Name of the Project

Kasiya rutile project.

Location

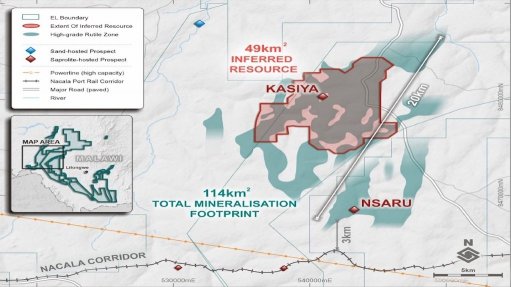

Malawi.

Project Owner/s

Sovereign Metals.

Project Description

Kasiya is the biggest undeveloped rutile deposit in the world. Total mineral resources are estimated at 605-million tonnes grading 0.98% rutile and 1.24% total graphitic carbon.

The initial scoping study on the project has developed the concept for a multidecade mine providing a consistent supply of a highly sought-after rutile and graphite while contributing to Malawi’s economy. The proposed large-scale operation will process soft, friable mineralisation mined from surface and will primarily use conventional hydromining to produce a slurry that will be pumped to a wet concentration plant where the material will be sized.

A heavy mineral concentrate will be produced by processing the sand fraction through a series of gravity spirals, after which it will be transferred to the dry-minerals separation plant, where premium-quality rutile will be produced using electrostatic and magnetic separation. Graphite-rich concentrate will be collected from the gravity spirals and processed in a separate graphite flotation plant, producing a coarse-flake graphite product.

The mine will have a throughput of 12-million tonnes a year over a 25-year mine life, producing 122 000 t/y of rutile and 80 000 t/y of graphite.

The rutile and graphite products will be trucked a short distance using existing bitumen roads to the Kanengo rail terminal, from where they will be railed through the Nacala logistics corridor to the deep-water port of Nacala, on the eastern seaboard of Mozambique.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has an after-tax net present value, at an 8% discount rate, of $861-million and an internal rate of return of 36%, with a payback of 2.5 years.

Capital Expenditure

$332-million.

Planned Start/End Date

Not stated.

Latest Developments

Sovereign Metals has entered into a nonbinding memorandum of understanding (MoU) with global rutile product distributor Hascor International to potentially supply up to 25 000 t/y of rutile from the Kasiya rutile project.

The supply agreement will cover an initial five-year period from the start of nameplate production. Offtake volumes could be by mutual agreement while pricing at the start of the offtake agreement would reference market prices to the welding sector, subject to agreed price variations through the supply term.

This maiden MoU is part of Sovereign’s product marketing strategy as the demand and pricing for natural rutile are very strong as the global structural deficit in supply continues to widen.

The MoU is nonexclusive and nonbinding, and remains subject to the negotiation and execution of a definitive agreement to give effect to the MoU, which will expire at the end of December 2023. It can, however, be extended by agreement by both parties should a definitive agreement not have been reached by that time.

Key Contracts, Suppliers and Consultants

DRA (lead study manager); Jem-Met (project management); Placer Consulting (mineral resource estimate); Oreology Mine Consulting (mine scheduling and pit optimisation); Fraser Alexander (mining methods and tailings management); Epoch Resources (tailing disposal); AML (metallurgy – rutile); SGS (metallurgy – graphite); Dhamana Consulting (environment and social studies); JCM Power (power); TZMI (marketing – rutile); Fastmarkets (marketing – graphite); Morgan Sterling Consultants (logistics); and Minviro (life-cycle assessments).

Contact Details for Project Information

Sovereign Metals, tel +61 8 9322 6322 or email info@sovereignmetals.com.au.