Alamos trading in negative territory as Young-Davidson output disappoints

VANCOUVER (miningweekly.com) – The NYSE-listed stock of Canadian gold miner Alamos Gold on Wednesday fell nearly 6% after the company announced disappointing results for the second-quarter ended June 30.

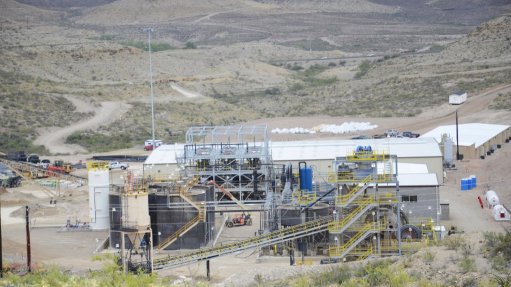

The Toronto-based intermediate miner, which operates the Young-Davidson mine, in northern Ontario, and the Mulatos and El Chanate mines, in Sonora state, Mexico, reported a net loss for the three months ended June 30, of $11.8-million, or $0.04 a share, reflecting higher noncash share-based compensation expenses of $5.9-million, or $0.02 a share, and an unrealised foreign exchange loss of $3.3-million, or $0.01 a share.

Removing all one-time expenses, the company reported an adjusted loss per share of $0.01, below analyst forecasts of nil per share.

Weighing on the second quarter’s performance was the Young-Davidson mine, in Ontario, where grades were below plan – in fact, the lowest since the mine started up. The main reason for this was that two stopes mined in the quarter underperformed relative to the block model, the company advised.

As a result of unplanned rehabilitation work in the period on the ore and waste passes, Alamos also reported that the mining rate of 6 123 t/d was below target, with a corresponding increase in unit costs. However, Alamos advised that the work was expected to be completed this month, which should allow the mine to ramp up and achieve its year-end target of 7 000 t/d.

Mill throughput at Young-Davidson was also below budget, averaging 7 006 t/d owing to optimisation work on the mill liners. Further, the company also noted that it would need to add a $4-million pebble crusher to the circuit in 2017, to process a portion of the mill feed that had been rejected by the circuit, as it had not been effectively ground by the semiautogenous grinding mill at the start of operations.

This ore was being stockpiled, with the current stockpile totalling about 420 000 t at a grade of more than 1 g/t gold, comprising both openpit and underground ore.

Meanwhile, the Mulatos mine had challenges of its own during the period under review, with the heap grade falling to 0.79 g/t, compared with the planned 0.89 g/t. Alamos said the mill was reconfigured to produce a concentrate, which would now be sold to a third party for smelting. This was expected to counter increased costs, owing to higher recoveries and gold production.

The company reiterated its 370 000 oz to 400 000 oz full-year production guidance.

Further, exploration at La Yaqui remained the highest-priority target with 8 of 13 Mulatos drill rigs on site. Management believed that the deposit held potential to significantly increase the reserves and resources from continued positive results at the project. Alamos said development of La Yaqui remained on track with initial production expected mid-2017. The environmental-impact assessment (EIA) for the road construction at La Yaqui was approved during the second quarter, while the project EIA was submitted in April.

Alamos’s NYSE-listed stock fell as low as $8.57 a share on Wednesday, having gained 165% since the start of the year.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation