AngloGold springs London Newco surprise, sets out to raise $2.1bn

Srinivasan Venkatakrishnan (Venkat),

Photo by Duane Daws

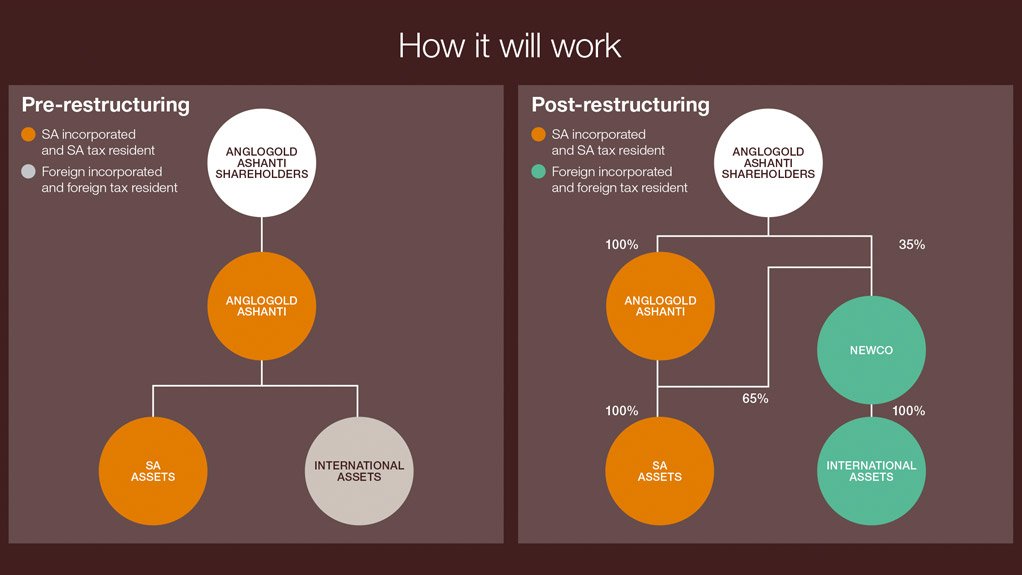

AngloGold's spinof plan

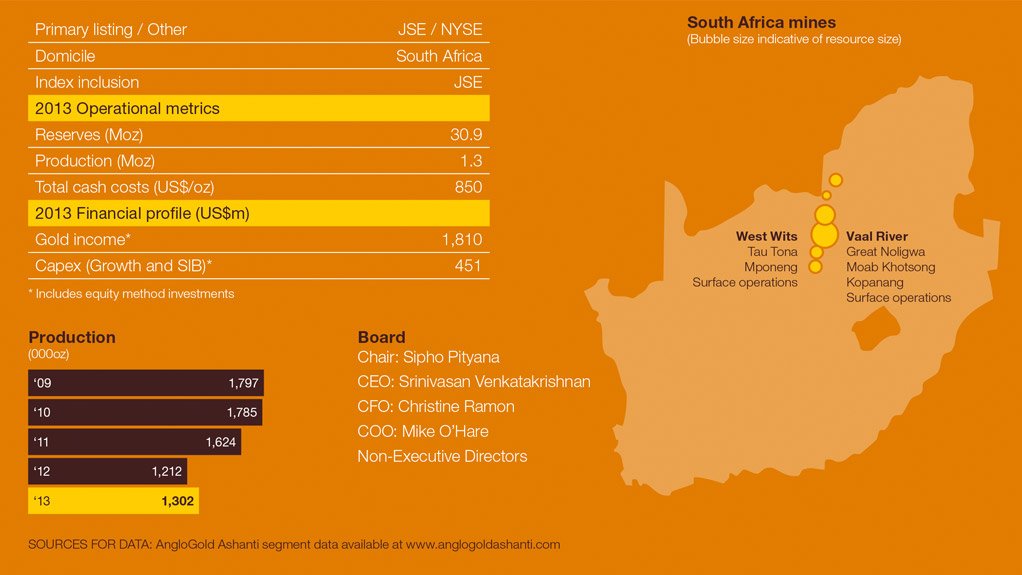

AngloGold South Africa

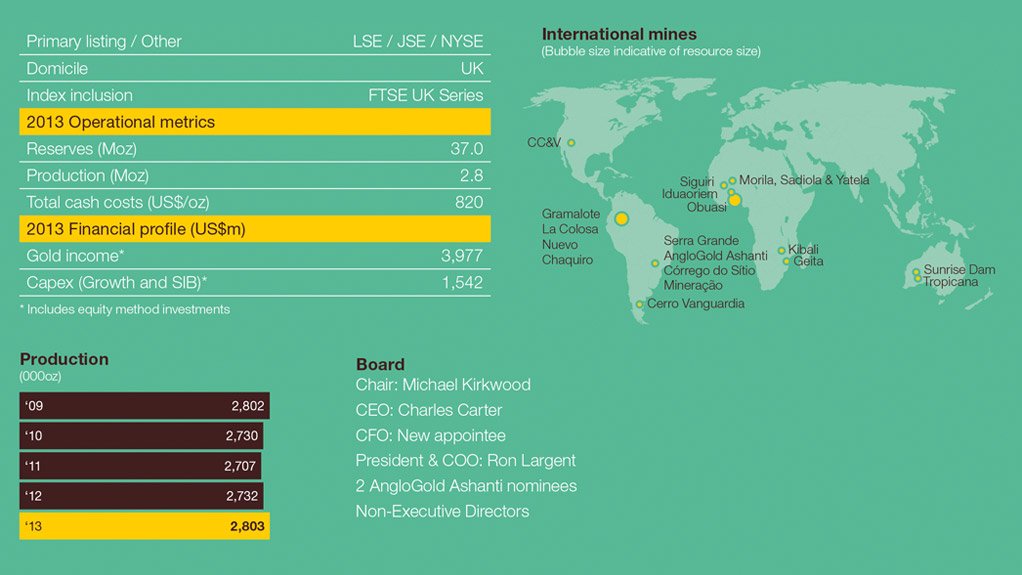

AngloGold's Newco

JOHANNESBURG (miningweekly.com) – Johannesburg- and New York-listed gold-mining major AngloGold Ashanti on Wednesday sprung a restructuring surprise with the spinoff of a separate Newco that will be listed in London, along with corporate restructuring and the raising of additional $2.1-billion capital next year in a move that would leave it debt-free.

AngloGold, under fast-moving CEO Srinivasan Venkatakrishnan (Venkat), has proposed morphing into simpler entities with Newco taking over gold production and exploration assets outside South Africa and AngloGold focusing on its South African portfolio and giving consideration to developing a multi-commodity growth strategy in South Africa and beyond over time.

Investec Securities said that latest data indicated that AngloGold Ashanti's international assets generated 60% to 65% of its gross profit and made up 75% of the assets.

Venkat said that AngloGold, which would initially be the controlling shareholder of the London-listed Newco in what is a partial demerger, would continue to be a South Africa-domiciled company under a new name and Newco would have an inward South African listing on the JSE.

Thirty-five per cent of Newco would be partially demerged to the shareholders of AngloGold, which would initially retain a 65% controlling interest.

"Newco could be a £3-billion company that would place it in the gap between African Barrick at £1-billion and Randgold Resources at £4-billion," Investec added.

Venkat would continue to lead AngloGold together with incoming CFO Christine Ramon, chief operating officer Mike O’Hare and Italia Boninelli.

AngloGold’s Charles Carter would move out as the Newco’s designate CEO, and be joined by AngloGold chief operating officer Ron Largent and AngloGold executive team members Graham Ehm, Maria Sanz Perez and David Noko.

Each business would chart its own course under separate identities.

AngloGold told the JSE that it had obtained South African Reserve Bank approval to restructure its international mining operations under the new UK Newco, which would seek a premium LSE listing, plus inward JSE and and NYSE secondary listings.

The restructuring was motivated by the belief that separately-listed vehicles would give independent management teams the opportunity to execute distinct strategies in the context of the current low gold price and macroeconomic environment.

It was envisaged that simplified portfolios would allow each management team scope to accelerate initiatives to lower operating costs and benefit from flatter overhead structures.

The combined corporate costs of both entities would be materially reduced and separate listings would also allow each to reflect their individual investment cases and associated access to capital in distinct markets.

"The two distinct parts of our portfolio require different strategies to realise their full potential and unlock further value for shareholders,” new AngloGold chairperson Sipho Pityana said.

The existing AngloGold board would remain with the exception of Michael Kirkwood, Newco’s designated chairperson, and David Hodgson, who would resign to join the Newco board once established.

AngloGold would have the right to nominate two nonexecutives, who would initially be Pityana as deputy chairperson and Venkat, for as long as the company’s shareholding in Newco was higher than 20%.

AngloGold wanted an equity capital raising rights issue irrespective of whether or not the restructuring occurred on the basis of its current debt levels deemed as too high.

The restructuring would itself render AngloGold debt free apart from existing guarantees to comply with reserve bank conditions.

Most of the $2.1-billion raised would be used to repay debt and allow AngloGold to retain flexibility and strengthen its balance sheet.

Execution, planned for 2015, was subject to shareholder approval at a general meeting, as well as regulatory and third-party consents.

AngloGold said that it had returned to production growth, commissioned two new projects and significantly reduced costs against the background of a 25% drop in the gold price in the last two years.

Second-quarter production had increased 17% to 1.098-million ounces, all-in sustaining costs lowered 19% to $1 060/oz, corporate and marketing costs cut 65% to $20-million and earnings before interest, taxes, depreciation and amortisation increased 33% to $382-million while a record safety performance was posted.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation