REELING EFFECT

In addition to global commodity-demand slowdowns, the copper price, at about $10 000/t in 2011, has dropped by 40% to $6 000/t and less this year

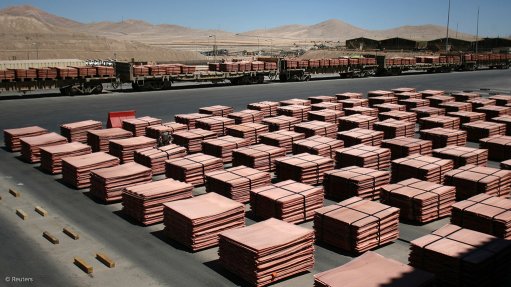

Photo by: Reuters

The Zambian mining sector is reeling from the effects of the global commodity-demand slowdown, which is mainly attributed to lower demand from China, and lower copper prices, says strategy and communications consultancy africapractice regional analyst Sinethemba Zonke, stating that the firm, therefore, believes the industry will experience a downtrend.

While China consumes more than 40% of the country’s total base metals output, including copper, Zambia’s gross domestic product (GDP) growth has stagnated at about 7% as the Chinese economy enters a new phase, Zonke points out.

“This has a substantial impact on its trade partners, who are the main suppliers of the natural resources required to feed China’s burgeoning growth,” he stresses, adding that lower copper demand and lower commodity prices have made it significantly more economically challenging for mining companies, particularly for those in Zambia.

Priced at about $10 000/t in 2011, copper prices have dropped by 40% to $6 000/t and less this year. In addition to these factors, the Zambian mining industry has had to mitigate power availability by reducing its power consumption by 30% in the past month, Zonke reiterates.

Development Debt

“Zambia – like many African countries dependent on commodities exports and their subsequent revenue – has also seen a major decline in revenues meant to fund State development goals,” Zonke further highlights.

He notes that government, while driving major infrastructure development since 2011, has increased State debt.

“Consequently, the State has been looking to its mining industry to fund some of this development through taxes and royalties. However, with the current climate in the commodities sector, this has become much more difficult,” Zonke says.

Zambia has taken out three Eurobonds over the past five years, which are respectively valued at about $750-million, $1-billion and $1.25-billion.

Most of this funding is and will be allocated to current infrastructure projects, which include the construction of electricity infrastructure and the upgrade of rail infrastructure, as well as the road construction and rehabilitation project Link Zambia 8000/Pave Zambia, to improve logistics trade and tourist routes.

However, Zonke believes that the Eurobonds are placing the country in a precarious debt situation. “Government has tried to allay any fears of the country falling into a debt trap; however, its latest Eurobond has shown that the country will have increased payback cost for its debts.”

Employment Risk

A significant impact of the end of the commodities cycle, which the global market is experiencing, will be on employment, Zonke believes.

“The mining sector is intrinsically linked to Zambia’s development. The sector’s inability to create new jobs . . . in fact, being at great risk of losing thousands of employment opportunities, might have political repercussions for government during the general elections in 2016,” he suggests.

The Zambian mining sector accounts for about 12% of the nation’s GDP and 10% of its formal employment.

Mining Weekly reported last month that Canada-based miner First Quantum Minerals planned to lay off about 1 480 workers at one of its Zambian copper projects, after a reduction in its power supply had curbed production.

Company subsidiary Kalumbila Minerals announced it would reduce construction jobs at the Trident project at Kalumbila, in north-western Zambia. The project comprises the Sentinel copper mine, the Enterprise nickel mine and associated infrastructure.

“With lower copper prices and a gloomy global commodities environment . . . mining companies worldwide have to face a new reality of a tougher and less profitable mining industry. They will look at cost-cutting measures, such as restructuring operations. Much of this restructuring might have a direct impact on jobs,” Zonke avers.

He concludes that further expansions in the mining sector might be delayed in the near future until such time as a more profitable mining climate emerges.