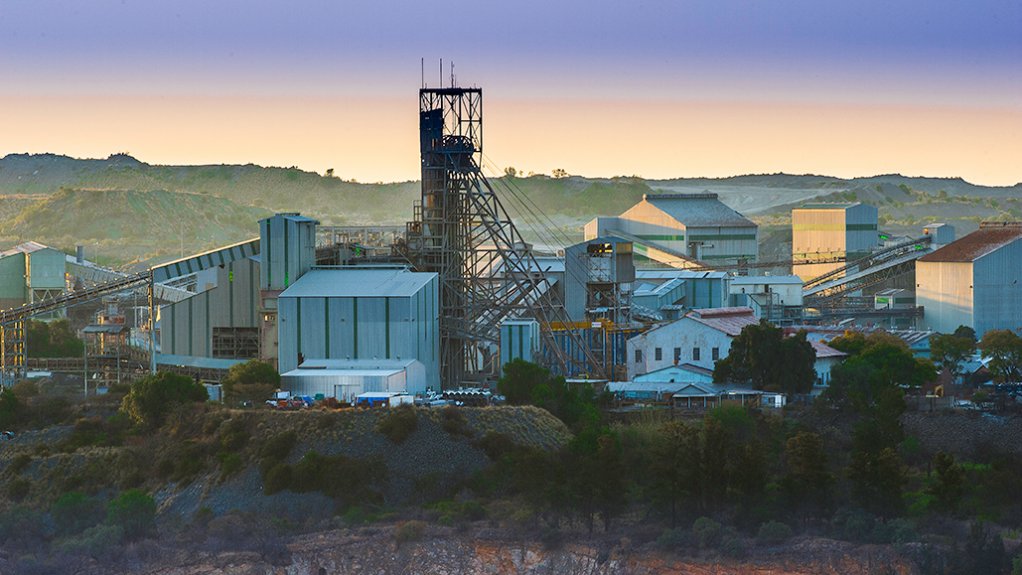

Demand at Petra’s first 2024 financial year tender muted, but expected to pick up

London-listed Petra Diamonds sold 696 194 ct of diamonds, recovered from its South African operations, for $79.3-million in the first tender of the company’s 2024 financial year.

No exceptional diamonds were sold as part of the tender.

This sales cycle included goods deferred for sale following an earlier decision to defer the majority of tender six in June, as well as the goods withdrawn from the company’s May tender (tender five), with prices for these goods remaining largely flat compared with the bids received in May.

No sales for either Koffiefontein or Williamson were recorded in this cycle. Following the restart of operations at Williamson in July, Petra is planning a first sale of Williamson goods during September.

“We saw very strong attendance at the tender, although demand was more muted than we had expected in exiting the summer holiday period,” explains CEO Richard Duffy.

He says the average prices for both the Cullinan and Finsch mines benefited from an improved product mix, while like-for-like prices declined by 4.3% compared with Petra’s most recent tender, tender five of full-year 2023, which closed in May.

“The expected seasonal improvement in demand was evident for higher-quality +10.8 ct stones with solid prices realised, including $82 630/ct for a 20.9 ct yellow diamond from Cullinan mine that sold for $1.7-milllion.

This was offset by slower demand for 2 ct to 10 ct size ranges with like-for-like prices down by about 14% compared with tender five. Demand in smaller categories remains resilient, with like-for-like prices increasing between 1% and 2%, Duffy outlines.

“Macroeconomic uncertainties around prevailing high interest and inflation rates have resulted in a more cautious approach from the mid-stream towards holding inventory. Indications are that these rates have now peaked and will start to decline, providing support to our view of improved demand in the medium term as a result of the structural supply deficit.

“Although demand for lab-grown goods increased, this was coupled with further price depreciation that continues to substantially differentiate this market segment from our unique and rare natural diamonds that provide enduring benefit in celebrating life’s most significant moments,” Duffy says.

“As we enter a seasonally stronger period which includes Diwali, Thanksgiving, Christmas and the Chinese New Year, we remain optimistic that jewellery demand will improve and provide some support to prices over the balance of the calendar year,” he adds.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation