Jacinth-Ambrosia set for A$7m restart as zircon market tightens

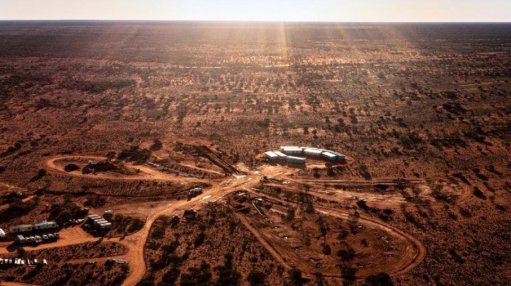

PERTH (miningweekly.com) – Mineral sands miner Iluka will restart mining and concentration activities at its Jacinth-Ambrosia operation, in South Australia, by December.

The ASX-listed company on Thursday said that the restart would cost some A$7-million to complete, with cash production costs estimated to be about A$6-million in 2017.

Operations at Jacinth-Ambrosia were suspended in April last year, for what was expected to be between 18 and 24 months, to allow for inventory drawdown at a time of low demand.

“Iluka continues to be encouraged by the improvement in mineral sands markets. The restart of Jacinth-Ambrosia reflects the continued tightening of the zircon market and follows the substantial drawdown on heavy mineral concentrate inventory over 2017,” said Iluka MD Tom O’Leary.

About 40 employees and 60 contractors would be required to restart operations.

The Jacinth-Ambrosia project is Iluka’s primary source of zircon, and the company is expecting to produce around 300 000 t of zircon in 2018.

Meanwhile, Iluka told shareholders on Thursday that the company was expecting an impairment charge of around A$150-million before tax during the half-year, on its Hamilton mineral separation plant, in Victoria.

Iluka is considering a stated development approach to its Balranald project, in New South Wales, which would see an initial lower mining rate and a lower capital requirement. As a result of this, production volumes will be lower than previously expected, and commercial quantities of mineral sands were not expected from Balranald until 2021.

The resultant lower yearly volumes from Balranald, combined with likely mineral sand production at Iluka’s other Australian operations, would be processed at the Western Australian mineral separation plant, rather than acquiring additional capacity from the Hamilton operation.

While it was possible that the Hamilton plant could be used in the future, there was insufficient certainty to justify carrying the book value, Iluka said.

In addition to the A$150-million impairment charge on the Hamilton operation, a A$14-million redundancy and restructuring cost will also be recorded in the half-year results.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation