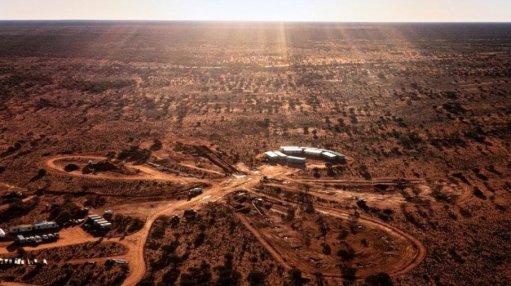

Liontown the Kathleen Valley project in Australia

PERTH (miningweekly.com) – Lithium developer Liontown Resources has knocked back a non-binding indicative proposal from North American major Albemarle Corporation, which had offered A$2.50 a share for the company, via a scheme of arrangement.

Albemarle confirmed that it had submitted a non-binding proposal to acquire all of the outstanding shares in Liontown, which valued at the company at A$5.2-billion, with the offer representing a 63% premium to Liontown’s last closing price and a 69% premium to the company’s 30-day volume weighted average share price.

Albemarle, which holds a near 5% stake in Liontown, said in a statement that the offer provided enhanced liquidity and accelerated the realisation of incremental value for Liontown shareholders beyond what might otherwise be expected from share price performance over the next few years and without the operating, market, financial and other risks that could impact the value of Liontown.

Albemarle said its cash offer was submitted in advance of Liontown’s completion of the Kathleen Valley project, in Western Australia, which allows Liontown shareholders to avoid future risks associated with project development and operations.

“As a leading supplier of battery grade lithium products, Albemarle is well positioned in Australia and holds various interests and stakes in important assets, including world-class spodumene resources and lithium conversion facilities at Greenbushes, Wodgina and Kemerton in Western Australia. Albemarle believes the addition of Liontown and its team would advance its strategy to produce a sustainable, high-quality supply of battery-grade materials to support the clean energy transition,” the company said.

“As a result, in addition to being highly compelling for Liontown shareholders, the proposal represents an exciting opportunity for Liontown, as well as its customers, employees and other stakeholders. Liontown has signed offtake agreements with three world-class partners in the battery and automotive sectors and Albemarle would look forward to continuing to partner with those leaders as the owner and operator of Liontown.”

Liontown on Tuesday said that the company’s board and its advisers had carefully considered the indicative proposal and had unanimously determined that it "substantially" undervalued the company.

The indicative proposal followed a A$2.35-a-share offer from Albemarle in early March, and a A$ 2.20-a-share offer in October last year.

“In coming to its decision, the Liontown board noted the opportunistic timing of Albemarle’s indicative proposal, coinciding with recent softness in companies exposed to the lithium sector and the pre-production status of the Kathleen Valley project,” Liontown told shareholders.

The ASX-listed company said that the indicative offer did not reflect the significant de-risking that had occurred at Kathleen Valley in recent months, with the mining operations starting and production progressing to schedule, Liontown’s extensive growth optionality, the positive outlook for existing or new lithium producers, and the significant synergies that could be available to Albemarle should it acquire Liontown.

Albemarle on Tuesday said that it was prepared to engage "immediately" in discussions with Liontown in order to reach a "mutually acceptable" definitive agreement, saying it was "ready to devote all necessary resources to finalise the documentation on an expeditious basis".

Liontown has, meanwhile, said that it would continue to progress a number of funding options for the remaining capital requirements at Kathleen Valley.

The 2.5-million-tonne-a-year Kathleen Valley operation will produce 500 000 t/y of spodumene concentrate, and in year six of operations, Liontown will look to increase the project capacity to 4-million tonnes a year, delivering 700 000 t/y of spodumene concentrate, within six years.

Based on this production scenario, the Kathleen Valley operation is expected to have a mine life of 23 years and will generate life-of-mine free cash flows of A$12.2-billion.