Agnico Eagle to maintain midterm output guidance amid cost cuts

TORONTO (miningweekly.com) – TSX- and NYSE-listed Agnico Eagle Mines this week said it was implementing a significant round of cost-cutting measures on the back of reporting a surprise loss for the second quarter.

The Toronto-based company, which is one of Canada’s oldest miners, on Wednesday said it would reduce costs by about $50-million for the rest of the year. It also cut $250-million from its expected $600-million capital expenditure plans for 2014.

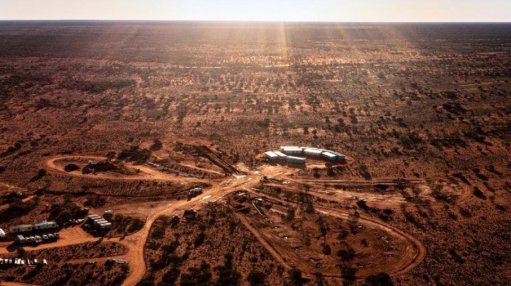

Despite the spending cuts, Agnico maintained its production guidance for the medium term, as the majority of the cuts were related to longer-term projects that were still on the drawing board, particularly the Meliadine project, in Nunavut.

Indeed, Agnico Eagle CEO Sean Boyd, in a May interview, told Mining Weekly Online that a sustained lower gold price would not affect its two near-term growth projects, La India, in Mexico, and Goldex, in Ontario, Canada, as these projects were nearing completion and were both reported to be ahead of schedule.

Many gold miners have, in the wake of the recent capricious decline in the gold price, scaled back expenditures, especially on exploration, while focusing on optimising operations and driving down costs.

The company said it expected to produce about 970 000 oz of gold this year and 1.2-million ounces by 2015.

Agnico reported an adjusted loss of $4.6-million, or $0.03 a share, for the three months ended June 30, mainly owing to a lengthy maintenance shutdown at its Kittila mine, in Finland, and lower prices for silver and other by-product metals. On average, analysts were expecting a profit of $0.08 a share.

Revenues declined by 26% to $336.4-million and the realised gold price in the period was $1 336/oz, compared with $1 602/oz in the same period last year.

The payable gold production in the quarter was 224 089 oz, including 5 389 oz from Kittila, compared with 265 350 oz in the second quarter of 2012.

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation