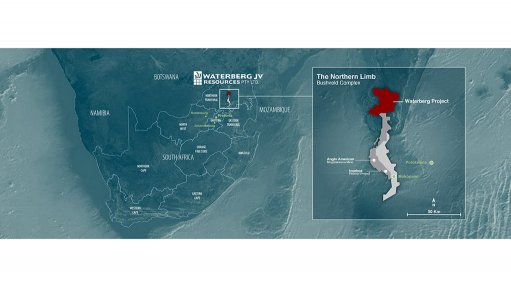

COMPLEX PROGRESS The pre-construction programme for the Waterberg project on the northern limb of the Bushveld Complex in South Africa has been approved in principal

In October, NYSE-listed-mining house Platinum Group Metals (PTM) reported that the Waterberg Joint Venture (JV) Resources, in principle approved a R380-million preconstruction work programme for the Waterberg project, which focuses on early infrastructure, derisking and project optimisation.

The Waterberg platinum group metals (PGMs) project is a bulk underground palladium and platinum deposit located on the northern limb of the Bushveld Complex in South Africa.

Waterberg represents a large-scale PGMs resource with an attractive risk profile given its shallow nature.

An initial budget for the first R45-million of the work programme is to be spent by March 31, 2023, and has been unanimously approved by the Waterberg JV board of directors.

The Waterberg JV is owned by PTM, Japanese State-owned institution Japan Oil, Gas and Metals National Corporation (Jogmec), global trading company Hanwa Co, platinum producer Impala Platinum and investment company Mnombo Wethu Consultants.

“The Waterberg JV co-owners are pleased to collaborate on and fund this important and substantial Work Programme, which will advance the Waterberg project,” said PTM president and CEO Frank Hallam.

He adds the Waterberg JV has laid out an early infrastructure plan intended to significantly derisk the future construction of the project.

While the programme is being executed, the company plans to continue seeking a third-party concentrate offtake agreement for Waterberg JV and, as a possible alternative, plans to assess the potential establishment of a new smelter and base metals refinery, jointly with third-party investors, that is capable of processing Waterberg concentrate.

The programme will focus on project infrastructure, including initial road access, water supply, essential site facilities, a first phase accommodation lodge, a site construction power supply from State-owned power utility Eskom and advancement of the Waterberg social and labour plan.

An update to the 2019 Waterberg definitive feasibility study (DFS) is also planned, including a review of cutoff grades, mining methods, infrastructure plans, scheduling, concentrate offtake, dry stack tailings, costing and other potential revisions to the project’s financial model.

As a precursor to the DFS update, an infill drilling programme has been approved. It targets near surface, modelled inferred mineral resource blocks that have good potential for conversion to higher confidence levels.

Consequently, allowing the blocks to be added to early mine plans potentially reduces early capital expenditure and the period to first mining.

The infill drill programme is budgeted at R23-million and is planned to consist of 16 T Zone NQ boreholes and 16 F Zone NQ boreholes.

Mineralised material recovered from the drill programme will be assayed and the remaining material will be processed to determine dry-stack tailings characteristics and provide additional concentrate metallurgical data.

If dry stack tailings methods are implemented in the DFS update, it is expected that mine water consumption will be reduced by 40% to 50%.

The initial budget for the programme will be funded pro rata by the JV partners and was coordinated to match fiscal year and budgetary periods for Jogmec and Hanwa.

Subsequent expenditures, in accordance with the programme, are subject to expected approvals for sequential time periods ending on August 31, 2024.

The announcement is another key step on the journey to leveraging the potential of the Waterberg deposit and its prospective positive economic, social and community impacts.

A future construction decision for the Waterberg project would benefit local stakeholders by offering skilled job opportunities, improved roads, better access to water services, as well as training and education opportunities.