Short seller Boatman Capital has made news in a full-frontal attack on Thungela Resources’ environmental liabilities.

However, when one sees coal miners as transitioning to “regenerative miners”, working with Nature to restore soil and water, while creating jobs for local communities, then one can leverage new green revenue opportunities, instead of liabilities.

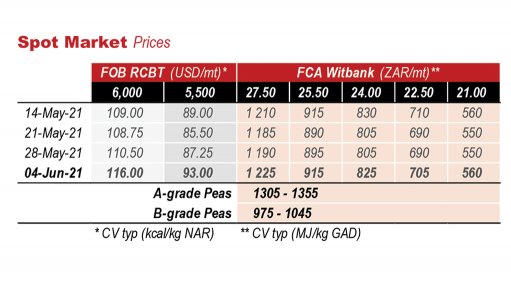

In the meantime, South African coal prices continue to soar as prompt physical cargoes remain rare due to ongoing tightness in all supply basins.

The forward curve has however softened as traders envision current supply issues to be resolved relatively soon. Bullish prices are helping coal miners to plan over 430 new mines (2.2-billion new tonnes per year), putting targets for slowing global climate change at risk.

China, Australia, India and Russia account for most new projects, with China alone building over 450 Mmtpa. Xi Jinping has said the country will only start cutting coal production (and emissions) by 2026. One wonders what he will say in 2025?

Unlike other countries, China will only have stranded assets if China says it has stranded assets. Australian exporters have been exploring the globe as Beijing continues its ban.

Although Newcastle shipments are slightly down year on year, new markets such as India, Thailand, Pakistan and even the Netherlands are enjoying Aussie coal. South African exporters have their work cut out for them.

Spot coal prices remain as firm as the rock of Gibraltar, although the back end of the curve is selling off, deepening the already steep backwardation.

We remain in concurrent mode to the upside (both trend and momentum positive) and it seems nothing can topple this horse right now. However, momentum is once again entering quite overbought territory.

Thus, whilst pullbacks are technically possible anytime from now, they will not be convincing until trend drops back down again. For now, a $100 floor seems like strong support. Who would have thought it just one year ago at $50?