Coal miner Stanmore Resources on Monday announced that it will buy diversified mining firm South32’s 50% interest in the Eagle Downs metallurgical joint venture (JV) coal project, in Queensland.

Stanmore will acquire the Eagle Downs stake for $135-million, comprising a $15-million upfront cash payment, $20-million upon the first 100 000 t of coal being mined from longwall mining methods and a capped royalty of about $100-million.

The other 50% of the Eagle Downs coal project, which has been in care and maintenance since late 2015, is held by China Baowu Steel Group subsidiary Aquila Coal.

Stanmore has signed a term sheet with Aquila, which has undertaken to waive any pre-emptive rights in respect of the sale and transfer of South32’s interest in the JV.

Further, Stanmore will be able to acquire an additional 30% interest in the Eagle Downs project from Aquila on the same commercial terms as those agreed under the South32 transaction. In addition, the company can acquire an 80% interest in the Eagle Downs south tenement.

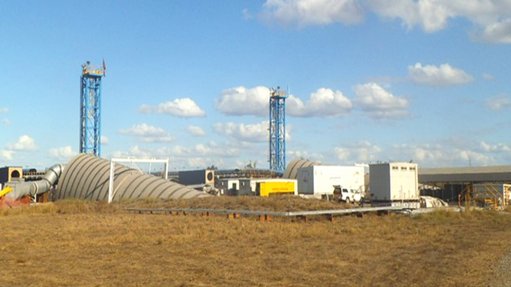

The acquisition of Eagle Downs is consistent with Stanmore’s ambition to expand its footprint in Queensland’s premium metallurgical coal basin, said CEO Marcelo Matos.

“Eagle Downs is a high-quality project underpinned by a substantial resource base, which provides an exciting development opportunity that is complementary to our broader portfolio and in close proximity to our existing operations,” he said.

Stanmore considers Eagle Downs as one of the last remaining undeveloped areas targeting the premium Moranbah coal measures in the Bowen basin. The previous owners have underpinned a resource base of 1.14-billion tonnes of resources and 292-million tonnes of reserves.

Previous studies indicated the potential to produce between four-million and six-million tonnes a year of high-quality, low-volatile hard coking coals via longwall mining set up.

The resource could underpin a 40-year-plus mine, adding longevity to Stanmore’s production profile.

There is also potential to reduce the overall development costs for the project by using Stanmore’s existing infrastructure, including the Poitrel and Isaac Plains coal handling and processing plants and train load-out facilities, which have an existing combined capacity of more than 13-million tonnes a year with potential for capital efficient upgrades.