Uranium One, a subsidiary of Russia’s Rosatom, is entering a lithium project in Argentina as the group continues its strategy of investing in non-uranium mineral resources.

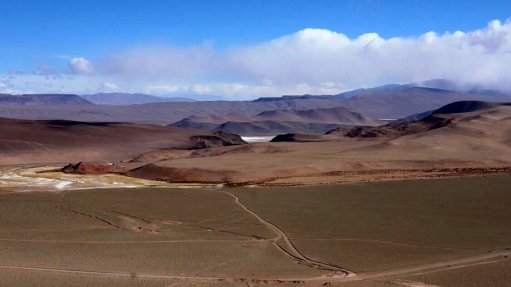

Uranium One will invest $30-million in the 27 500-ha Tolillar Salar project of TSX-V-listed Alpha Lithium, and will earn an option to acquire another 35% of the project for $185-million.

Exercising the earn-in right implies a value at Tolillar of $529-million, said Alpha Lithium CEO Brad Nichol. Including the maximum additional consideration, the implied project value would be $604-million, or more than C$750-million for the Tolillar asset alone.

The additional determination is dependent on the net present value of Tolillar, as determined by the feasibility study.

The announcement on Monday lifted Alpha Lithium’s stock by 20% to C$1.48 a share, giving the Vancouver-headquartered exploration and development company a market capitalisation of C$184-million.

Uranium One president Andrey Shutov commented in a statement that the company was “excited to work with the famous Alpha Lithium team to advance the Tolillar project”.

Alpha Lithium would use the initial $30-million investment for additional development drilling and geophysical data gathering, the construction of a permanent on-site camp to house 400 personnel, to secure natural gas, electricity and water supplies, the construction of a 5 t/y lithium carbonate equivalent (LCE) plant to provide proof of concept of Tolillar’s flow sheet, and to complete a feasibility study.

Should Uranium One exercise its earn-in right, the proceeds of the $185-million equity injection would be focused on the construction of an initial 10 000 t/y LCE commercial production facility.

The facility would be the first module of several, allowing for production to be expanded.

Once Uranium One exercised its earn-in right, it would gain operatorship of the project, control the board of directors of Alpha One and have marketing rights for 100% of the market-rate offtake from the production facility. Alpha would retain 50% of the economics of the offtake.

“Having gotten to know Mr. Shutov and his team over the past few months, I am truly pleased to be partnering with Uranium One, an internationally recognised, large-scale project developer. I have no doubt they will match our hunger for fast and full development of the Tolillar Salar, in addition to offering large project execution experience and significant downstream contacts in Europe,” said Nichol.