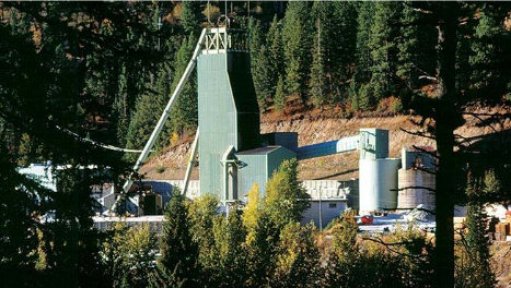

Hecla operates the Lucky Friday mine, in Idaho.

NYSE-listed Hecla Mining has hiked its silver-linked dividend by 50%, reflecting the miner’s confidence in its cashflow performance and position as the US’ largest silver producer.

The company on Wednesday announced that the silver-linked dividend would be increased by $0.01 a year for each $5 increase in the quarterly average realised silver price above $25/oz.

In September last year, Hecla lowered the minimum threshold for payment of the silver-linked portion of its quarterly dividend where if the average realised silver price for a quarter is $25/oz, the silver-linked quarterly dividend policy provided an annualised $0.02 a share.

“We’ve enhanced our long-standing silver-linked portion of our dividend policy by increasing the payment by $0.01 a share. As prices rise, shareholders should get more of the company’s cash flow, which reflects continued strong operating and capital cost discipline,” said president and CEO Phillips Baker.

Hecla has realised a silver price of $25.66/oz in the first quarter and, as such, the board approved payment of the quarter’s dividend at the increased rate.

Baker added that the backdrop for silver remained “very positive” with improving industrial demand, owing to global policies that supported green energy, strong investment demand and tight supply.

Hecla currently mines more than a third of all US production of silver, a key component in green energy, and will increase its US silver output to about 15-million ounces by 2023.

In the first quarter of 2021, the company produced 3.5-million ounces of silver – a 7% increase over the prior-year period. The miner also produced 52 004 oz of gold, 10 704 t of lead and 16 107 t of zinc.

The Greens Creek mine, in Alaska, produced 2.6-million ounces of silver and 13 266 oz of gold and Lucky Friday, in Idaho, delivered 863 901 oz of silver, while Casa Berardi, in Quebec, produced 10 675 oz of silver and 36 190 oz of gold. The Nevada operations produced 2 548 oz of gold.

Hecla reported first-quarter sales of $120.9-million, which was the second-highest in its 130-year history and a 54% year-on-year increase. Gross profit came to $64.8-million – an increase of $53.4-million over the prior year. Adjusted net income was $30.6-million, or $0.06 a share.

Adjust earnings before interest, taxes, distribution and amortisation (Ebitda) rose to a record $86.1-million in the quarter.

"The strong performance Hecla has had in five of the last six quarters continued in the first quarter of 2021 with the second highest sales in our history, a new record for Ebitda and gross profit on sales that is about a third higher than the next closest quarter," said Baker.

"Free cash flow generation was the most Hecla has had in the first quarter in a decade. Since the first quarter is typically our smallest quarter, we anticipate cash flow increasing over the rest of the year.”