Colluli sulphate of potash project, Eritrea – update

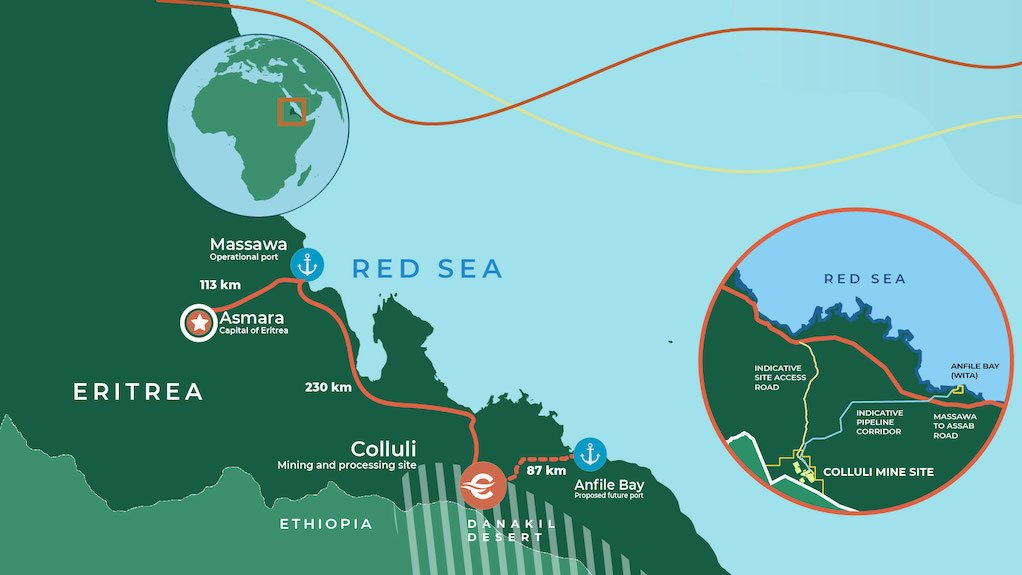

Location map of the Colluli project

Photo by Danakali

Name of the Project

Colluli sulphate of potash (SoP) project.

Location

The Danakil Depression, within the East African Rift Valley of Eritrea – one of the world’s most geothermally endowed rifts.

Project Owner/s

ASX-listed Danakali struck a $166-million binding share sale agreement (SSA) with Sichuan Road and Bridge Group in January 2023 to sell its 50% shareholding in the Colluli SoP project.

A potential sale was flagged in October 2022 after Danakali signed a nonbinding term sheet with Sichuan Road and Bridge Group.

Under the terms of the SSA, Sichuan Road and Bridge Group would acquire all Danakali’s shares in the Colluli Mining Share Company (CMSC), as well as a shareholder loan owned by CMSC to Dankali, for $135-million and $31-million respectively.

Danakali has said the agreement provides shareholders with an attractive after-tax value outcome in the absence of a full equity funded solution for the Colluli SOP project. The transaction will result in Danakali’s receiving $121-million net of all government taxes.

The transaction will be subject to several conditions, including shareholder and Chinese regulatory approvals, as well as approval from the Eritrean government, which holds the remaining 50% interest in the Colluli project.

Following the completion of the transaction, Danakali plans to distribute 90% of the net proceeds to shareholders, and will continue as a listed company to identify new projects and potential new alternative growth opportunities.

The transaction is expected to be completed in the second quarter of 2023.

Project Description

In a front-end engineering design (FEED) study completed in January 2018, the Colluli project was established as the most advanced, economically attractive and fundable SoP greenfield development project worldwide.

Colluli is also the closest known SoP deposit to a coastline anywhere in the world, only 75 km from the Red Sea.

At FEED production rates, the project has an expected mine life of 200 years. It is fully permitted, with the mining agreement and all requisite mining licences in place.

Colluli is the only known SoP resource that allows for the extraction of potassium salts in solid form that, in turn, allows for immediate processing, significantly less time between mining and revenue generation, and a reduction of the evaporation pond’s footprint, consequently contributing to a lower overall capital intensity.

A modular development approach has shown a highly scalable, long-life project. The shallow mineralisation of the project makes the resources amenable to opencut mining.

Module 1 is expected to produce 472 000 t/y of premium SoP. Module 2, starting production in Year 6 of the project, will increase total SoP production to 944 000 t/y. The massive Colluli ore reserve has significant capacity to underpin further expansions and support decades of growth beyond modules 1 and 2.

The mine will comprise an openpit, developing progressively from north-east to south-west. The pit will have a progressive working face that will provide access to each of the mineralised layers simultaneously. The orebody comprises sylvinite, carnallitite and kainite that will be fed as ore feed into the processing plant and from which sylvite, carnallite and kainite will be extracted and mixed to produce SoP.

Mining will be conducted by mining contractors using conventional mechanised equipment, with no drill-and-blast required. Mined ore will be transported by truck to a run-of-mine pad adjacent to the processing plant.

Colluli has significant diversification potential beyond SoP, including the option to produce additional potash and salt products such as muriate of potash, SoP-magnesia, kieserite, gypsum, magnesium chloride and rock salt.

Potential Job Creation

The project is expected to create more than 500 permanent jobs for locals and Eritrean nationals in Module 1, and more than 650 (cumulative) jobs once Module 2 is on line, and benefits from strong local support.

Net Present Value/Internal Rate of Return

The project has an after-tax net present value, at a 10% discount rate, of $902-million for modules 1 and 2, and an internal rate of return of 29.9%. Module 1 has a payback of 3.25 years.

Capital Expenditure

Module 1 development will require an initial capital investment of $302-million. The $200-million senior debt facility offered by Africa Finance Corporation (AFC) and African Export-Import Bank (Afreximbank), as well as the equity investment from AFC, provide the majority of the funding required for construction and project execution.

The incremental Module 2 development is expected to require an initial capital investment of $202-million.

Planned Start /End Date

Construction is expected to start in 2021, with production targeted for 2022.

Latest Developments

Danakali has presented favourable results from six months of detailed testwork conducted with industry experts Saskatchewan Research Council, Global Potash Solutions, DRA Global and CasCan.

The testwork involves the Colluli project’s process design using filtered seawater.

Danakali has also worked closely with its offtake partner EuroChem to ensure that high-quality SoP grades have been produced in line with international standards.

The project will be a world-first using filtered seawater, column flotation and co-processing of carnalite and sylvinite ore, which significantly reduces project development, and operational, finance and market risk.

Danakali aims to start production next year.

Key Contracts, Suppliers and Consultants

The company and project have a strong network of partnerships, including EuroChem (ten-year binding offtake agreement with Danakali for up to 100% of Module I production); AFC and Afreximbank (provision of $200-million in senior debt finance to CMSC, with the AFC having also agreed to a $50-million strategic equity investment in Danakali); DRA Global (engineering, procurement and construction management contractor); Inglett & Stubbs (preferred power contractor); EMW (preferred mining contractor) and Turner & Townsend (contract development).

Contact Details for Project Information

Danakali CEO Niels Wage, tel +61 8 6189 8635 or email info@danakali.com.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation