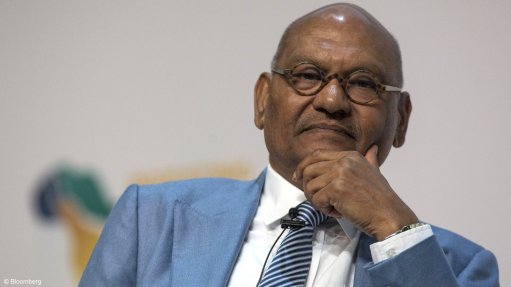

Anil Agarwal

Commodities tycoon Anil Agarwal is planning to invest $10-billion through a new partnership targeting government privatisations in India.

The billionaire is teaming up with London-based Centricus Asset Management to seek investments in Indian companies offering substantial growth opportunities, according to a statement Thursday. They will look to turn around companies being sold off as part of the country’s 2.1- trillion-rupee ($29-billion) divestment programme.

Agarwal made a fortune buying state companies and fixing them up, building a metals and mining powerhouse under the umbrella of Vedanta Resources. He’s now seeking to repeat that success, betting he can spot gems among the dozens of companies being put on the block by Prime Minister Narendra Modi’s administration.

The entrepreneurial dynamism in India “can be harnessed to unlock incredible transformation in the public sector,” Agarwal said in the statement. “We believe that this strategy can, and will, play a crucial role in the country’s ongoing industrialisation.”

The billionaire plans to help former government companies accelerate their transformation into private-sector firms with professional management, according to the statement. Vedanta is among the parties that have expressed interest in acquiring India’s stake in $12-billion refiner Bharat Petroleum.

Agarwal and Centricus have been seeking to raise capital from international investors to deploy in such turnaround opportunities, Bloomberg News first reported in September. They have been planning a fund with a 10-year life span that will use a private equity-type strategy, buying into companies and boosting their profitability before seeking an exit, a person with knowledge of the matter has said.

A former metals trader, Agarwal built his business through a series of ambitious acquisitions over the past few decades, including a 2001 deal to take control of government-owned Bharat Aluminium in one of the first tests of India’s efforts to offload state holdings. He now has a net worth of $2.5-billion, according to the Bloomberg Billionaires Index.

Centricus oversees $28-billion in assets, according to its website. The firm was founded in 2016 by Nizar Al-Bassam, a former investment banker at Deutsche Bank, and ex-Goldman Sachs Group partner Dalinc Ariburnu. Centricus advised SoftBank Group on the creation of its $100-billion Vision Fund and also worked on its $3.3-billion takeover of Fortress Investment Group.