Calidus Resources

Name of the Project

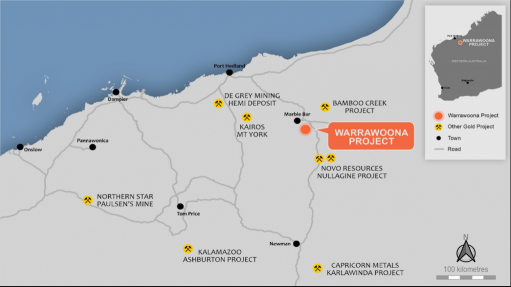

Warrawoona gold project.

Location

Pilbara, in Western Australia.

Project Owner/s

Calidus Resources.

Project Description

The Warrawoona project is a high-margin gold operation, with average gold production estimated at 90 000 oz/y over an initial eight-year mine life.

The project includes a two-million-tonne-a-year conventional carbon-in-leach processing circuit with a single-stage crushing and semiautogenous grinding mill

Calidus’ acquisition of the high-grade Blue Spec mine provides immediate opportunity to expand production and free cash flow at the Warrawoona gold project. The definitive feasibility study and integration plan are being undertaken in parallel with the construction of Warrawoona.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has a pretax net present value, at an 8% discount rate, of $408-million and an internal rate of return of 81%, with a payback of 13 months.

Capital Expenditure

The project has a capital cost of $120-million, including contingency and preproduction mining costs.

Planned Start/End Date

The project is expected to pour first gold in the first half of 2022.

Latest Developments

Calidus Resources has signed an agreement with Zenith Pacific for the construction of a 4 MW solar farm with 3.5 MW battery energy storage system at its Warrawoona gold project.

Zenith is constructing the 11 MW gas-fired power station at Warrawoona under a power purchase agreement (PPA). The construction of the solar farm is part of the PPA whereby Calidus buys power from Zenith.

The solar farm will be built in the second half of 2022 and will feed into the distribution line between the power station and accommodation village.

The decision to proceed with the solar farm and battery storage is in line with the company’s environmental, social and governance (ESG) initiatives, Calidus MD Dave Reeves has said.

“Calidus is committed to carbon reduction as part of its ESG policy. This renewable microgrid is a cornerstone of our carbon reduction plan, which includes the use of liquefied natural gas (LNG), not diesel, and the ability of the LNG gensets to use up to 25% hydrogen. We are pleased to extend the relationship with Zenith to incorporate this renewables project, and look forward to its construction in the second half of this year,” he has noted.

Key Contracts, Suppliers and Consultants

Optiro Consultants, Lynn Widenbar and Associates (mineral resource estimate); Rapallo, Biologic, Woodman, Sticks and Stones, Total Heritage, Nyamal Heritage, Bat Call, Graeme Campbell and Associates, Mine Earth, Lloyd George Acoustics (environmental, base line studies and project permitting); Peter O’Bryan and Associates, ATC Williams (geotechnical); ATC Williams (tailings storage facility); Groundwater Resource Management, or GRES (hydrology and hydrogeology); GR Engineering Services (processing plant); GRES, Metallurgy Management Services, Nagrom, ALS, BV (metallurgy and testwork); GRES, Aerodrome Management Services (infrastructure); Intermine Engineering Consultants, Entech and Galt Mining (mining); Macmahon Holdings (openpit mining and tailings dam); GRES (process plant engineering, procurement and construction contract); Rangecon (village install); and Telstra (communication).

Contact Details for Project Information

Calidus Resources, email info@calidus.com.au.