Langer Heinrich uranium restart project, Namibia – update

Photo by Paladin Energy

Name of the Project

Langer Heinrich uranium restart project.

Location

Namib Desert, Namibia.

Project Owner/s

Langer Heinrich Mauritius Holdings is the holding company of Langer Heinrich Uranium, which holds 100% of the Langer Heinrich tenements.

Paladin Energy owns 75% of Langer Heinrich Mauritius Holdings, with 25% owned by CNNC Overseas Uranium Holdings.

Project Description

Langer Heinrich has an estimated 17-year mine life, supported by ore reserves of 84.8-million tonnes with an average uranium grade of 448 parts per million.

Life-of-mine production is estimated at 77.4-million pounds of uranium, up from a previously stated 76.1-million pounds.

Langer Heinrich was placed on care and maintenance in August 2018, owing to the sustained low uranium price.

Paladin completed a concept study on Langer Heinrich in February 2019, which identified multiple options to reduce operating costs, improve process plant performance and potentially recover a saleable vanadium product.

A two-stream prefeasibility study (PFS1 and PFS2) was started in March 2019 to improve the details of the restart plan and pursue further improvement options to clearly present a compelling investment case.

PFS1 focused on confirming effective care and maintenance plans, practices and costs while developing a more detailed plan to execute a rapid restart at Langer Heinrich in an improved uranium market.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

Not stated.

Capital Expenditure

Restart costs for the Langer Heinrich operation were previously estimated at $81-million; however, in July 2022, Paladin reported that restart costs had increased to $118-million, driven by:

- the industry-wide cost escalation in labour, equipment and raw materials;

- key utility infrastructure work packages having been brought forward to ensure the provision of water and power over the life of the operation;

- strengthening the project management team through expanded engineering, procurement, construction and management services;

- minor modifications to the scope of the project; and

- an increase in project contingency levels.

Planned Start/End Date

Restart project started in July 2022, with target production expected in the first quarter of 2024.

Latest Developments

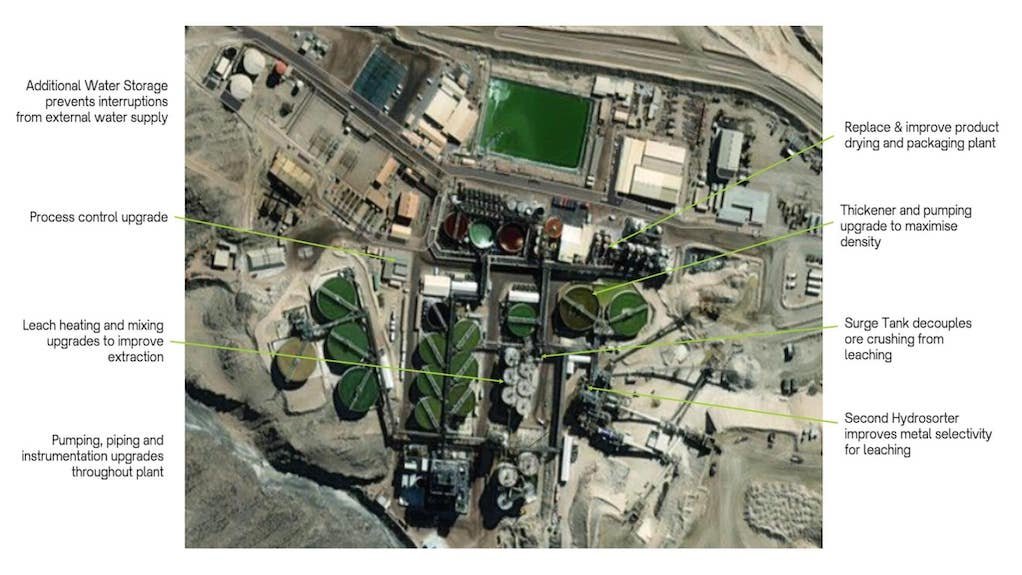

The restart project is continuing, focusing on general repairs and refurbishment to return the existing process plant to operational readiness, coupled with the engineering and procurement for the delivery of growth projects and process upgrades to increase throughput capacity and operational availability.

The project has progressed several activities in the six months to December 31, 2022.

This includes the completion of redundant process equipment removal and starting strategic equipment removal to facilitate growth projects scope execution; the completion of site establishment activities in preparation for receiving site construction contractors, and project equipment and materials; and site work programmes started and progressed for concrete repairs, pump refurbishments and statutory electrical upgrades.

Further, the final contractor selections have been made, and the primary repairs and refurbishment construction scopes of work awarded.

Paladin has also awarded all material contracts and purchase orders for project parts and equipment.

It has also accepted the supply proposals of NamPower and NamWater.

The debottlenecking planning and the preservation of the LHM processing plant and related infrastructure are also continuing.

Further, Paladin has secured four uranium offtake agreements with industry-leading US and European counterparties, successfully agreed nomination volumes and negotiated to supply additional volumes to China National Nuclear Corporation in 2024 and 2025, in addition to negotiating an early payment agreement.

It is negotiating a contract for a further tender award for the supply of uranium to a leading US utility.

The company continues to engage with top-tier industry counterparties as it aims to layer industry-leading offtake agreements ahead of production.

Key Contracts, Suppliers and Consultants

None stated.

Contact Details for Project Information

Paladin Energy, tel +61 8 9381 4366 or email paladin@paladinenergy.com.au.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation