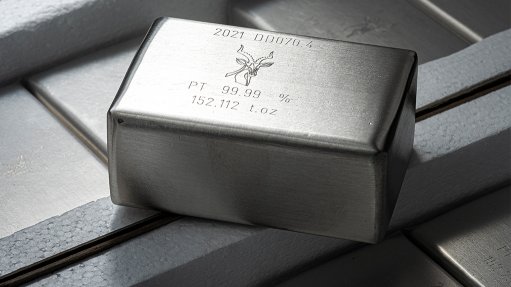

A platinum bar produced by Impala Platinum

South Africa’s worst ever power blackouts are threatening platinum and palladium supplies in the top miner, both now and in the years ahead.

Outages last year curbed output of the metals, and the power crisis that’s crimping the economy has worsened in recent months. The nation’s platinum-group metals production will likely fall this year, according to Impala Platinum.

The electricity crunch is hurting South African industry and agriculture and blackouts are expected for at least two more years, threatening output in Africa’s most industrialised economy. It’s yet another headache for major mining companies such as Anglo American Platinum, Sibanye-Stillwater and Impala who have found it increasingly harder to run deep and aging shafts.

“If things don’t get better soon then we are likely to have a worse period this year than last,” Impala spokesperson Johan Theron said in an interview. “If it gets worse it will get to a point when you have certain days where we will stop sending people underground.”

South Africa mines roughly 70% of the world’s platinum and about 40% of all palladium, according to Metals Focus. Both are mainly used in autocatalysts that cut auto emissions.

Output curbs could widen a global platinum shortage that Metals Focus forecasts to be the biggest in two decades in 2023, and add to an expected palladium deficit. Longer term, the power crisis is another worry for investors already wary of backing new mines as the electric-vehicle boom clouds platinum metals demand prospects.

ELECTRICITY CUTS

State-owned utility Eskom can’t produce enough power from its old and poorly maintained plants. It imposed blackouts on more than 200 days last year and throughout this month.

Mining companies are scaling down some surface activities and then catching up when power supplies are less tight — sometimes during the night and weekends — Impala’s Theron said.

South African platinum-group metals output last year was probably on average 6% below producers’ initial guidance and one of the worst in the past two decades, according to UBS Group analysts including Steve Friedman.

Platinum has rallied about 25% since the start of September, when power cuts intensified, while palladium has retreated. Reduced output may help support prices, Friedman said. But lower volumes could weigh on producers’ margins, at a time when they’re also facing inflationary pressures, he said.

Worsening blackouts could lead to the early closure of some marginal shafts, according to Sibanye spokesperson James Wellsted.

The power crunch also risks stifling appetite to invest in future production.

“How do you develop a mine in an environment where you are not sure whether you have got power or not?” Wellsted said. “Nobody is investing in replacement ounces or growth in the industry.”