Kambalda nickel restart project, Australia – update

Photo by Mincor Resources

Name of the Project

Kambalda nickel restart project.

Location

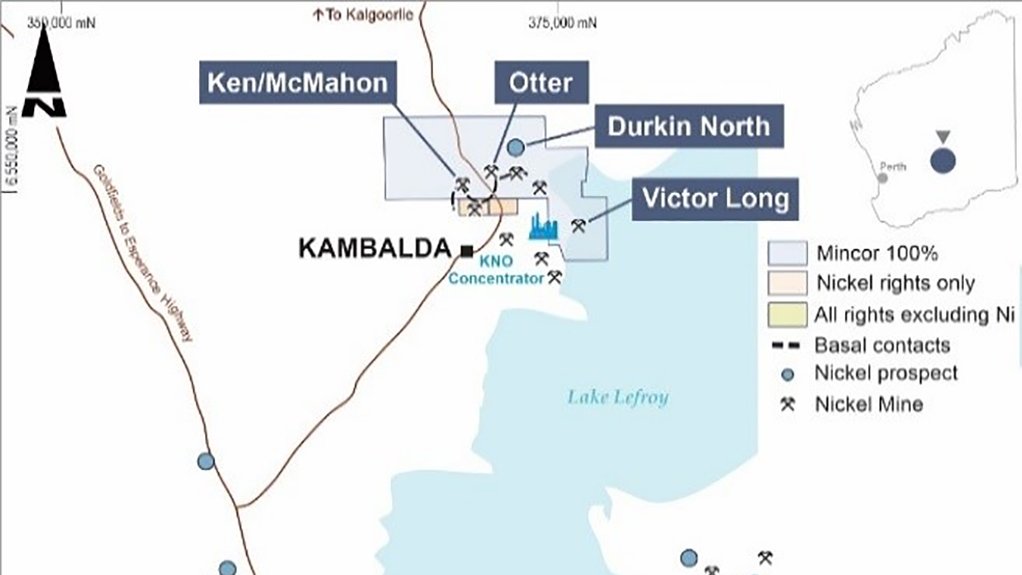

The Kambalda district of Western Australia.

Project Owner/s

Nickel miner Mincor Resources.

Project Description

A definitive feasibility study has proposed the development of a mining operation producing 63 000 t of recovered nickel-in-concentrate with relatively low capital intensity.

The initial five-year operation is based on 2.5-million tonnes of ore grading 2.9% nickel for 71 000 t of contained nickel-in-ore and 5 000 t of copper-in-ore.

The Mincor nickel operations are expected to comprise the Cassini and Northern operations (Long and Durkin North) at the start, with the Miitel mine contributing towards the latter half of the project life.

The flagship Cassini mine, a greenfield discovery by Mincor, is forecast to contribute 56% of the total nickel-in-concentrate production over the initial life of the project.

The mine plan involves underground extraction of the Cassini deposit through a boxcut and decline, mining 1.2-million tonnes of ore at an average nickel grade of 3.3%.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has a pretax net present value, at a 7% discount rate, of $305-million and an internal rate of return of 98%, with a payback of 12 months.

Capital Expenditure

Preproduction capital is estimated at $68-million, mainly associated with mine development and related infrastructure.

Planned Start/End Date

First nickel concentrate is scheduled in the June 2022 quarter, instead of late in the March 2022 quarter as previously guided.

Latest Developments

Mincor Resources has extended the reserve-backed mine life at its Kambalda nickel operations to six years, following an initial ore reserve for the Golden Mile.

The company announced on October 28 an ore reserve of 475 000 t at 2.6% nickel for 12 500 t of nickel at Golden Mile, increasing the ore reserve for the Northern operations by 58%, and the total ore reserves for the Kambalda nickel operations by 18%.

Mincor has said that the close proximity of the new mining area to existing underground infrastructure connecting the Long and Durkin North operations, access development Is planned to start in the new area over the course of the 2023 financial year, with first stoping targeted late in the 2023 calendar year.

The company has said that the new mining zone will provide a third discrete mining front at the Northern operations, substantially increasing mining flexibility and derisking Mincor’s broader ramp-up objectives.

“Delivering an initial ore reserve on the Golden Mile less than 16 months after exploration drilling first commenced in this sector of the Northern operations is a remarkable achievement by our geology and mining teams,” Mincor chairperson Brett Lambert has said.

Lambert further explains that the initial ore reserve for the Golden Mile has provided not only a brand-new mining front for the Northern operations but has also proven the largely untapped potential of the exploration space to host significant economic nickel ore reserves, which can be fast-tracked into production using extensive existing infrastructure.

Within 16 months of the first diamond drill hole into the Golden Mile, Mincor has increased its Northern operations reserve base 58%, and its global ore reserves by 18%. This has added a full extra year of reserve-backed production with Mincor’s very first Golden Mile programme.

Key Contracts, Suppliers and Consultants

None stated.

Contact Details for Project Information

Mincor Resources, tel +61 8 9476 7200 or email mincor@mincor.com.au.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation