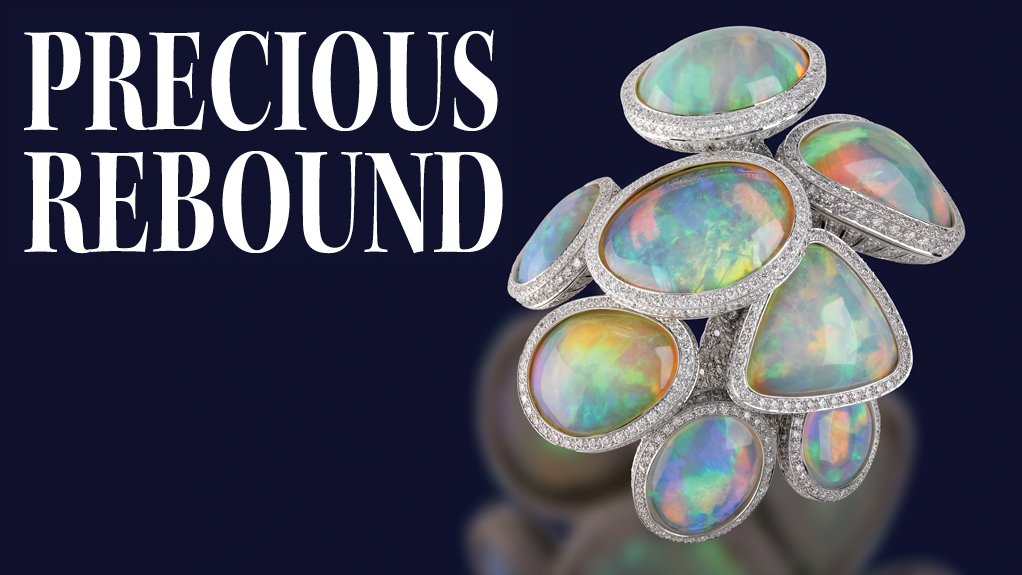

Coloured gemstones coming into their own after being outshone by diamonds for decades

Until the 1940s, coloured gemstones and diamonds shared a stake of about 50:50 in the global jewellery market, and from that time diamond miner De Beers undertook an aggressive marketing campaign that resulted in the value and popularity of diamonds significantly outstripping those of other gems and this has largely remained the status quo ever since.

Nonetheless, over the past five years, the coloured-gemstone sector has been growing at a compound yearly growth rate of about 18%, according to the United Nations commodity trade statistics database, with rough global imports for emeralds, rubies and sapphires currently amounting to about $3.3-billion a year.

However, accurate figures for the volume of all coloured gemstones produced by area or country are not available, says the global nonprofit organisation representing the coloured-gemstone industry, the International Coloured Gemstone Association (ICA).

“This information is lacking because the gemstone industry is highly fragmented,” explains ICA VP Jean Claude Michelou.

Michelou says that small- and medium-scale miners produce 75% of gemstones worldwide and very few declare how much material their operations produce.

The material is fed directly into the global sales pipeline and important information concerning weights and carat numbers, in most instances, is not recorded.

Nonetheless, the association estimates that the coloured-gemstones industry, including cut stones, rough gems and jewellery, is worth in excess of $10-billion a year.

Michelou notes that, over the past three years, the ICA has placed a significant emphasis on ensuring that the flow of gemstones is traceable and the industry is improving its levels of transparency.

“The gemstones industry has traditionally been highly secretive, with most companies preferring not to publicly disclose the state of their operations. However, this is changing, as the supply chain, including gem sellers, retailers and customers, is advocating for greater transparency in the sector.”

Michelou attributes this transparency push to coloured gemstones now being considered as a viable commercial investment, owing to their increasing value, with several mining companies having invested significantly in establishing gemstone mining operations over the past five years.

“Although this is far less than the billions that are being invested in the diamond sector, these investments [still] represent a significant advancement in the development of the coloured-gemstone industry,” he notes.

For example, coloured-gemstone mining and marketing company Gemfields held two emerald auctions and one ruby auction, which generated $93.7-million in total, during the first half of their 2014/15 financial year.

“Our first ruby auction was held in June 2014 and generated a record $33.5-million, covering almost all the initial costs associated with the establishment of our Montepuez ruby mine, in Mozambique,” Gemfields CEO Ian Harebottle tells Mining Weekly.

He adds that the second ruby auction, held in December 2014, generated $43.3-million in revenue.

Michelou points out that emeralds, rubies and sapphires are the most valuable gemstones from a monetary perspective. However, he says other coloured gemstones, such as spinels and green garnets, are increasing in value.

He explains that the value of a gemstone is defined by its rarity, purity and hardness, stating that the hardness is important, as this determines the suitability of a gemstone to be made into jewellery.

He adds that, about ten years ago, red tourmalines, also known as rubelite, were not worth much, and were valued at less than $150/ct; however, currently cut red tourmalines can sell for more than $1 000/ct.

Meanwhile, local gems and minerals trader African Gems & Minerals CEO and Federation of Southern African Gem and Mineralogical Societies member Rob Smith informs Mining Weekly that South Africa is the world’s largest producer of the violet-coloured sugilite gemstones, which are mined from strata-bound manganese deposits in the Kalahari region of the Northern Cape.

“The price of sugilite has increased significantly over the past two years, from between $50/kg and $100/kg to between $5 000/kg and $10 000/kg, mostly owing to increased demand from the Chinese market,” he says.

Smith states that although sugilite is used mainly to produce jewellery, the Chinese also use it during rituals to cure people of diseases, “which is a popular belief held by segments of Chinese society”.

He points out that future prospects for the sector are positive, as demand continues to grow, but that the major impediment to growth is scarcity of supply, as sugilite is not a core commodity concern for manganese miners.

Although South Africa is a leading African trading centre for coloured gemstones, there are no dedicated gemstone mines in operation, Smith notes, with African Gems & Minerals receiving most of its gemstones from several African countries, including sapphires from Malawi and rubies from Mozambique.

African Potential

Michelou believes that Madagascar has the potential to be one of the largest producers of coloured gemstones worldwide, if sufficient capital is invested in the sector, as the country has relatively large unexploited deposits of ruby, sapphire, emerald and tourmaline, as well as other high-value gemstones.

According to the website of Madagascar and US-based rough-gemstone seller Madagascar Gems, the small-scale gemstone mines – located mostly in the country’s northern jungles – yield sphene, emerald, amethyst, aquamarine, sapphire and ruby.

The company also notes that new gemstone mines are being established in the central and northern regions of Madagascar.

“Tourmaline mines are located near the capital city of Antananarivo, while ruby, garnet and other stones are found in many locations near the country’s east coast. The mines in the arid south-central area produce blue and pink sapphires,” says Madagascar Gems.

Further, Michelou adds that Mozambique also has several gemstone deposits of rubies, tourmalines, as well as varieties of beryl, such as aquamarine and green beryls.

Harebottle points out that the Gemfields Montepuez mine, in Mozambique, is in the exploration phase and the company is targeting production of about eight-million carats of ruby and corundum in the current financial year.

“We are hoping to move towards full-scale mining operations over the course of the next 18 months . . .” he says, adding that this will require installing a considerably larger washing plant and appointing a contractor to manage the waste mining.

Moreover, Smith points out that there are also proven high-quality gemstone deposits of aquamarines, tourmalines, alexandrite, garnet and emeralds in Zimbabwe.

However, owing to the small scale and artisanal nature of gemstone mining in the country, output is very low.

“Namibia, Zambia and Mozambique also have large proven deposits of tourmaline, which, if invested in, could provide significant financial benefits because it is in high demand,” he states.

Smith highlights that garnet and tanzanite gemstones are also increasingly sought after by global jewellers.

Tanzania Ministry of Energy and Minerals mineral economics and trade assistant commissioner Salim Salim tells Mining Weekly that Tanzania produced and exported coloured gemstones to the value of $50.34-million in 2013.

“I believe that there is a bright future for the gemstones industry of Tanzania. There are different types of gemstones in the country and new finds are being made continuously, which makes Tanzania the right destination for gemstones industry investment.”

He notes that, with improved mining, beneficiation and value-adding skills, Tanzania is likely to become the gemstones centre of Africa.

Local Beneficiation

Michelou says the gemstones sector has learnt many lessons from the diamonds sector in terms of ensuring continuity of supply and effectively marketing the sector to buyers and investors.

He is encouraged by gemstones-producing countries taking heed of the advice of the World Bank. The institution has been encouraging countries over the past 15 years to develop a mine-to-market approach to the mineral resources sector through processing the bulk of their commodities locally.

“The establishment of downstream beneficiation sectors has the potential to create hundreds, if not thousands, of local job opportunities,” Michelou emphasises.

In 2010, Tanzania’s Ministry of Energy and Minerals imposed a ban on the export of facetable rough tanzanite exceeding 1 g.

However, Salim says there is ongoing debate in the country about lifting the ban.

“The ban . . . was intended to facilitate the start of the local gemstones cutting industry to create jobs for Tanzanians, encourage value addition from raw to cut and polished gems, as well as to ensure technology transfer regarding gem cutting, heat treatment and overall enhancements,” he explains.

The Tanzania Gemological Centre, in the City of Arusha, started training students in the cutting and polishing of gemstones in November 2014.

“It will continue to train students in other fields, such as gem carving, jewellery making, gemmology and gem laboratory services, as soon as training facilities are procured and instructors are employed.”

Salim explains that the Tanzania government aims not only to develop Arusha as the gemstone centre of Africa but also establish it as a minerals trading house, subsequently providing locally licensed dealers with a premise from which to trade with international gemstone buyers.

He points out that the yearly Arusha Gem Fair attracts hundreds of buyers worldwide to buy gemstones produced by East, Central and Southern African countries.

Small-scale miners from all over the country and neighbouring countries will find it easier to find a market for their gemstones, with illegal trading thus being eradicated, he adds.

“There will be a convention centre for gem fairs and small-scale miners markets. Other facilities, like valuation, sealing, export permits, security, safe custody, taxation and banking will also be provided . . . ”

Tanzanian Energy and Minerals Minister advisory committee member and Tanzania Mineral Dealers Association founding member Abe Suleman agrees that the increasing emphasis on the local processing of gemstones, particularly tanzanite, will create many job opportunities in Tanzania.

He highlights that, on average, for every one person that is employed in Tanzania, the lives of 16 Tanzanians are improved financially by being dependants of an employed person.

Suleman notes that, in India, for example, there are about 20 000 cutters in the tanzanite processing industry.

“This number of gemstone artisans employed in Tanzania would directly improve the lives of about one-million locals. Additionally, local jewellers could buy tanzanite and manufacture jewellery from it to sell to locals and tourists, thereby creating more downstream job opportunities,” he concludes.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation