Hudbay pursues Augusta Resource’s Rosemont flagship in Arizona

TORONTO (miningweekly.com) – Base metals miner Hudbay Minerals on Sunday announced a C$540-million all-scrip hostile takeover offer for US project developer Augusta Resource Corp, lifting Augusta’s TSX-listed shares to a new intra-year high.

Canada-based Hudbay said it would offer Augusta shareholders 0.315 of a Hudbay share for each Augusta share held, representing about C$2.96 per Augusta share, or a 62% premium to Augusta’s 20-day volume-weighted average share price on the TSX on Friday, or an 18% increase over the stock’s Friday closing price.

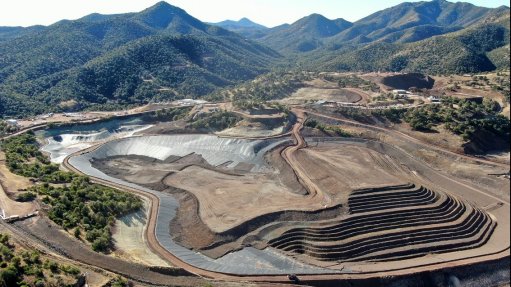

Hudbay said that Augusta’s flagship project, the proposed $1.2-billion Rosemont copper mine, near Tucson, Arizona, could position it as a leading intermediate base metals producer and described it as an “ideal fit” for Hudbay’s growth strategy.

Hudbay currently owns 23.06 shares of Augusta, representing about 16% of Augusta's issued and outstanding shares.

"Since our initial investment in Augusta in 2010, we have been excited about the potential of the Rosemont project. We view the Rosemont project as an attractive complement to our existing portfolio of high-quality, long-life assets that fits well with our construction timeline at Constancia.

The transaction will be accretive to Hudbay shareholders on key per-share metrics and both Hudbay and Augusta shareholders will benefit from our ability to leverage our 87-year history of successful project execution and operations,” Hudbay president and CEO David Garofalo said.

Hudbay said the Rosemont project would benefit from its greater capacity to advance the project.

“Hudbay is confident the Rosemont project will receive all necessary permits. However, based on its extensive due diligence independent of Augusta, Hudbay believes Augusta's management continues to be overly optimistic about the permitting timeline, and Augusta's ability to complete the required engineering and raise the necessary financing to construct the Rosemont project," the company said.

It added that it believed that, through its significant technical expertise and superior financial capacity, it was better positioned than Augusta to advance the Rosemont project through the final stages of permitting and into construction, without the risk currently facing Augusta of further delays, resulting in liquidity shortfalls or requiring dilutive financings, which would materially impair the value of Augusta shareholders’ investments.

Hudbay had appointed BMO Capital Markets and GMP Securities as financial advisers to Hudbay and Goodmans LLP and Milbank, Tweed, Hadley & McCloy LLP were acting as legal counsel.

Laurentian Bank Securities metals and mining analyst Christopher Chang on Monday said that given the fundamental value of Rosemont and the significant share price re-rating he expects upon securing the project’s two remaining major permits, he viewed Hudbay’s unsolicited takeover offer to be low.

“In our view, a positive permitting decision alone should improve Augusta’s share price by more than 18%. While we believe Rosemont is an attractive asset with very robust economics, we believe the number of white knights in a position to trump Hudbay’s proposal is relatively limited,” he said in a note to clients.

Chang added that he believed ASX-listed Oz Minerals and Canadian diversified miner Teck Resources represented companies with the financial capacity to make a competing offer.

“Overall, we believe an improved offer, either by Hudbay or a competing offer, is likely required to motivate current Augusta shareholders to tender,” Chang said.

ATTRACTIVE ROSEMONT

Augusta’s Rosemont large porphyry copper/molybdenum project is close to advancing through the permitting phase.

When up and running, Rosemont is expected to be the third-largest copper mine in the US, after Kennecott Utah Copper’s Bingham Canyon mine, in Utah.

The project has Canadian National Instrument 43-101-compliant proven and probable reserves of 1.1-billion pounds grading 0.44% copper and 35-million pounds of molybdenum.

The feasibility study pointed to a 21-year mine life, with seven mining phases, with high grades and low strip ratios in the first phase.

Sulphide ore would be processed at an initial rate of 75 000 t/d.

The mine is expected to come into production in 2016, with average production of 110 223 t/y at an average cash cost over the life of the mine of $1.02/lb.

Using an interest rate of 8%, the project has a net present value (NPV) of $1.5-billion and an internal rate of return of 30.9%, based on a long-term copper price of $2.62/lb.

The after-tax NPV is based on an interest rate of 8%.

ENVIRONMENTAL CONCERN

Augusta’s TSX-listed stock in November collapsed after a nongovernmental organisation published a letter dated November 7 on its website, and issued a press release alleging that the Environmental Protection Agency (EPA) had recommended to the US Army Corps of Engineers that the Rosemont mine should not receive a permit that would allow the company to “dump potentially toxic mine wastes into area waterways”.

The environmentalists Save the Scenic Santa Ritas said the EPA had concluded in the letter that Augusta’s proposals to mitigate Rosemont's severe damage to area water supplies were “scientifically flawed” and “grossly inadequate”, and advised the Corps of Engineers that the project “should not be permitted as proposed”.

The unverified letter, addressed to Colonel Kim Colloton, said the construction of the mine would permanently fill about 29 km of streams across the about 2 000 ha project footprint and result in the fragmentation of an intact natural hydrologic landscape unit composed of hundreds of streams stretching many linear miles.

However, the Rosemont draft record of decision and final environmental-impact statement was published by the US Forest Service, in December, recommending the project proceed under the environmentally preferable alternative as it, where feasible, minimised adverse environmental and social impacts.

Augusta’s TSX-listed stock on Monday shot up to a high of C$3.45 a share, before settling at levels of about C$3.16 apiece, 25.90% higher than Friday’s closing price.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

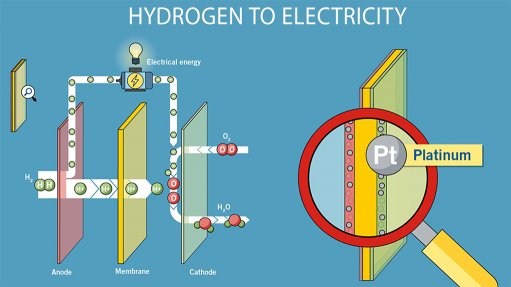

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation