Name of the Project

Mt Peake vanadium/titanium/iron project.

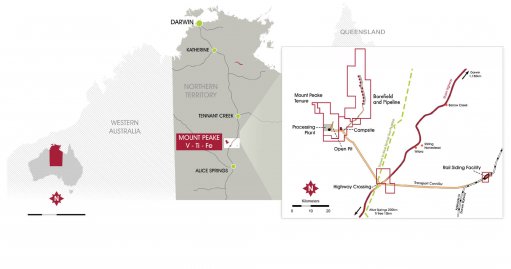

Location

Northern Territory, Australia.

Project Owner/s

TNG.

Project Description

As part of the ongoing front-end engineering design process for its Mt Peake project, TNG has optimised its planned execution and delivery strategy for the project, delivering savings and reductions in upfront capital costs while maintaining robust economics.

Discussions have confirmed that simplifying the project towards a one-stage build while minimising capacity and capital expenditure is best suited to the targeted debt/equity structure for the project.

The Mt Peake mine site will involve mining the titanomagnetite ore and recovering the magnetite in a concentrate through a beneficiation process.

The company and its advisers have selected a development strategy based on an initial production rate of two-million tonnes a year of ore throughput at the beneficiation plant, corresponding to 100 000 t/y of titanium oxide pigment through the proposed TIVAN processing plant. At a later date, after the financial completion of the construction and operation of the two-million-tonne-a-year plant, TNG may consider the option to expand production capacity.

Previous feasibility studies were conducted using three-million tonnes a year of run-of-mine (RoM) production capacity during an initial production stage and increasing capacity to six-million tonnes a year of RoM by expanding the plant after four years of production.

Under the new mining schedule, the life-of-mine (LoM) has been extended to 37 years, from the previously planned 20-year LoM.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The updated pretax net present value, at an 8% discount rate, is estimated at A$2.8-billion, with an internal rate of return of 33% and a payback of 2.8 years.

Capital Expenditure

Preproduction capital expenditure is estimated at A$824-million.

Planned Start/End Date

Not stated.

Latest Developments

TNG will raise A$12.5-million in a share placement to fund work at its Mt Peake project and progress green energy initiatives.

The company has received firm commitments from institutional and high net-worth investors.

A total of 139-million new shares will be issued under the company’s existing placement capacity, at 9c each, representing a 25% discount to TNG’s last closing price.

MD and CEO Paul Burton has said that the company is now in a strong financial position to progress with all the workstreams required to support the planned development of a fully integrated operation at the Mt Peake mine site and execute its funding strategy to launch the project.

Funds raised will go towards consolidation planning for the Mt Peake project, including the required permitting, engineering and execution planning workstreams, project financing workstreams, and progressing TNG’s green energy initiatives, including green hydrogen opportunities for the Mt Peake project and the company’s vanadium electrolyte production strategy.

TNG previously unveiled plans to progress the development of its Mt Peak project with a fully integrated mining and processing operation within its existing mining lease.

Key Contracts, Suppliers and Consultants

Snowden Mining Industry Consultants (revised mining strategy); Como Engineering (beneficiation plant – recoveries, operating expenditure and capital expenditure); McMahon Services (infrastructure – operating and capital expenditures); SMS (process plant flowsheets); and METS Engineering (process plant construction and operating expenditure).

Contact Details for Project Information

TNG, tel +61 8 9327 0900 or email corporate@tngltd.com.au.