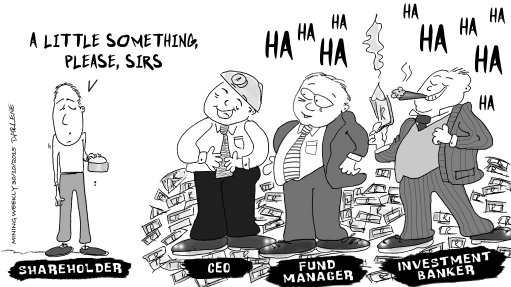

Mining company shareholders have become emaciated watching CEOs making a ton of money, investment bankers a killing and fund managers a nice spread. To blame are misguided share price incentives and rubber-stamping boards of directors, who also score from the system. That message came over loudly and clearly at the Joburg Indaba from a panel made up of Regarding Capital Management chairperson Piet Viljoen, Public Investment Corporation listed investments executive head Fidelis Madavo, Allan Gray portfolio manager Sandy McGregor and Coronation Fund Managers analyst Henk Groenewald, who denounced the poor capital allocation skills of mining company CEOs and called for new incentives based on operational metrics rather than financial ones.