Kasiya rutile project, Malawi – update

Photo by Sovereign Metals

Name of the Project

Kasiya rutile project.

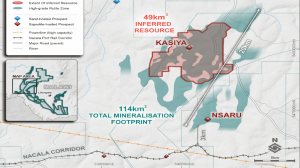

Location

Malawi.

Project Owner/s

Sovereign Metals.

Project Description

Kasiya is the biggest undeveloped rutile deposit in the world. Total mineral resources are estimated at 605-million tonnes grading 0.98% rutile and 1.24% total graphitic carbon.

The initial scoping study on the project has developed the concept for a multidecade mine providing a consistent supply of highly sought-after rutile and graphite while contributing to Malawi's economy.

The proposed large-scale operation will process soft, friable mineralisation mined from the surface and will primarily use conventional hydromining to produce a slurry that will be pumped to a wet concentration plant where the material will be sized.

A heavy mineral concentrate will be produced by processing the sand fraction through a series of gravity spirals, after which it will be transferred to the dry mineral separation plant, where premium quality rutile will be produced using electrostatic and magnetic separation.

Graphite-rich concentrate will be collected from the gravity spirals and processed in a separate graphite flotation plant, producing a coarse-flake graphite product.

The mine will have a throughput of 12-million tonnes a year over a 25-year mine life, producing 122 000 t/y of rutile and 80 000 t/y of graphite.

The rutile and graphite products will be trucked a short distance using existing bitumen roads to the Kanengo rail terminal, from where they will be railed through the Nacala Logistics Corridor to the deep-water port of Nacala on the eastern seaboard of Mozambique.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has an after-tax net present value, at an 8% discount rate, of $861-million and an internal rate of return of 36%, with a payback of 2.5 years.

Capital Expenditure

$332-million.

Planed Start/End Date

Not stated.

Latest Developments

Rio Tinto will make an A$40.4-million investment in Sovereign Metals in exchange for a 15% initial shareholding in the critical minerals developer.

Rio Tinto's exploration arm, Rio Tinto Mining and Exploration, will subscribe for an initial 83.09-million shares in the company at 48.6c each.

Rio will also be granted an option over a further 34.54-million shares, with a 12-month option period, which could result in Rio's share in Sovereign increasing to 19.99%.

Sovereign has indicated that the proceeds from Rio Tinto's investment in the company will be used to advance the company's Kasiya rutile/graphite project, including progressing a definitive feasibility study.

In addition to the subscription agreement, the Rio Tinto and Sovereign have also signed an investment agreement. Under this agreement, the two companies will negotiate financing arrangements to fund mine construction if Sovereign is raising debt finance, and will work to qualify Kasiya's graphite product with a particular focus on supplying the spherical purified graphite segment of the lithium-ion battery anode market.

Rio also has the option to become the operator of Kasiya on commercial arm's-length terms. For so long as Rio is the operator of the project, the major will have exclusive marketing rights over 40% of the yearly production from the project.

Rio will also be entitled to appoint a director to the Sovereign board and will have the right of first refusal over any capital raisings that are not pro-rata entitlement offers, as long as it holds a minimum 10% interest in Sovereign.

Sovereign is working on a prefeasibility study for the project, which is expected in the coming months.

Key Contracts, Suppliers, and Consultants

DRA (lead study manager); Jem-Met (project management); Placer Consulting (mineral resource estimate); Oreology Mine Consulting (mine scheduling and pit optimization); Fraser Alexander (mining methods and tailings management); Epoch Resources (tailing disposal); AML (metallurgy – rutile); SGS (metallurgy – graphite); Dhamana Consulting (environment and social studies); JCM Power (power); TZMI (marketing – rutile); Fastmarkets (marketing – graphite); Morgan Sterling Consultants (logistics) and Minviro (life-cycle assessments).

Contact Details for Project Information

Sovereign Metals, Tel +61 8 9322 6322, or email info@sovereignmetals.com.au.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation