Kachi lithium brine project, Argentina – update

Photo by Lake Resources

Name of the Project

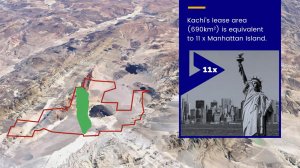

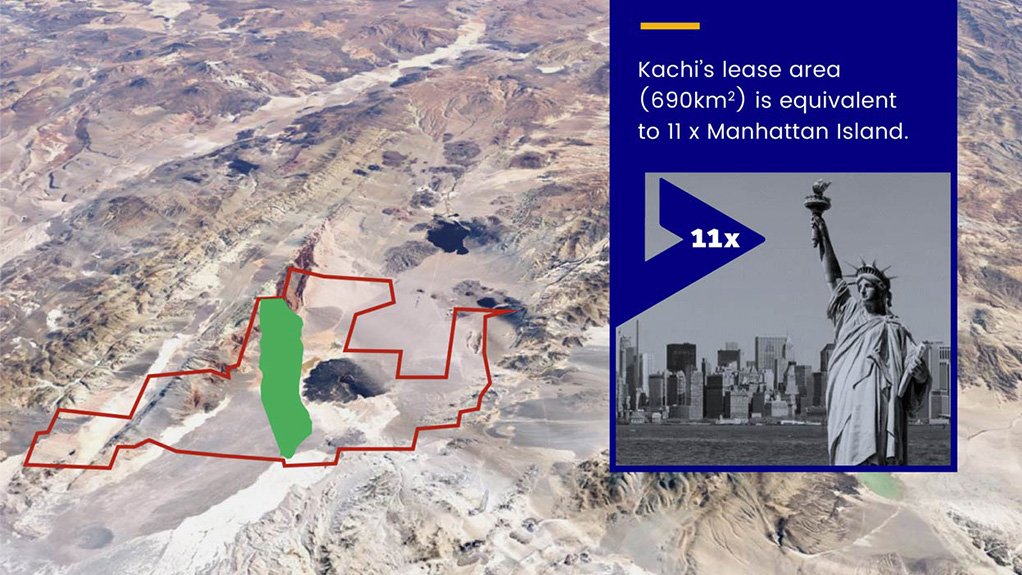

Kachi lithium brine project.

Location

Catamarca, Argentina.

Project Owner/s

Lithium developer Lake Resources.

Project Description

A prefeasibility study (PFS) has demonstrated Kachi’s potential to deliver high-purity product – based on a sustainable and scalable process – required by battery makers.

The PFS envisages a long-life, low-cost operation with a production target of 25 500 t/y of battery-grade lithium carbonate using direct lithium extraction technology based on ion exchange, which, in turn, is based on an indicated resource of one-million tonnes lithium carbonate equivalent.

The process involves the treatment of about 23-million cubic metres a year of brine at 250 g/ℓ lithium, with an overall plant recovery of 83.2%. The eluate from the process is further concentrated and purified, and then fed into a conventional lithium carbonate plant.

No solvent extraction plant is required to remove boron.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has a pretax net present value, at an 8% discount rate, of $1.05-billion and an internal rate of return of 25%, with a payback from first product delivery of five years.

Capital Expenditure

The project entails an investment of $544-million.

Planned Start/End Date

Not stated.

Latest Developments

Lake Resources has reached a conditional framework agreement with electric vehicle battery developer SK On for the supply of up to 25 000 t/y of lithium from the Kachi project, and a potential 10% stake in Lake through a strategic investment.

The agreement strengthens Lake’s long-term shareholder base and adds to the equity component required for the drawdown of debt facilities for project development.

The agreement with SK On will cover 50% of Kachi’s planned lithium production, an initial five-year term and the option for a further five years. The offtake will be priced on an agreed-upon market price formula, based on the average quoted price in the quotation period.

The agreement is subject to several conditions, including a positive definitive feasibility study (DFS) for Kachi, positive results from Lilac Solutions’demonstration plant, financial due diligence and product specifications.

The company reported earlier this year that the DFS will consider a production case of 50 000 t/y, given the increased demand from potential offtakers. The DFS is due for completion in the third quarter of 2022.

Key Contracts, Suppliers and Consultants

Lilac Solutions (lithium extraction testwork); Hatch (engineering and design services); and Citi and JP Morgan (finance coordinators of the Kachi project).

Contact Details for Project Information

Lake Wells, tel +61 2 9299 9690 or email hello@lakeresources.com.au.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation