Bardoc gold project, Australia – update

Name of the Project

Bardoc gold project.

Location

North of Kalgoorlie, in Western Australia.

Project Owner/s

Exploration and development company Bardoc Gold.

Project Description

A definitive feasibility study (DFS) has confirmed the potential of the project to support a significant near-term, high-margin gold development project with a robust production profile, competitive operating costs and attractive financial returns.

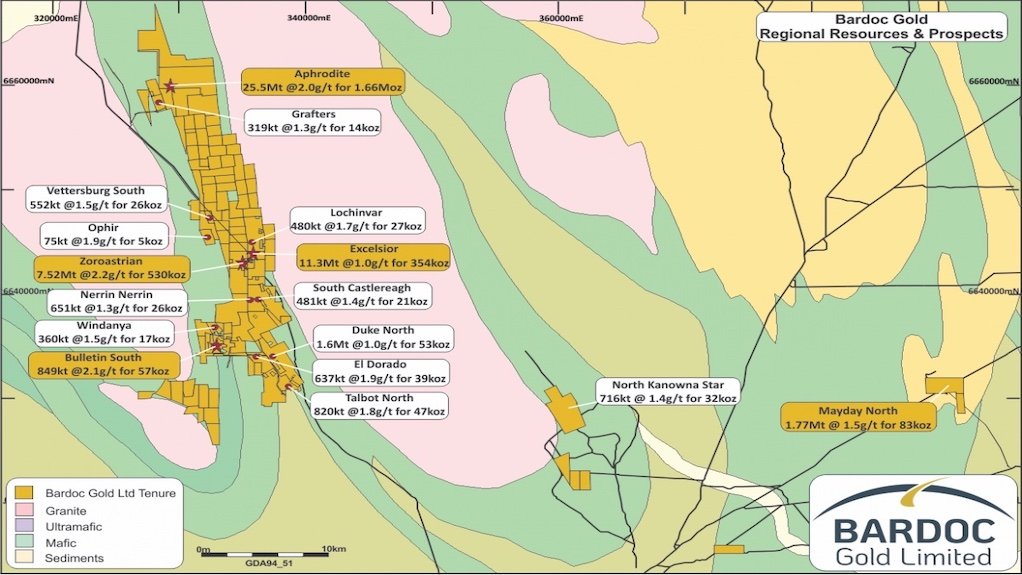

Bardoc comprises the Excelsior, Zoroastrian, Aphrodite, Bulletin South and Mayday openpits, which will be mined using conventional openpit mining methods.

The DFS is based on the development of a standalone mining and processing operation, with a 2.1-million-tonne-a-year carbon-in-leach (CIL) plant and flotation circuit to be built on site.

The processing plant will be built in two stages. Stage 1 will comprise CIL processing, while Stage 2 is an upgrade to include the flotation and dewatering circuits to treat the Aphrodite refractory material to be mined in Year 2.

The life-of-mine (LoM) plan will initially comprise a ten-year mining operation, delivering LoM production of 1.1-million ounces of contained gold, with peak gold production of 140 000 oz/y over six years.

Potential Job Creation

None stated.

Net Present Value/Internal Rate of Return

The project has a pretax net present value, at a 6% discount rate, of A$479-million and an internal rate of return of 41%, with a payback of 32 months from the start of production.

Capital Expenditure

A recently completed cash flow optimisation study has indicated a 31% increase, or about A$55-million, in the preproduction capital cost estimate for the project. In March 2021, the DFS indicated a capital cost estimate of A$177-million; this is now estimated to be A$232-million.

Planned Start/End Date

The project is targeted to start production in the fourth quarter of 2022.

Latest Developments

Bardoc has deferred the final investment decision for the project to complete a strategic review of the development strategy for project.

The strategic review has been prompted by a rapidly escalating cost environment in the Western Australia resources sector, a tightening labour market and other Covid-19-related challenges facing resource projects.

The company has stated that key suppliers have indicated that cost pressures for new resources projects will continue to worsen over the next 12 to 18 months, citing rising steel prices, materials and input costs.

Bardoc chairperson Tony Leibowitz has said that the board is not prepared to expose its shareholders to the risk associated with mine development at a “very challenging time in the resources cycle”.

The strategic review will include consideration of strategic merger and acquisition, and consolidation opportunities, as well as other pathways to monetise the deposit in the near term.

While the review is under way, all expenditure pertaining to predevelopment and project financing activities have been terminated and corporate overheads and costs will be reviewed.

Key Contracts, Suppliers and Consultants

Bardoc (study manager, mineral resource estimate, processing and environmental and stakeholder management); SMJ Engineering and Galt Mining Services (openpit mine design and scheduling); WestAuz and Bardoc (underground mine design and scheduling); Strategic Metallurgy (metallurgical testwork); Como Engineering (process plant design); WML Consultants & Longrun Infrastructure (road and rail realignment); ATC Williams (tailings dam design); Peter O’Bryan and Associates (geotechnical studies); REC Engineering (Excelsior tailings assessment); Orica Limited (blast-impact assessment); Cube Consulting (geology); IME Consultants, Como Engineering and Bardoc (infrastructure); AQ2 (hydrogeology); Landloch (waste classification); Talis Consulting (environmental studies); and Bardoc BurnVoir Corporate Finance (financial modelling).

Contact Details for Project Information

Bardoc Gold investor relations, tel +61 8 6215 0090 or email admin@bardocgold.com.au.

Read Corporate, on behalf of Bardoc, email info@readcorporate.com.au.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation