Name of the Project

Kathleen Valley lithium/tantalum project.

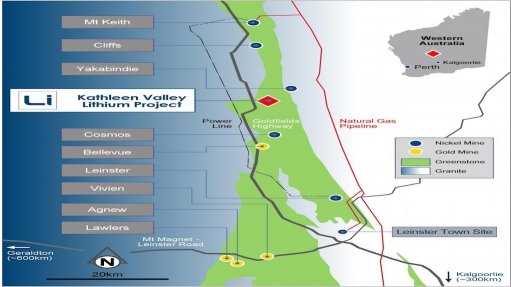

Location

North-east Goldfields of Western Australia.

Project Owner/s

Liontown Resources.

Project Description

A definitive feasibility study (DFS) has confirmed the potential to develop a state-of-the-art, second-generation lithium/tantalum mining and processing operation.

The DFS optimises the mine schedule, process plant design and forecast sales pricing to enhance the technical and financial viability of a standalone, long-life, four-million-tonne-a-year operation.

The project has an ore reserve of 68.5-million tonnes grading 1.34% lithium oxide and 120 parts per million tantalum pentoxide, underpinning an initial estimated 23-year mine life, based on the updated mining schedule.

Building on the October 2020 prefeasibility study, the DFS base production has been increased from two-million tonnes a year to 2.5-million tonnes a year, producing about 500 000 t/y of spodumene concentrate, with a four-million-tonne-a-year expansion planned in Year 6 to deliver about 700 000 t/y spodumene concentrate.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has an after-tax net present value, at a real 8% discount rate, of A$4.2-billion and an internal rate of return of 57%, with a payback of 2.3 years.

Capital Expenditure

Initial project capital is estimated at A$437-million.

Planned Start/End Date

First production is expected to start in the first half of 2024.

Latest Developments

Liontown and electric vehicle (EV) manufacturer Tesla have executed a full-form agreement for the supply of spodumene concentrate from the Kathleen Valley lithium project

The agreement expands on the detail regarding the material terms agreed to in the binding term sheet announced in February, and specifies the operational and logistical requirements for the delivery of product.

Tesla will buy 100 000 dry metric tonnes (DMT) of spodumene concentrate, representing about one-third of the project’s startup capacity of 500 000 t/y, in the first year, increasing to 150 000 DMT a year in subsequent years.

The agreement is conditional upon Liontown’s starting commercial production at Kathleen Valley by not later than December 1, 2025.

The offtake is Tesla’s second definitive agreement secured for Kathleen Valley, following the foundational offtake agreement with LG Energy Solutions. Together, these agreements account for up to 60% of Liontown’s planned production.

Liontown has reported that it has received strong interest from a range of parties for the remaining third offtake, which, once completed, will result in about 85% of the production from Kathleen Valley contracted.

The remaining production will be sold on spot or to existing customers.

Key Contracts, Suppliers and Consultants

ZOOID (environmental social governance); Optiro (geology and mineral resources estimate); Snowden Mining Industry Consultants (mine optimisation, planning, design and scheduling); ALS Metallurgy (process testwork); Lycopodium Minerals (process and infrastructure design, capital and operating expenditure); Knight Piésold (tailings and hydrogeology); MBS Environmental (environmental studies); Peter O’Bryan and Associates (geomechanical engineering); and Metso-Ouotec (design, fabrication and delivery of a semiautogenous grinding mill).

Contact Details for Project Information

Liontown Resources, tel +6 8 6186 4600 or email info@ltresources.com.au.