a combination of lenders. This follows the June 2020 announcement by Black Rock of a strategic alliance with Posco for the development of Mahenge.

This included an equity investment of $7.5-million, followed by an offtake agreement for 32% of the volume of fines for Module 1 plus a $10-million prepayment facility.

Posco has also signed an MoU for 6 000 t/y of large flake graphite, about 7% of the volume, thereby increasing Posco’s offtake interest to almost 40% of Module 1.

The debt funding is intended to fund Module 1 and supporting infrastructure, including a 220 kV powerline and associated switchyards at the Mahenge town site.

Key Contracts, Suppliers and Consultants

None stated.

Contact Details for Project Information

Black Rock Mining, tel +61 8 9320 7550 or email info@blackrockmining.com.au.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation