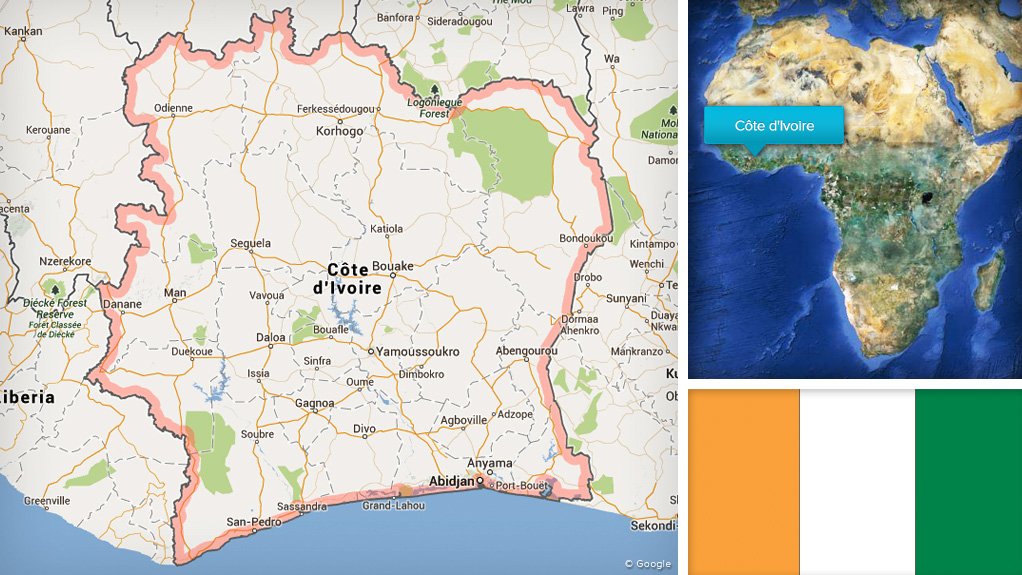

Ity carbon-in-leach project, Côte d'Ivoire

Name of the Project

Ity carbon-in-leach (CIL) project.

Location

Côte d’Ivoire.

Project Owner/s

Endeavour Mining.

Project Description

An optimisation study on the project has significantly improved the previous feasibility study results published in November 2016 and has positioned the project as Endeavour’s next long-life, low-cost flagship asset.

The project’s reserves have increased from 41-million tonnes grading 1.42 g/t gold in the 2016 feasibility study to 57-million tonnes grading 1.57 g/t gold in the optimisation study.

The key change to the design in the optimisation study is the increase in the CIL process plant nameplate design from three-million tonnes a year to four-million tonnes a year to better capture the value created from the recent exploration success, which discovered the Bakatouo deposit and increased resources at Daapleu and Mont/Ity Flat.

Soluble copper from the Bakatouo asset will be blended with the low-copper Daapleu ore into the plant process schedule until the depletion of Bakatouo. A maximum process plant feed limit of 200 parts per million cyanide-soluble copper constraint has been set to manage cyanide consumption within the CIL plant and detoxification circuit.

The process plant will comprise single-stage primary crushing to produce a crushed product size of 80% passing (P80 of 166 mm) and a two-stage semiautogenous (SAG)/ball milling in closed circuit with hydrocyclones to produce a P80 grind size of 75 μm. A gravity concentrator and intensive leach reactor have been included in the design in accordance with the feasibility study.

The CIL circuit comprises eight CIL tanks (up from six in the feasibility study) containing carbon for gold and silver adsorption, with oxygen sparged from two 25-t-pressure swing adsorption oxygen plants and an 18 t split Anglo elution circuit.

Electrowinning and induction furnace smelting will complete the gold doré production process. A cyanide detoxification and arsenic removal circuit is included in the process facility design for the treatment of process residue before discharge to the fully lined 57-million-tonne tailings storage facility, located adjacent to the processing facility.

Other changes made in the optimisation study include:

• the addition of a diverter/flop-gate system, which enables the ball mill to operate independently during periods when the SAG mill is shut down – this operability enables the plant to maximise use and effectively ensure process milling all year;

• the addition of a 26 MW full backup power station, identical to the one installed at the Houndé project;

• optimised upfront capital cost and sequenced overall build time, with a higher percentage of ‘self-perform’ works; and

• the optimisation of the site layout, which allows for the current heap-leach operation to run independently of the CIL project.

In addition, several changes have been made to leverage construction and operating synergies between Ity and Endeavour’s Agbaou and Houndé operations.

The mining sequence and stockpile management have improved in the optimised study, compared with the 2016 feasibility study. Whereas previously the mining period was nine years followed by the processing of stockpiled low-grade ore for another five years, the current mine plan is based on about 12 years of mining followed by the processing of stockpiled low-grade ore for about another two years.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

Based on a gold price of $1 250/oz, the optimisation study has estimated an after-tax net present value, at a 5% discount rate, of $710-million, compared with $411-million in the 2016 feasibility study. The internal rate of return has increased from 35.9% in the feasibility study to 40.3% in the optimisation study.

The project has a payback of 1.8 years.

Capital Expenditure

The Ity CIL project capital expenditure (capex) spend is tracking under budget, compared with the initial budget of $412-million. As construction is tracking ahead of schedule and below budget, Endeavour decided to conduct additional works such as the construction of a fuel farm and building exploration facilities, and an additional $7-million of crop compensation and resettlement related to prospective exploration grounds. As a result of these additional works, and the $10-million to $15-million required for the proposed plant upgrade to five-million tonnes a year, the total project capex spend is expected to amount to about $420-million.

Planned Start /End Date

Construction of the Ity CIL project started in September 2017 and the first gold pour is expected to occur early in the second quarter of 2019.

Latest Developments

The first gold pour the Ity CIL project took place on March 18, ahead of schedule and under budget.

The first pour yielded about 1 800 oz of gold.

About 135 160 t of ore have been processed since ore was introduced into the CIL processing plant last month, the company has said.

Commercial production is expected to be declared in the second quarter of 2019, with performance trial testing to start soon, considering that the crushing, milling and CIL circuits have attained a stable nameplate capacity of four-million tonnes a year.

Following the performance tests already conducted, Endeavour has launched optimisation and debottlenecking work, which is expected to increase the plant’s nameplate capacity by one-million tonnes a year to five-million tonnes a year at a minimal cost of between $10-million and $15-million.

The volumetric upsize work mainly comprises an upgrade to pipes and pumps and a second 50 t oxygen plant, with no additional mining fleet required. These plant upgrades are expected to be completed during scheduled plant maintenance shutdowns throughout the next six months.

Given its current estimated 15-year mine life and strong exploration potential, Endeavour’s ability to increase the plant size to five-million tonnes a year at minimal additional capital expenditure (capex) represents “a compelling investment” the company has said, and is in line with its focus on capital allocation efficiency and return on capital employed criteria.

An exploration programme, valued at about $11-million and totalling about 71 000 m of drilling, has been planned for this year to delineate additional resources at the Le Plaque target, and testing other targets such as Floleu, Daapleu SW and Samuel.

Ity is expected to produce between 160 000 oz and 200 000 oz of gold this year at an all-in sustaining cost of between $525/oz and $590/oz, with the bottom-end of the production guidance corresponding to the four-million-tonne-a-year nameplate capacity, while the top-end factors in upsides such as an earlier start date, an expedited ramp-up and the plant producing above its nameplate capacity.

Key Contracts and Suppliers

None stated.

On Budget and on Time?

The project was completed four months ahead if schedule and under budget.

Contact Details for Project Information

Endeavour Mining VP: strategy and investor relations Martino De Ciccio, tel +44 203 640 8665 or email mdeciccio@endeavourmining.com.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation