Gibellini vanadium project, US

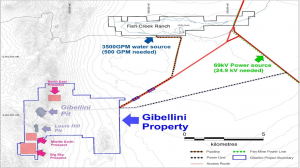

Location map of Silver Elephant's Gibellini vanadium project, in the US

Name of the Project

Gibellini vanadium project.

Location

Nevada’s Battle Mountain region, in the US.

Project Owner/s

Silver Elephant.

Project Description

Vanadium is designated a critical material by the US government, owing to its importance to the defence and energy storage sectors.

The preliminary economic assessment (PEA) envisages an openpit, heap-leach operation, with average production of 10.2-million pounds of vanadium pentoxide a year over an 11.1-year mine life.

Initial mine development will be focused on the Gibellini deposit, with Louie Hill following nine years later.

Gibellini has measured and indicated resources estimated at 22.95-million tons grading 0.286% vanadium, and inferred resources of 14.97-million tons grading 0.175% vanadium pentoxide.

Louie Hill has inferred resources of 7.52-million tons grading 0.276% vanadium pentoxide. Silver Elephant believes that there is an opportunity to upgrade the inferred resources to higher confidence categories through drilling, and to incorporate Bisoni McKay Mineral Resources in future economic studies.

Total vanadium pentoxide expected to be recovered is estimated at 114.6-million pounds a year. Heap leaching will be performed at ambient temperature and atmospheric pressure without preroasting or other beneficiation processes.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has an after-tax net present value, at a 7% discount rate, of $127.9-million and an internal rate of return of 25.4%, with a payback period of 2.49 years.

Capital Expenditure

The initial capital cost is estimated at $147-million, including contingency of 25%.

Planned Start/End Date

Not stated.

Latest Developments

None stated.

Key Contracts, Suppliers and Consultants

Wood Group USA and Mine Technical Services (PEA).

Contact Details for Project Information

Silver Elephant, tel +1 604 569 3661 or email info@silverelef.com.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation