Low capital, operating costs for McEwan's Gold Bar following feasibility study

TORONTO (miningweekly.com) – A feasibility study conducted on Toronto-headquartered McEwen Mining’s Gold Bar project, in Nevada, reports that low capital and operating costs and a reasonable rate of return in the current price environment, increase the likelihood that the project will become the company’s next new mine.

Prepared by SRK Consulting, the study found that for an expected capital cost of $60-million, using a base case scenario of $1 150/oz of gold, the 100%-owned project would generate an after-tax net present value, at a 5% discount rate, of $30-million, with the internal rate of return stated at 20%.

“Completion of this feasibility study is an important milestone. I believe Gold Bar will be the next mine we put into production. It includes the fundamental elements we consider important to investors when building a mine - low capital and operating costs, and a reasonable rate of return in the current price environment. We can now move ahead with a high degree of confidence in the capital estimate and projected operating performance,” chairperson and chief owner Rob McEwen advised.

The Gold Bar project would produce gold at an average rate of 65 000 oz/y over the five-year mine life, with costs estimated to average $728/oz. The project would break even at a projected gold price of $995/oz.

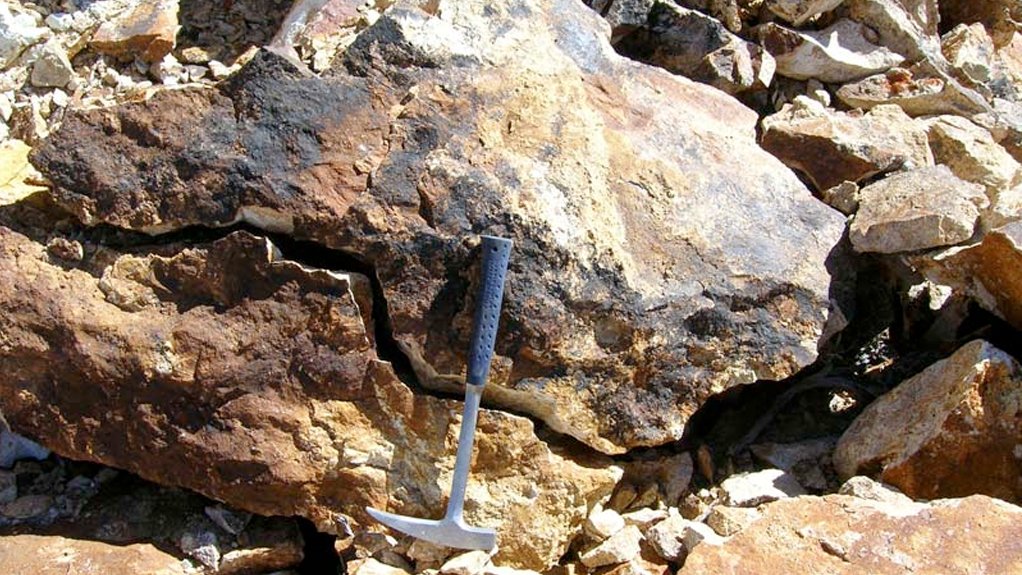

The operation would comprise an owner-operated openpit mine, with run-of-mine oxide heap leach processing. Gold Bar would produce 13-million tons of ore over the life of the operation, grading 1.1 g/t on average, and 325 000 oz of yellow metal. The average strip ratio would be 5.2.

SRK also developed an updated compliant resource estimate for the project, stating pit-constrained measured and indicated resources of 611 000 oz and 111 000 oz in the inferred category. Proven and probable reserves were 441 000 oz at an average grade of 0.034 g/t of gold.

Gold Bar ore comprised a Carlin-style carbonate sedimentary sequence with strong fracture-controlled oxidation above the water table to the full depth of planned mining. Testwork showed that ore was amenable to heap leach cyanidation, with high gold recoveries and relatively rapid leaching kinetics. A 15 t bulk sample taken earlier this year had demonstrated that material size did not significantly influence recovery.

McEwen added that further opportunities existed to improve the economics of the Gold Bar project through further exploration, capital cost reductions and potential process plant engineering synergies with its existing El Gallo mine, in Mexico.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation