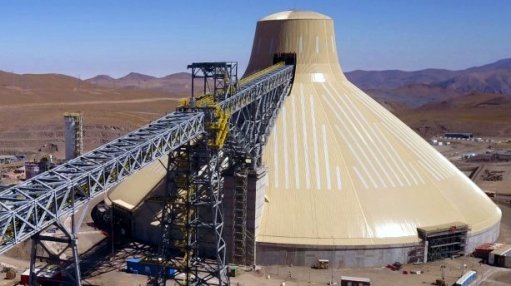

Rising costs to build Teck Resources’ flagship copper project in Chile shows how the mining industry is struggling to expand supply on budget and on time when the world faces a looming shortage of the key metal.

Teck’s Quebrada Blanca 2 expansion is expected to cost an additional $600-million from its previous estimate due to construction delays, the Canadian metals producer said Tuesday in a statement. The company also withdrew its environmental permit application for the project’s mill expansion after regulators recommended against approving the plan. Submitting a revised application will add 12 months to the overall regulatory process, Teck said.

The latest setbacks highlight the challenges facing mine builders while inflation spirals and regulators tighten environmental standards. It’s a theme that will become ever more pressing as demand increases for metals like copper, which are crucial to decarbonizing the global economy.

Quebrada Blanca 2 will now cost $8.6-billion to $8.8-billion to finish, up from an earlier estimate of $8-billion to $8.2-billion. The project is essential to Teck’s push to become a standalone metals producer as part of a sweeping overhaul that involves selling its coal business. The Vancouver-based firm’s share price plunged to its lowest level in seven months after disclosing the updated cost estimates.

“Capex blowouts and delays have been problematic for Teck at QB2,” Jefferies analyst Christopher LaFemina said in a Tuesday note. “This is an especially important point as part of the standalone investment case for Teck is the value of its organic growth.”

Teck’s QB2 is by no means the only major project to experience setbacks at a critical moment. At Codelco, the world’s biggest copper producer, the state-owned Chilean firm is plowing billions of dollars into revamping century-old mines that are running out of profitable ore. Rio Tinto faced long delays and spiraling costs while building its own flagship copper mine, Oyu Tolgoi in Mongolia. And Anglo American Plc’s Minas-Rio in Brazil, an iron ore mine, cost $14-billion to buy and build and nearly sunk the company.

QB2’s cost estimates have risen steadily since early 2019, when the project was expected to cost $4.7-billion. The mine faced disruptions related to the Covid-19 pandemic and logistical challenges exacerbated by Russia’s war in Ukraine. The latest projections come two days before Teck is scheduled to host a ribbon-cutting ceremony at the site.

The company faces even more pressure to deliver on its promises after spending much of this year fighting off an unsolicited approach from Swiss commodities giant Glencore, which wanted to acquire QB2 before switching its focus to Teck’s coal business. Teck shares fell 7.7% to C$49.15 at 3:21 p.m. in Toronto, its biggest intraday drop since March 15 — about two weeks before Glencore’s $23-billion takeover attempt.

QB2 is completing its ramp-up this year after churning out first concentrate in March. At full production, it will double Teck’s copper output. The Canadian miner owns an indirect 60% interest, with Sumitomo holding 30% and state-owned Enami 10%.