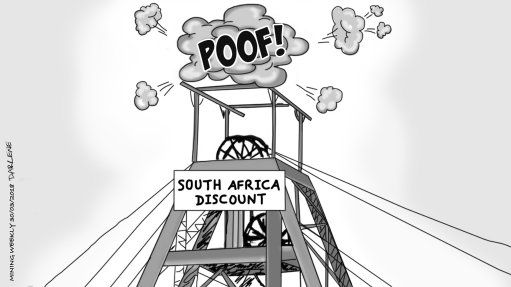

The South Africa discount that shareholders in local mining companies have had to endure for decades is going up in a puff of smoke. Goldman Sachs analysts say in a multipage report that the risks around South African operations are dissipating against the backdrop of the winds of political change bringing with them lower operational precariousness. Goldman Sachs Europe Metals & Mining Equity Research analysts Eugene King, Abhinandan Agarwal, Felix Schlueter and Peter Hackworth expect the discount to close. Their graphs accompanying the report show that the share prices of Glencore and Anglo are at 2013 levels, despite Glencore’s earnings being 45% higher and its net debt being 90% lower, and Anglo’s earnings being considerably higher and its net debt being 85% lower. The analysts describe commodities as the best-performing asset class and add that their current bullishness is based on current spot prices persisting and is not dependent on prices rising further. They reiterate a ‘buy’ on Glencore and upgrade Anglo from ‘neutral’ to ‘buy’.