JV marks strategic leap in chrome, PGMs recovery

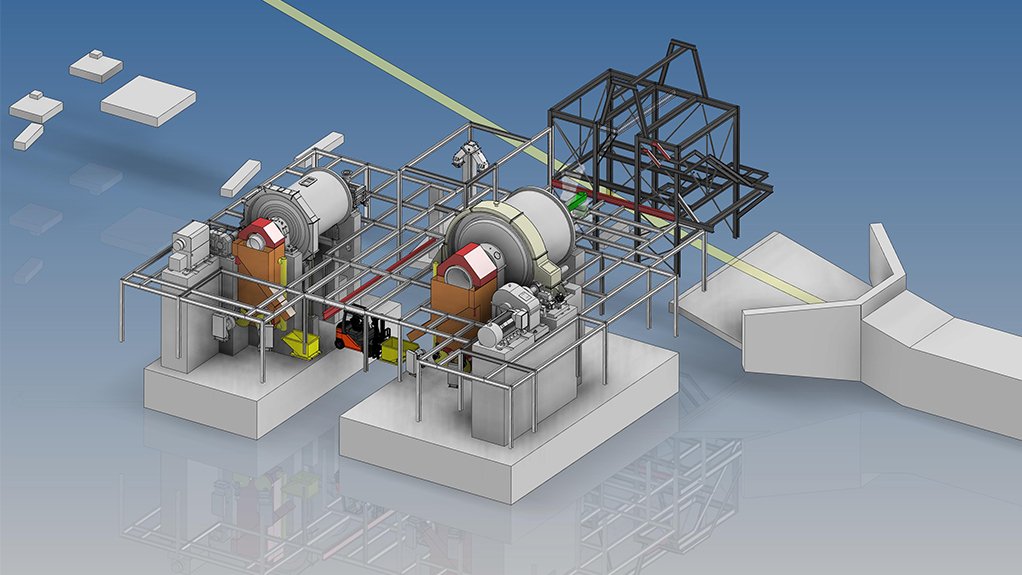

ENHANCED PRODUCTION Sylvania Platinum’s ongoing efforts centre on improving production efficiencies

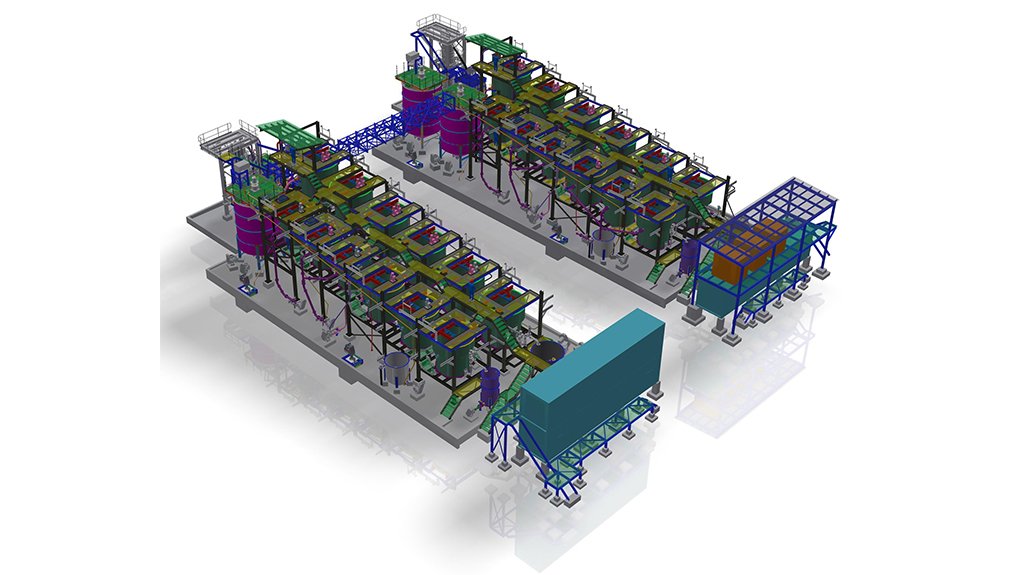

THABA JV AREA The Thaba JV is set to be transformative in terms of Sylvania’s PGMs extraction in South Africa’s mineral-rich Bushveld region

JACO PRINSLOO The PGM market's challenges are expected to impact major players

August marked a strategic milestone for platinum group metals (PGMs) miner Sylvania Platinum with the announcement of the 50:50 Thaba joint venture (JV) with low-cost chrome producer ChromTech’s Limberg Mining, which is set to “be transformative in terms of Sylvania’s PGMs extraction in South Africa’s mineral-rich Bushveld region”, says Sylvania Platinum CEO Jaco Prinsloo.

The JV aligns with Sylvania’s growth strategy, as it serves as a gateway for the miner to access revenue from its chrome operations, expanding its footprint and capitalising on the company’s distinctive position in recovering PGMs and chrome as by-products from the ore it treats.

Sylvania, already a major PGMs processor, operates in the bottom, more profitable, quartile of the PGMs cost curve, which offers a significant advantage, while the Thaba JV is expected to share similar fundamentals, also positioning it in the bottom quartile of the PGMs cost curve.

Prinsloo says this alignment with low operating costs makes the JV an “attractive investment”, especially amid current PGM market challenges.

The JV introduces a novel revenue-sharing approach, “not only exposing Sylvania to the chrome market but also diversifying its revenue streams”.

Since the August announcement, the Thaba JV has achieved significant milestones in project development, with project teams being actively engaged in initial design work, and detailed design phases having been completed.

Procurement of major processing and long-lead items started in October, while site activity started in November. Prinsloo says these both indicate the imminent start of construction works.

The timeline for civil construction works is expected to start in the first quarter of 2024, with commissioning targeted within 18 months from August 2023.

Additionally, Sylvania is currently reviewing the mineral resource estimate (MRE) statement for the Volspruit North and South orebodies, which form part of the company’s exploration asset portfolio. Previously focusing on the North orebody, an initial MRE for prospecting and a scoping study were announced in October 2022.

This initial estimate, based on Joint Ore Reserves Committee-compliant data, excluded rhodium data and material from the South orebody.

However, in the past year, the focus has shifted to include rhodium content assays in the North and South orebodies, and the final drafts of these updated MREs are expected to be announced and published before the end of this month.

“The significance of this updated estimate lies in not only its technical precision but also its strategic implications for Sylvania's growth trajectory. The inclusion of rhodium data enhances the overall value proposition, aligning with the company's commitment to optimising value from its exploration assets,” Prinsloo adds.

Further, Sylvania has commissioned consultants to revisit and update the preliminary economic assessment and the scoping study for the project. This update, based on the new MREs, is expected to be completed by June 2024.

The revised scoping study will play a pivotal role in shaping investment decisions, providing a roadmap for subsequent phases of development, potentially leading to a prefeasibility study, Prinsloo says.

Market Outlook

Amid the current elevated chrome ore prices and the ongoing importance of PGMs in decarbonisation technologies and solutions, the Thaba JV and Limberg chrome mine position Sylvania strategically in the Southern Africa region, says Prinsloo.

Despite declining PGM prices over the past year, the company remains confident in its operations being sustainable, owing to its existing operations being in the lowest quartile of PGM costs.

PGM market challenges are expected to impact on major players, with announcements of restructuring, capital programme downscaling and revised production guidance becoming commonplace, and this will impact on supply of the metals, he adds.

However, Sylvania anticipates a recovery in global vehicle sales, with sales predictions of between 84-million and 90-million vehicles to be sold in 2024 and potentially exceeding about 100-million vehicles from 2025 onwards.

Prinsloo believes that vehicles using internal combustion engines will continue to dominate the market with demand to stay stronger for longer than forecasted, as the transition to electric vehicles (EVs) faces constraints in metals availability and associated EV infrastructure.

“We remain optimistic that, despite challenges in the next six to twelve months, the PGMs market, particularly in palladium and rhodium, will strengthen from 2025 onwards, based on estimated metal deficits positively influencing metal prices,” he says.

Sylvania’s current market focus revolves around maintaining control over key aspects it can influence, which Prinsloo says, includes maintaining stable production, continuous optimisation of plant operations in terms of efficiencies and operating costs, and efficient use of capital.

Prinsloo mentions the successful conversion of Sylvania’s last operating plant to a secondary milling and flotation circuit, which assists in reducing unit costs, noting the ongoing efforts that centre on improving production efficiencies, managing operating costs and evaluating capital initiatives.

“We prioritise critical projects essential for growth while reassessing nonessential, no-discretionary expenditures to optimise resource use. “Despite challenging circumstances, we have consistently delivered yearly dividends to shareholders for the past five years and performed significant share buybacks, reflecting our strong operational, and environmental, social and corporate governance track record.”

Maintaining a robust cash balance positions Sylvania “uniquely for potential growth, and merger and acquisition opportunities”, he concludes.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation