Bardoc gold project, Australia – update

Name of the Project

Bardoc gold project.

Location

North of Kalgoorlie, in Western Australia.

Project Owner/s

Exploration and development company Bardoc Gold.

Project Description

A definitive feasibility study (DFS) has confirmed the potential of the project to support a significant near-term, high-margin gold development project with a robust production profile, competitive operating costs and attractive financial returns.

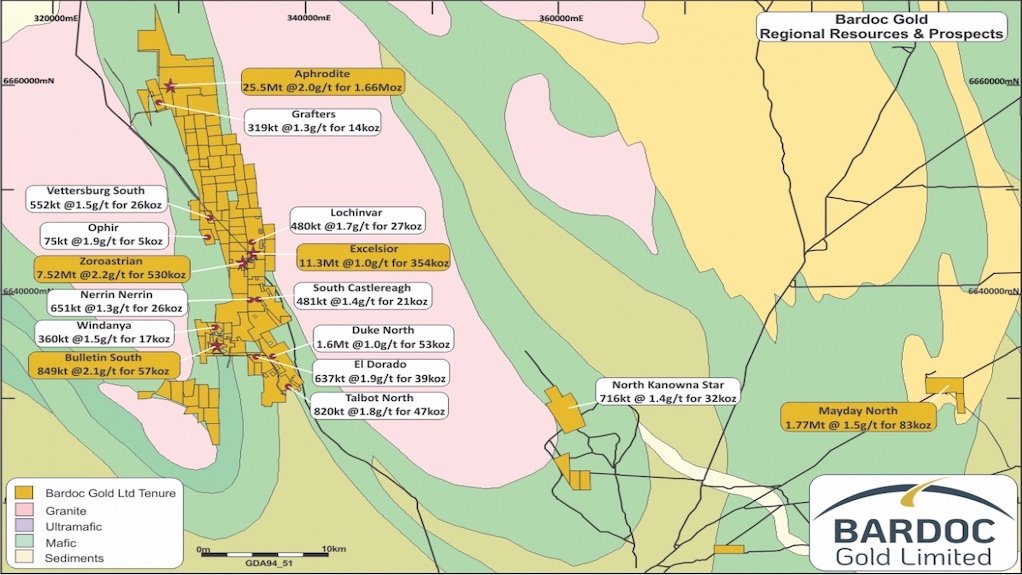

Bardoc comprises the Excelsior, Zoroastrian, Aphrodite, Bulletin South and Mayday openpits, which will be mined using conventional openpit mining methods.

The DFS is based on the development of a standalone mining and processing operation, with a 2.1-million-tonne-a-year carbon-in-leach (CIL) plant and flotation circuit to be built on site.

The processing plant will be built in two stages. Stage 1 will comprise CIL processing, while Stage 2 is an upgrade to include the flotation and dewatering circuits to treat the Aphrodite refractory material to be mined in Year 2.

The life-of-mine (LoM) plan will initially comprise a ten-year mining operation, delivering LoM production of 1.1-million ounces of contained gold, with peak gold production of 140 000 oz/y over six years.

Potential Job Creation

None stated.

Net Present Value/Internal Rate of Return

The project has a pretax net present value, at a 6% discount rate, of A$479-million and an internal rate of return of 41%, with a payback of 32 months from the start of production.

Capital Expenditure

A$177-million.

Planned Start/End Date

The project is targeted to start production in the fourth quarter of 2022.

Latest Developments

Bardoc Gold is investigating increasing gold production at the project.

The company has initiated a cash flow optimisation study aimed at increasing the forecast gold production rate, margins and free cash flow during the first five years of operations at the gold project.

Preliminary analysis conducted by the company indicates that there is strong potential to increase total ounce production in years 1 to 5 by bringing forward production from its cornerstone Aphrodite deposit in the mine schedule. As part of this strategy, the proposed 2.1-million-tonne-a-year processing facility will be located at Aphrodite, rather than adjacent to the Zoroastrian and Excelsior deposits. This provides the opportunity to extract further value from the 1.6-million-ounce Aphrodite project and, in the future, from the highly prospective Omega, Sigma and Gamma lodes, where recent exploration success has highlighted the strong potential for significant resource growth.

Analysis suggests that the additional upfront capital expenditure required to bring forward construction of the flotation circuit required to treat baseload ore from the Aphrodite deposit is partially offset by other infrastructure cost reductions, while the additional high-grade ounces will provide strong free cash flow in the first five years of the mine plan.

An update on the project development is expected by the end of August 2021, which will outline, in detail, the benefits of the increased production on all-in costs and free cash flow generation and refine the upfront capital requirement, paving the way for project financing and a final investment decision.

Meanwhile, engineering, procurement and construction tender negotiations for the processing plant are close to being finalised.

Further, diamond core drilling is under way at Zoroastrian targeting untested areas, as well as depth extensions.

Key Contracts, Suppliers and Consultants

Bardoc (study manager, mineral resource estimate, processing and environmental and stakeholder management); SMJ Engineering and Galt Mining Services (openpit mine design and scheduling); WestAuz and Bardoc (underground mine design and scheduling); Strategic Metallurgy (metallurgical testwork); Como Engineering (process plant design); WML Consultants & Longrun Infrastructure (road and rail realignment); ATC Williams (tailings dam design); Peter O’Bryan and Associates (geotechnical studies); REC Engineering (Excelsior tailings assessment); Orica Limited (blast-impact assessment); Cube Consulting (geology); IME Consultants, Como Engineering and Bardoc (infrastructure); AQ2 (hydrogeology); Landloch (waste classification); Talis Consulting (environmental studies); and Bardoc BurnVoir Corporate Finance (financial modelling).

Contact Details for Project Information

Bardoc Gold investor relations, tel +61 8 6215 0090 or email admin@bardocgold.com.au.

Read Corporate, on behalf of Bardoc, email info@readcorporate.com.au.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation