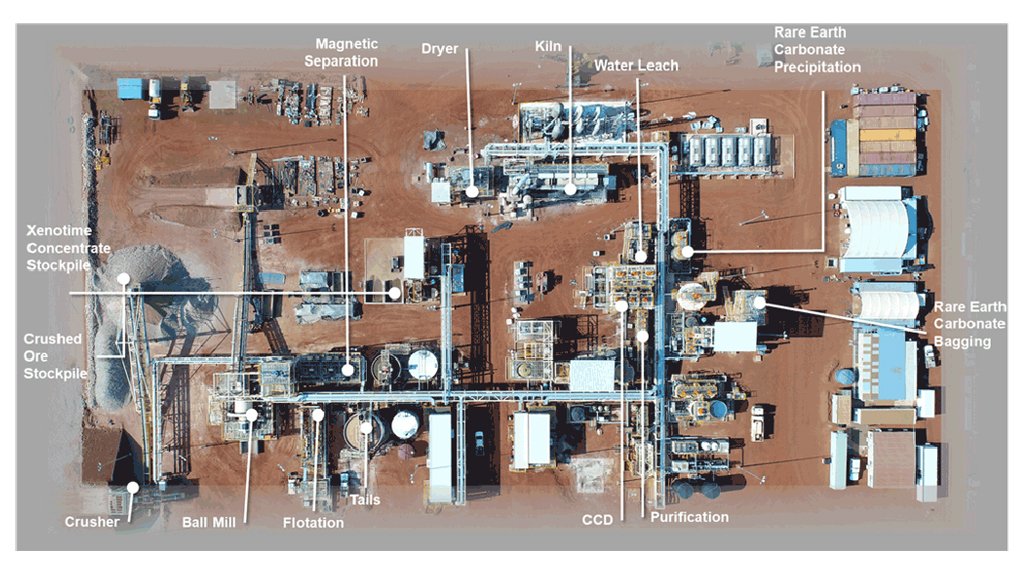

Browns Range heavy earths pilot plant development project, Australia – update

Photo by Northern Minerals

Name of the Project

Browns Range heavy earths pilot plant development project.

Location

Western Australia.

Project Owner/s

Northern Minerals.

Project Description

The project has been separated into three development stages and enables Northern Minerals to test the process, market the mixed rare-earth carbonate product, develop the project to bankable feasibility study (BFS) level and build the full-scale operation.

Stage 1 includes the construction of a three-year, 60 000 t/y pilot plant operation. It will comprise an opencut mining operation, with processing through a beneficiation and hydrometallurgical pilot plant to produce 49 000 kg/y of dysprosium in 590 000 kg/y of total rare-earth oxide (TREO) contained in a mixed rare-earth carbonate. This stage is important to derisk the operation by testing the process and improving the knowledge of grade control and the project’s geology.

Stage 2 involves developing the project to BFS level, based on the definitive feasibility study completed in March 2015; and on the results of the studies, announced on August 27, 2015, aimed at reducing mining costs, boosting production, producing a premium product and increasing the ore reserve.

The final stage involves building the project to full-scale production based on the successful outcomes of stages 1 and 2. Once at full-scale, the project will process 585 000 t/y to produce 279 000 kg of dysprosium contained within 3 098 000 kg/y TREO (before yttrium rejection) in a mixed rare-earth carbonate.

Potential Job Creation

The project is expected to create 50 construction jobs and 45 ongoing operational positions.

Net Present Value/Internal Rate of Return

Not stated.

Capital Expenditure

The project has a capital cost of A$56-million.

Planned Start/End Date

Construction of Stage 1 is expected to take about nine months once product offtake and funding are in place.

Latest Developments

Northern Minerals and Iluka have announced a A$78-million funding package for the Browns Range project.

Under the agreement, the two companies have signed an offtake agreement for all the available concentrate from the project, capped at the delivery of 30 500 t of contained rare-earth oxide (REO), and covering the project’s initial eight-year mine life.

Iluka has said that the concentrate will be a valuable additional source of feedstock for its Eneabba rare earths refinery, in Western Australia, and will be a significant contributor to establishing the refinery as a long-term producer of highly valued heavy, as well as light, permanent magnet REOs.

Iluka made a final investment decision on the Eneabba rare earths refinery in April this year.

To support Northern’s development of Browns Range, Iluka will initially invest A$20-million in Northern through a A$15-million convertible note and A$5-million share placement, providing Northern with the funding required to complete a definitive feasibility study (DFS) and, consequently, promoting the delivery of a final investment decision on Browns Range over the next year.

Iluka will subscribe to 125-million shares at 4c each in Northern Minerals.

Meanwhile, the funding arrangements between Northern and Iluka will also result in a future placement to Iluka, following an final investment decision for the Browns Range project, under which Iluka could be issued an additional 230-million shares, at 6c each, for a further A$13.6-million investment.

The funding also includes a call option/put option arrangement, under which Iluka will be issued up to an additional 653.3-million shares at a maximum price of 6c per share rising up to A$39.2-million. The issue and grant of the call and put options are conditional on Northern Minerals shareholder approval.

The call option could be exercised at any time until the end of December 2025, and is conditional upon a positive final investment decision for the Browns Range project and Iluka completing due diligence on the project’s DFS.

The funding package will enable the company to complete the DFS for a mine and commercial-scale beneficiation plant at Browns Range, provide ongoing working capital, and contribute to the future equity component of the capital and commissioning costs for the project.

The company is targeting the completion of the DFS in the third quarter of 2023, with first production forecast in 2026, subject to regulatory approvals.

Key Contracts, Suppliers and Consultants

MACA (bulk earthworks), Primero (turnkey solutions provider); Sinosteel MECC (engineering, procurement and construction contract); and K-Technologies (scoping study).

Contact Details for Project Information

Northern Minerals, tel +61 8 9481 2344, fax +61 8 9481 5929 or email info@northernminerals.com.au.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation