Barrick issues cease and desist notice to AJN over Kibali stake purchase

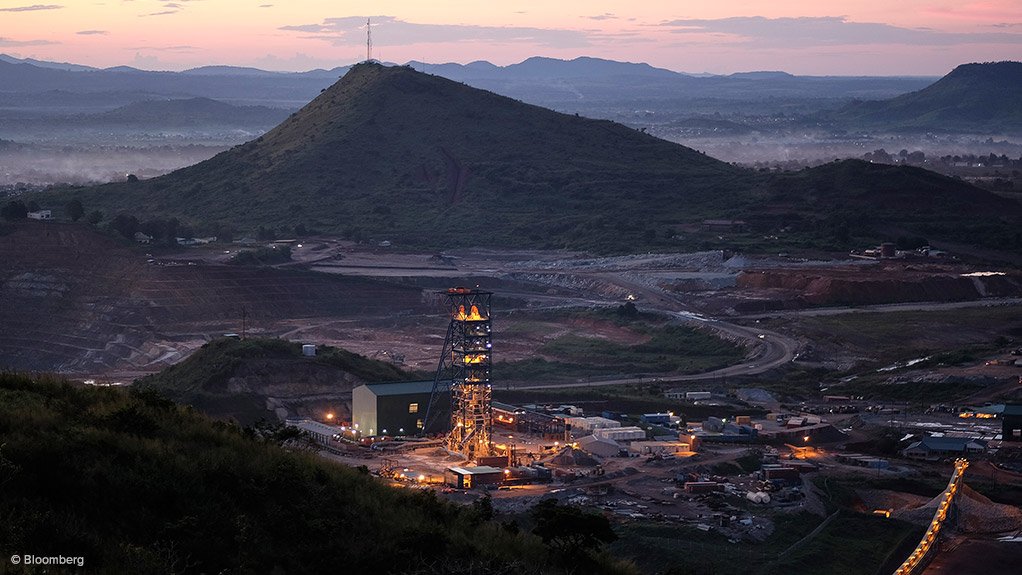

KINSHASA/TORONTO/JOHANNESBURG – Barrick Gold, the operator of Congo's biggest gold mine, has issued a cease and desist notice to junior miner AJN Resources as it moves to block its acquisition of a 10% stake in the project, which it says the deal undervalues.

Barrick and AngloGold Ashanti, which each own 45% of the Kibali mine, said they had not been consulted about the acquisition even though the stake's owner Societe Miniere de Kilo-Moto (Sokimo) may not transfer or sell its Kibali shares without their approval.

The two companies and the chair of State-owned Sokimo say AJN's planned acquisition was prematurely announced to the market, without notifying stakeholders or securing approval from Sokimo's board.

Barrick has issued a cease and desist notice to AJN , and its executives in Congo are currently engaged with the government on the matter, CEO Mark Bristow said.

The miner won't support the sale for reasons of valuation, as well as process, he said.

"From what little we know, it's a deeply discounted transaction," he told Reuters. "It's cheeky at best."

AJN CEO Klaus Eckhof confirmed the previously unreported cease and desist notice from Barrick, which he said instructed AJN to stop pursuing the asset because Barrick has first right of refusal if Sokimo chooses to sell.

However, his firm can still go ahead with due diligence, he said. He declined to comment on what value the deal gives the Kibali stake.

AJN announced a memorandum of understanding with Sokimo on February 6 under which the state-owned firm's 10% stake in Kibali, plus stakes of between 30% and 35% in five other gold assets, would be exchanged for a 60% stake in AJN.

Investec in 2014 valued 45% of Kibali, one of the world's biggest mines, at $2.1-billion, meaning a 10% stake would have been worth $467-million.

Canada-listed AJN Resources currently has a market capitalisation of just C$11.93-million, according to Thomson Reuters Eikon.

Asked about the gap between AJN's valuation and the valuation of the mine, Eckhof said: "The market will adjust. The share price will be different and actually value the project."

The deal would also give SOKIMO access to capital markets, he added.

SURPRISED

On Tuesday AJN said it had closed a C$2-million equity issue. Eckhof said he aims to raise C$20-million "at minimum" by the time the deal is signed.

At the close of the deal, AJN said its board would consist of two nominees from Sokimo and three current directors of AJN, making Sokimo board members a minority even though the firm would hold 60% of the shares.

Sokimo chair Annie Kithima said she was "surprised" by AJN's statement and that the make-up of the board was still to be negotiated.

"The way AJN rushed to make this public is quite puzzling to me because at the board level we were still waiting for the full report from our management," she told Reuters.

Eckhof said the MoU had been approved by the minister of portfolio, who manages State-owned enterprises.

Barrick said it believes Sokimo should maintain its stake.

"We don't believe the state should be selling that asset because it's got so much value," he said. "They should be participating in it."

AJN shares spiked 140% on the day of the statement, and hit a record high of C$1.34 the following day.

A representative with the British Columbia Securities Commission declined to comment on AJN's announcement of the stake sale, citing a policy of not discussing interactions with issuers.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation