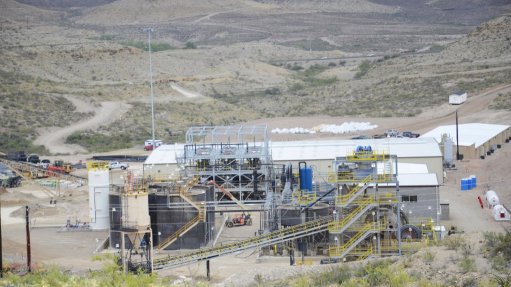

Etango-8 uranium project, Namibia

Name of the Project

Etango-8 uranium project.

Location

Erongo region of Namibia.

Project Owner/s

Bannerman Energy, through its 95%-owned subsidiary Bannerman Mining Resources.

Project Description

Etango-8 has declared maiden ore reserves of 117.6 -million tonnes at 232 parts per million of uranium for 60.3-million pounds of uranium.

A prefeasibility study (PFS) has confirmed the strong technical and economic viability of conventional openpit mining and heap-leach processing of the Etango deposit at an eight-million-tonne-a-year throughput.

Planned development of the Etango project entails bulk openpit mining of a large, relatively homogenous uranium deposit followed by crushing, acid heap leaching, ion exchange with nano filtration, and uranium recovery into yellowcake product.

The PFS estimates the production of 52.9-million pounds of uranium over the project’s 15-year mine life, with average production estimated at 3.5-million pounds a year of uranium.

Further upside potential exists from future life extension and/or scale-up expansion.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has an after-tax net present value, at an 8% discount rate, of $222-million and an internal rate of return of 20.3%, with a payback of 3.8 years.

Capital Expenditure

Forecast preproduction capital expenditure is estimated at $274-million.

Planned Start/End Date

Not stated.

Latest Developments

Bannerman has approved the start of a definitive feasibility study on Etango, with completion targeted for the third quarter of 2022, at an expected cost of about $4-million.

Key Contracts, Suppliers and Consultants

Wood (process plant design and related infrastructure, plant capital and operating cost estimates); and Qubeka Mining Consultants (pit inventory, mine planning and mining cost estimates).

Contact Details for Project Information

Bannerman Energy, tel +61 8 9381 143 or email info@bannermanenergy.com.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation