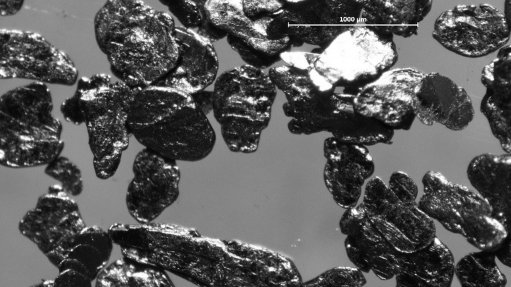

Photo by: Walkabout Resources

Name of the Project

Lindi Jumbo graphite project.

Location

South-east Tanzania.

Project Owner/s

Walkabout Resources.

Project Description

The Lindi Jumbo project has mineral ore reserves of 5.15-million tonnes grading 17.9% total graphitic carbon for 987 000 t of contained graphite.

The mine life has increased from 20 years in the 2017 definitive feasibility study (DFS) to 24 years in the enhanced DFS to produce 40 000 t/y of graphite.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The pretax net present value has increased from $302-million, at a 10% discount rate, in the 2017 DFS, to $335-million in the enhanced DFS. The project’s pretax internal rate of return is estimated at 142% in the enhanced DFS, from 108% in the 2017 DFS. The payback period is less than two years.

Capital Expenditure

Preproduction capital costs have decreased from $29.7-million in the 2017 DFS to $27.8-million in the enhanced DFS.

Planned Start/End Date

The construction schedule has not been modified in the enhanced DFS, as commissioning can be achieved 9 to 12 months after project-start funding has been received.

Latest Developments

Walkabout Resources has reached an agreement with earthmoving and civils contractor TNR that will allow for the completion of the earthworks and civils portion of the Lindi Jumbo graphite mine.

TNR has agreed to defer $1.4-million in payments for work to be completed at the site, enabling the acceleration of the civil and concrete works for the installation of the machinery and the equipment being prepared for despatch from China.

It will also allow for the advancement of the tailings storage facility before the start of commissioning of the processing plant.

Lindi Jumbo will be required to pay TNR at least $250 000 in cash or the actual amount of each invoice, with the balance of the invoiced amount forming part of the TNR deferred consideration. Walkabout has said that funding the first few months’ obligation would be funded by a director bridging loan.

The deal with TNR comes after Walkabout secured a $10-million funding commitment from institutional investor Battery Metals Capital to finalise construction of the project, and to fund general working capital, if required.

The commitment is for a term of 24 months and constitutes standby funding to be substantially drawn down at Walkabout’s discretion. Battery Metals has committed to invest up to $10-million in the aggregate for subscription shares worth more than $11.6-million, with Walkabout also issuing 6.7-million shares as a commitment fee.

Key Contracts, Suppliers and Consultants

TNR (bulk earthworks civil engineering works contract); Yantai Jinpeng Mining Machinery (engineering, procurement and construction, or EPC); and Axis Group International (EPC oversight).

Contact Details for Project Information

Walkabout Resources, tel +61 8 6298 7500 or email admin@wkt.com.au.